Stephens Inc. AR raised its holdings in Plains GP Holdings, L.P. (NYSE:PAGP - Free Report) by 7.3% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 222,831 shares of the pipeline company's stock after buying an additional 15,153 shares during the quarter. Stephens Inc. AR owned approximately 0.11% of Plains GP worth $4,760,000 at the end of the most recent quarter.

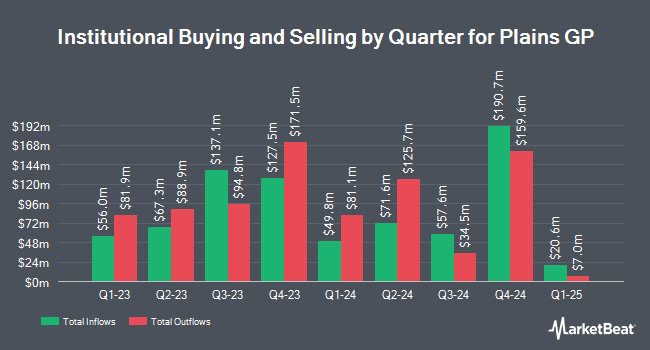

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in PAGP. Jones Financial Companies Lllp lifted its stake in shares of Plains GP by 61.7% in the 4th quarter. Jones Financial Companies Lllp now owns 1,363 shares of the pipeline company's stock valued at $25,000 after purchasing an additional 520 shares in the last quarter. Farther Finance Advisors LLC raised its position in shares of Plains GP by 8,120.7% in the 4th quarter. Farther Finance Advisors LLC now owns 2,384 shares of the pipeline company's stock valued at $44,000 after purchasing an additional 2,355 shares in the last quarter. Mark Sheptoff Financial Planning LLC raised its position in shares of Plains GP by 1,000.0% in the 4th quarter. Mark Sheptoff Financial Planning LLC now owns 4,400 shares of the pipeline company's stock valued at $81,000 after purchasing an additional 4,000 shares in the last quarter. Golden State Wealth Management LLC increased its holdings in shares of Plains GP by 233.1% in the 1st quarter. Golden State Wealth Management LLC now owns 5,995 shares of the pipeline company's stock valued at $128,000 after acquiring an additional 4,195 shares during the last quarter. Finally, Brown Brothers Harriman & Co. bought a new stake in shares of Plains GP in the 4th quarter valued at approximately $158,000. Hedge funds and other institutional investors own 88.30% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently commented on the company. JPMorgan Chase & Co. upped their price objective on Plains GP from $19.00 to $20.00 and gave the stock a "neutral" rating in a research note on Wednesday, June 18th. Morgan Stanley increased their price target on Plains GP from $19.00 to $23.00 and gave the stock an "equal weight" rating in a research note on Tuesday, March 25th. Barclays decreased their target price on Plains GP from $19.00 to $18.00 and set an "underweight" rating for the company in a research note on Thursday, April 10th. Wall Street Zen raised Plains GP from a "hold" rating to a "buy" rating in a research note on Friday, May 16th. Finally, Mizuho raised their target price on Plains GP from $20.00 to $22.00 and gave the company an "outperform" rating in a research note on Wednesday, June 18th. One research analyst has rated the stock with a sell rating, four have given a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Plains GP has a consensus rating of "Hold" and a consensus target price of $20.88.

View Our Latest Stock Analysis on PAGP

Plains GP Trading Up 1.5%

Shares of NYSE PAGP traded up $0.31 during mid-day trading on Friday, hitting $20.02. 1,188,262 shares of the company traded hands, compared to its average volume of 1,601,287. Plains GP Holdings, L.P. has a 1 year low of $16.61 and a 1 year high of $22.31. The stock has a market capitalization of $3.96 billion, a price-to-earnings ratio of 37.76 and a beta of 0.65. The company has a quick ratio of 0.92, a current ratio of 1.01 and a debt-to-equity ratio of 0.49. The business has a 50 day moving average of $18.83 and a two-hundred day moving average of $19.74.

Plains GP Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, August 14th. Investors of record on Thursday, July 31st will be paid a $0.38 dividend. This represents a $1.52 annualized dividend and a yield of 7.59%. The ex-dividend date is Thursday, July 31st. Plains GP's dividend payout ratio is currently 205.41%.

Plains GP Company Profile

(

Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Featured Stories

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.