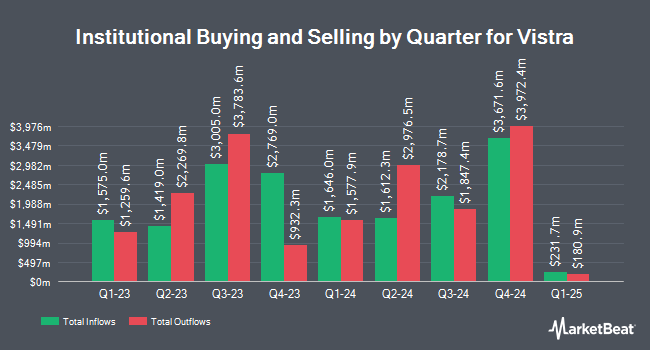

Plan Group Financial LLC purchased a new position in shares of Vistra Corp. (NYSE:VST - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 1,990 shares of the company's stock, valued at approximately $234,000.

A number of other hedge funds have also recently added to or reduced their stakes in VST. Capital International Investors purchased a new position in Vistra during the fourth quarter valued at $286,414,000. Palidye Holdings Caymans Ltd purchased a new position in Vistra during the fourth quarter valued at $149,451,000. D1 Capital Partners L.P. purchased a new position in Vistra during the fourth quarter valued at $92,649,000. Bridgewater Associates LP lifted its holdings in Vistra by 58.9% during the fourth quarter. Bridgewater Associates LP now owns 1,773,499 shares of the company's stock valued at $244,512,000 after purchasing an additional 657,217 shares in the last quarter. Finally, GAMMA Investing LLC lifted its holdings in Vistra by 10,810.6% during the first quarter. GAMMA Investing LLC now owns 633,471 shares of the company's stock valued at $74,395,000 after purchasing an additional 627,665 shares in the last quarter. 90.88% of the stock is owned by hedge funds and other institutional investors.

Vistra Trading Down 1.6%

Vistra stock traded down $3.24 during midday trading on Friday, hitting $202.35. 4,060,980 shares of the stock were exchanged, compared to its average volume of 5,319,267. Vistra Corp. has a fifty-two week low of $72.90 and a fifty-two week high of $216.85. The stock has a market capitalization of $68.66 billion, a price-to-earnings ratio of 31.82, a PEG ratio of 2.50 and a beta of 1.30. The stock's 50-day simple moving average is $188.82 and its 200 day simple moving average is $156.36. The company has a current ratio of 0.86, a quick ratio of 0.77 and a debt-to-equity ratio of 6.53.

Vistra Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Friday, September 19th will be given a dividend of $0.226 per share. The ex-dividend date is Friday, September 19th. This is an increase from Vistra's previous quarterly dividend of $0.23. This represents a $0.90 annualized dividend and a yield of 0.4%. Vistra's dividend payout ratio (DPR) is 14.15%.

Analyst Ratings Changes

Several equities analysts have issued reports on VST shares. UBS Group increased their price objective on shares of Vistra from $207.00 to $230.00 and gave the company a "buy" rating in a report on Friday, July 25th. The Goldman Sachs Group increased their target price on shares of Vistra from $134.00 to $164.00 and gave the company a "neutral" rating in a research report on Friday, May 23rd. Evercore ISI set a $192.00 target price on shares of Vistra and gave the company an "outperform" rating in a research report on Thursday, May 15th. Morgan Stanley increased their target price on shares of Vistra from $178.00 to $186.00 and gave the company an "overweight" rating in a research report on Wednesday, June 18th. Finally, Raymond James Financial began coverage on shares of Vistra in a research report on Friday, June 13th. They issued a "strong-buy" rating and a $216.00 target price for the company. Three research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $186.69.

View Our Latest Research Report on Vistra

Insider Activity

In other Vistra news, EVP Stephanie Zapata Moore sold 35,000 shares of the stock in a transaction dated Tuesday, May 27th. The shares were sold at an average price of $161.44, for a total transaction of $5,650,400.00. Following the completion of the transaction, the executive vice president owned 88,073 shares of the company's stock, valued at $14,218,505.12. This trade represents a 28.44% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director John R. Sult sold 25,000 shares of the stock in a transaction dated Friday, June 6th. The stock was sold at an average price of $171.67, for a total transaction of $4,291,750.00. Following the transaction, the director directly owned 75,946 shares of the company's stock, valued at approximately $13,037,649.82. This trade represents a 24.77% decrease in their position. The disclosure for this sale can be found here. Insiders sold 294,000 shares of company stock valued at $47,461,490 in the last quarter. Insiders own 1.42% of the company's stock.

Vistra Company Profile

(

Free Report)

Vistra Corp., together with its subsidiaries, operates as an integrated retail electricity and power generation company. The company operates through six segments: Retail, Texas, East, West, Sunset, and Asset Closure. It retails electricity and natural gas to residential, commercial, and industrial customers across states in the United States and the District of Columbia.

Read More

Before you consider Vistra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vistra wasn't on the list.

While Vistra currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.