Plato Investment Management Ltd lessened its stake in shares of Futu Holdings Limited Sponsored ADR (NASDAQ:FUTU - Free Report) by 45.0% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,903 shares of the company's stock after selling 3,187 shares during the quarter. Plato Investment Management Ltd's holdings in Futu were worth $404,000 as of its most recent SEC filing.

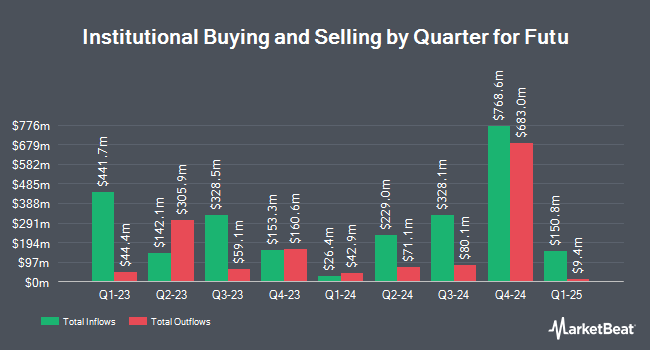

Several other hedge funds also recently bought and sold shares of FUTU. Hhlr Advisors LTD. boosted its stake in Futu by 285.2% during the first quarter. Hhlr Advisors LTD. now owns 4,307,492 shares of the company's stock worth $440,872,000 after buying an additional 3,189,189 shares during the period. Trivest Advisors Ltd purchased a new position in Futu during the first quarter worth about $98,651,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its stake in Futu by 883.4% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 989,367 shares of the company's stock worth $101,262,000 after buying an additional 888,760 shares during the period. Yong Rong HK Asset Management Ltd purchased a new position in Futu during the first quarter worth about $77,172,000. Finally, Greenwoods Asset Management Hong Kong Ltd. boosted its stake in Futu by 48.2% during the first quarter. Greenwoods Asset Management Hong Kong Ltd. now owns 1,901,635 shares of the company's stock worth $194,632,000 after buying an additional 618,701 shares during the period.

Futu Stock Performance

FUTU stock traded down $5.22 during midday trading on Monday, reaching $180.67. 2,346,813 shares of the company were exchanged, compared to its average volume of 2,632,060. Futu Holdings Limited Sponsored ADR has a 1-year low of $57.48 and a 1-year high of $199.86. The stock's 50-day simple moving average is $167.14 and its 200 day simple moving average is $126.41. The company has a market cap of $25.14 billion, a price-to-earnings ratio of 25.06, a price-to-earnings-growth ratio of 0.82 and a beta of 0.57.

Analysts Set New Price Targets

Several research analysts have recently commented on the stock. Bank of America raised their price objective on shares of Futu from $172.00 to $200.00 and gave the company a "buy" rating in a research note on Thursday, August 21st. Barclays raised their price objective on shares of Futu from $176.00 to $232.00 and gave the company an "overweight" rating in a research note on Friday, August 22nd. JPMorgan Chase & Co. raised their price objective on shares of Futu from $200.00 to $270.00 and gave the company an "overweight" rating in a research note on Thursday, August 28th. Daiwa Capital Markets began coverage on shares of Futu in a research note on Monday, August 11th. They issued a "buy" rating and a $190.00 price objective for the company. Finally, Citigroup raised their target price on shares of Futu from $176.00 to $190.00 and gave the company a "neutral" rating in a report on Thursday, August 21st. One research analyst has rated the stock with a Strong Buy rating, seven have given a Buy rating and one has given a Hold rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of $190.43.

Read Our Latest Research Report on Futu

Futu Company Profile

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Further Reading

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.