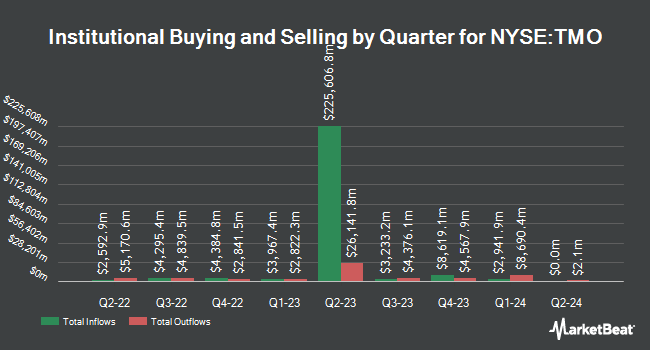

PKO Investment Management Joint Stock Co bought a new stake in Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 4,600 shares of the medical research company's stock, valued at approximately $2,393,000.

Several other institutional investors have also recently added to or reduced their stakes in the business. Stonegate Investment Group LLC lifted its stake in Thermo Fisher Scientific by 0.3% in the fourth quarter. Stonegate Investment Group LLC now owns 6,788 shares of the medical research company's stock valued at $3,531,000 after buying an additional 18 shares during the period. Semus Wealth Partners LLC lifted its stake in Thermo Fisher Scientific by 4.0% in the fourth quarter. Semus Wealth Partners LLC now owns 471 shares of the medical research company's stock valued at $245,000 after buying an additional 18 shares during the period. Evernest Financial Advisors LLC lifted its stake in Thermo Fisher Scientific by 4.0% in the fourth quarter. Evernest Financial Advisors LLC now owns 521 shares of the medical research company's stock valued at $271,000 after buying an additional 20 shares during the period. Proactive Wealth Strategies LLC lifted its stake in Thermo Fisher Scientific by 2.7% in the fourth quarter. Proactive Wealth Strategies LLC now owns 753 shares of the medical research company's stock valued at $392,000 after buying an additional 20 shares during the period. Finally, Cassaday & Co Wealth Management LLC lifted its stake in Thermo Fisher Scientific by 0.9% in the fourth quarter. Cassaday & Co Wealth Management LLC now owns 2,286 shares of the medical research company's stock valued at $1,189,000 after buying an additional 20 shares during the period. 89.23% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, EVP Gianluca Pettiti sold 300 shares of the stock in a transaction dated Monday, April 28th. The stock was sold at an average price of $429.93, for a total transaction of $128,979.00. Following the sale, the executive vice president now owns 23,167 shares of the company's stock, valued at approximately $9,960,188.31. This represents a 1.28% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, SVP Michael A. Boxer sold 3,775 shares of the stock in a transaction dated Monday, March 10th. The stock was sold at an average price of $532.52, for a total value of $2,010,263.00. Following the sale, the senior vice president now directly owns 10,816 shares in the company, valued at $5,759,736.32. This trade represents a 25.87% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 14,075 shares of company stock valued at $7,305,942. Corporate insiders own 0.33% of the company's stock.

Analyst Ratings Changes

Several brokerages have issued reports on TMO. Morgan Stanley boosted their price target on Thermo Fisher Scientific from $647.00 to $678.00 and gave the company an "overweight" rating in a research note on Friday, January 31st. Citigroup lowered their target price on Thermo Fisher Scientific from $650.00 to $570.00 and set a "neutral" rating on the stock in a research report on Tuesday, March 4th. Robert W. Baird lowered their target price on Thermo Fisher Scientific from $603.00 to $573.00 and set an "outperform" rating on the stock in a research report on Thursday, April 24th. UBS Group lowered their target price on Thermo Fisher Scientific from $715.00 to $500.00 and set a "buy" rating on the stock in a research report on Thursday, April 24th. Finally, Wells Fargo & Company lowered their target price on Thermo Fisher Scientific from $580.00 to $570.00 and set an "overweight" rating on the stock in a research report on Thursday, April 24th. Four equities research analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $607.43.

Get Our Latest Report on TMO

Thermo Fisher Scientific Stock Performance

Shares of TMO stock traded down $1.34 on Friday, hitting $402.41. 2,521,302 shares of the stock were exchanged, compared to its average volume of 1,879,798. The company has a current ratio of 1.66, a quick ratio of 1.29 and a debt-to-equity ratio of 0.59. The firm has a market capitalization of $151.91 billion, a PE ratio of 24.34, a P/E/G ratio of 2.99 and a beta of 0.82. Thermo Fisher Scientific Inc. has a one year low of $390.50 and a one year high of $627.88. The firm's 50 day moving average is $430.85 and its two-hundred day moving average is $500.06.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last issued its quarterly earnings data on Wednesday, April 23rd. The medical research company reported $5.15 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $5.10 by $0.05. The business had revenue of $10.36 billion for the quarter, compared to analysts' expectations of $10.23 billion. Thermo Fisher Scientific had a return on equity of 17.51% and a net margin of 14.78%. The firm's quarterly revenue was up .2% on a year-over-year basis. During the same quarter in the prior year, the firm posted $5.11 EPS. Sell-side analysts expect that Thermo Fisher Scientific Inc. will post 23.28 earnings per share for the current fiscal year.

Thermo Fisher Scientific Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, July 15th. Investors of record on Friday, June 13th will be issued a dividend of $0.43 per share. The ex-dividend date of this dividend is Friday, June 13th. This represents a $1.72 dividend on an annualized basis and a yield of 0.43%. Thermo Fisher Scientific's dividend payout ratio (DPR) is 10.09%.

Thermo Fisher Scientific Profile

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Featured Stories

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report