Polen Capital Management LLC cut its stake in Novo Nordisk A/S (NYSE:NVO - Free Report) by 84.4% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 1,001,906 shares of the company's stock after selling 5,403,842 shares during the period. Polen Capital Management LLC's holdings in Novo Nordisk A/S were worth $69,572,000 as of its most recent filing with the Securities and Exchange Commission.

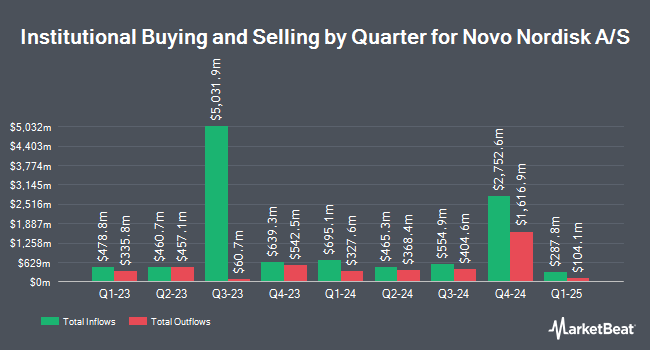

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in NVO. Strategic Investment Solutions Inc. IL raised its holdings in shares of Novo Nordisk A/S by 2,727.3% in the 4th quarter. Strategic Investment Solutions Inc. IL now owns 311 shares of the company's stock valued at $27,000 after purchasing an additional 300 shares during the period. Copeland Capital Management LLC raised its holdings in shares of Novo Nordisk A/S by 184.8% in the 1st quarter. Copeland Capital Management LLC now owns 393 shares of the company's stock valued at $27,000 after purchasing an additional 255 shares during the period. North Capital Inc. bought a new stake in shares of Novo Nordisk A/S in the 1st quarter valued at about $27,000. Park Square Financial Group LLC bought a new position in Novo Nordisk A/S in the 4th quarter valued at about $29,000. Finally, Transce3nd LLC bought a new position in Novo Nordisk A/S in the 4th quarter valued at about $33,000. 11.54% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research firms have weighed in on NVO. Barclays reissued an "equal weight" rating on shares of Novo Nordisk A/S in a report on Wednesday, July 30th. Guggenheim cut shares of Novo Nordisk A/S from a "strong-buy" rating to a "hold" rating in a report on Thursday, April 17th. Wall Street Zen cut shares of Novo Nordisk A/S from a "buy" rating to a "hold" rating in a report on Saturday, August 2nd. Dbs Bank cut shares of Novo Nordisk A/S to a "sell" rating in a report on Friday, April 25th. Finally, HSBC cut shares of Novo Nordisk A/S from a "buy" rating to a "hold" rating and set a $57.00 price target on the stock. in a report on Thursday, July 31st. Two analysts have rated the stock with a sell rating, ten have issued a hold rating and two have issued a buy rating to the company. According to MarketBeat.com, Novo Nordisk A/S currently has an average rating of "Hold" and an average price target of $93.67.

Get Our Latest Report on NVO

Novo Nordisk A/S Stock Performance

Shares of NYSE:NVO traded up $2.30 on Friday, reaching $51.06. 23,312,357 shares of the company's stock were exchanged, compared to its average volume of 24,770,900. The company has a fifty day moving average of $67.14 and a 200-day moving average of $71.47. Novo Nordisk A/S has a twelve month low of $45.05 and a twelve month high of $139.74. The company has a market capitalization of $227.98 billion, a price-to-earnings ratio of 14.03, a PEG ratio of 1.75 and a beta of 0.63. The company has a current ratio of 0.78, a quick ratio of 0.56 and a debt-to-equity ratio of 0.52.

Novo Nordisk A/S (NYSE:NVO - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported $0.97 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.93 by $0.04. Novo Nordisk A/S had a net margin of 35.60% and a return on equity of 78.64%. The firm had revenue of $11.69 billion for the quarter, compared to analyst estimates of $77.51 billion. On average, research analysts predict that Novo Nordisk A/S will post 3.84 EPS for the current fiscal year.

Novo Nordisk A/S Cuts Dividend

The firm also recently announced a semi-annual dividend, which will be paid on Tuesday, August 26th. Shareholders of record on Monday, August 18th will be given a dividend of $0.4119 per share. This represents a dividend yield of 240.0%. The ex-dividend date is Monday, August 18th. Novo Nordisk A/S's dividend payout ratio is presently 45.05%.

Novo Nordisk A/S Company Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

Featured Articles

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.