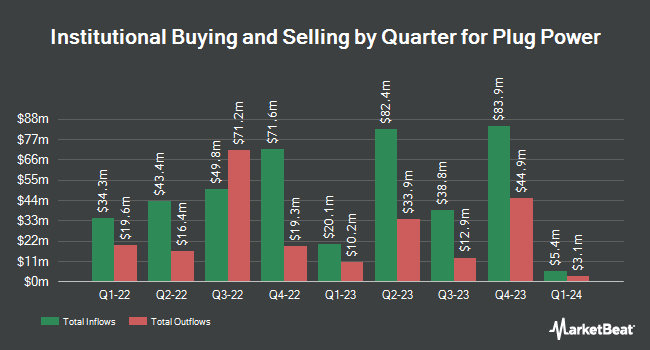

Vontobel Holding Ltd. raised its holdings in Plug Power, Inc. (NASDAQ:PLUG - Free Report) by 11.9% in the 2nd quarter, according to its most recent 13F filing with the SEC. The fund owned 3,878,389 shares of the electronics maker's stock after acquiring an additional 412,585 shares during the period. Vontobel Holding Ltd. owned 0.34% of Plug Power worth $5,779,000 at the end of the most recent reporting period.

Several other institutional investors also recently bought and sold shares of the business. Abel Hall LLC acquired a new position in Plug Power in the 2nd quarter valued at $30,000. KLP Kapitalforvaltning AS increased its holdings in shares of Plug Power by 32.8% during the 2nd quarter. KLP Kapitalforvaltning AS now owns 199,200 shares of the electronics maker's stock worth $297,000 after buying an additional 49,200 shares during the last quarter. QRG Capital Management Inc. increased its holdings in shares of Plug Power by 31.8% during the 2nd quarter. QRG Capital Management Inc. now owns 25,014 shares of the electronics maker's stock worth $37,000 after buying an additional 6,039 shares during the last quarter. O ROURKE & COMPANY Inc acquired a new stake in shares of Plug Power during the 2nd quarter worth $30,000. Finally, Lazari Capital Management Inc. increased its holdings in shares of Plug Power by 49.2% during the 2nd quarter. Lazari Capital Management Inc. now owns 36,798 shares of the electronics maker's stock worth $55,000 after buying an additional 12,141 shares during the last quarter. 43.48% of the stock is currently owned by institutional investors and hedge funds.

Plug Power Stock Down 9.5%

Shares of NASDAQ PLUG opened at $3.42 on Friday. Plug Power, Inc. has a 12-month low of $0.69 and a 12-month high of $4.58. The company has a market cap of $3.95 billion, a P/E ratio of -1.48 and a beta of 2.23. The company has a current ratio of 1.59, a quick ratio of 0.82 and a debt-to-equity ratio of 0.22. The stock has a fifty day moving average price of $2.03 and a 200 day moving average price of $1.47.

Plug Power (NASDAQ:PLUG - Get Free Report) last posted its quarterly earnings data on Monday, August 11th. The electronics maker reported ($0.16) earnings per share for the quarter, missing analysts' consensus estimates of ($0.15) by ($0.01). The firm had revenue of $173.97 million during the quarter, compared to analysts' expectations of $157.97 million. Plug Power had a negative net margin of 292.84% and a negative return on equity of 90.22%. Research analysts anticipate that Plug Power, Inc. will post -1.21 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

PLUG has been the subject of a number of research analyst reports. HSBC set a $4.40 price objective on Plug Power in a report on Thursday. Evercore ISI upgraded Plug Power to a "strong sell" rating in a report on Tuesday, July 15th. BMO Capital Markets dropped their price objective on Plug Power from $1.10 to $1.00 and set an "underperform" rating for the company in a report on Tuesday, August 12th. HC Wainwright increased their price target on Plug Power from $3.00 to $7.00 and gave the company a "buy" rating in a report on Friday, October 3rd. Finally, Weiss Ratings reiterated a "sell (d-)" rating on shares of Plug Power in a report on Wednesday. Five investment analysts have rated the stock with a Buy rating, seven have issued a Hold rating and six have given a Sell rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Reduce" and a consensus price target of $2.35.

Read Our Latest Analysis on Plug Power

About Plug Power

(

Free Report)

Plug Power Inc develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally. The company offers GenDrive, a hydrogen-fueled proton exchange membrane (PEM) fuel cell system that provides power to material handling electric vehicles; GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenKey, an integrated turn-key solution for transitioning to fuel cell power.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Plug Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plug Power wasn't on the list.

While Plug Power currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.