Praxis Investment Management Inc. reduced its position in shares of Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 74.1% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 1,580 shares of the software company's stock after selling 4,510 shares during the quarter. Praxis Investment Management Inc.'s holdings in Autodesk were worth $489,000 as of its most recent filing with the Securities and Exchange Commission.

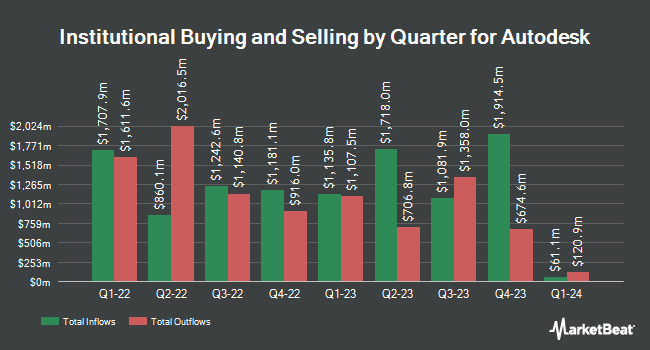

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in ADSK. OMNI 360 Wealth Inc. bought a new stake in shares of Autodesk in the 2nd quarter valued at about $359,000. E. Ohman J or Asset Management AB increased its stake in shares of Autodesk by 1.8% in the 2nd quarter. E. Ohman J or Asset Management AB now owns 127,126 shares of the software company's stock valued at $39,354,000 after acquiring an additional 2,276 shares during the last quarter. Spire Wealth Management increased its stake in shares of Autodesk by 2.5% in the 1st quarter. Spire Wealth Management now owns 2,075 shares of the software company's stock valued at $543,000 after acquiring an additional 50 shares during the last quarter. Sowell Financial Services LLC bought a new stake in shares of Autodesk in the 1st quarter valued at about $324,000. Finally, GK Wealth Management LLC bought a new stake in shares of Autodesk in the 2nd quarter valued at about $348,000. 90.24% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several brokerages recently issued reports on ADSK. Mizuho boosted their price objective on Autodesk from $350.00 to $375.00 and gave the company an "outperform" rating in a research report on Friday, August 29th. Wall Street Zen lowered Autodesk from a "strong-buy" rating to a "buy" rating in a research report on Sunday, September 28th. Royal Bank Of Canada reiterated an "outperform" rating and issued a $380.00 price objective on shares of Autodesk in a research report on Monday, October 6th. Barclays boosted their price objective on Autodesk from $355.00 to $385.00 and gave the company an "overweight" rating in a research report on Friday, August 29th. Finally, HSBC set a $343.00 price objective on Autodesk and gave the company a "buy" rating in a research report on Wednesday, October 1st. One investment analyst has rated the stock with a Strong Buy rating, eighteen have issued a Buy rating and six have given a Hold rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $359.13.

Check Out Our Latest Analysis on Autodesk

Autodesk Trading Up 1.3%

NASDAQ:ADSK opened at $303.66 on Friday. Autodesk, Inc. has a twelve month low of $232.67 and a twelve month high of $329.09. The company has a quick ratio of 0.76, a current ratio of 0.76 and a debt-to-equity ratio of 0.91. The business has a 50 day moving average price of $308.89 and a two-hundred day moving average price of $295.72. The company has a market cap of $64.68 billion, a P/E ratio of 62.87, a price-to-earnings-growth ratio of 2.69 and a beta of 1.49.

Autodesk (NASDAQ:ADSK - Get Free Report) last released its quarterly earnings results on Thursday, August 28th. The software company reported $1.46 earnings per share for the quarter, missing analysts' consensus estimates of $2.45 by ($0.99). Autodesk had a return on equity of 51.23% and a net margin of 15.75%.The firm had revenue of $1.76 billion for the quarter, compared to analyst estimates of $1.72 billion. During the same period last year, the company earned $2.15 EPS. The company's revenue was up 17.1% compared to the same quarter last year. Autodesk has set its FY 2026 guidance at 9.800-9.980 EPS. Q3 2026 guidance at 2.480-2.510 EPS. As a group, analysts expect that Autodesk, Inc. will post 5.76 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director Ayanna Howard sold 917 shares of the stock in a transaction that occurred on Monday, September 29th. The stock was sold at an average price of $325.00, for a total value of $298,025.00. Following the completion of the sale, the director owned 3,476 shares of the company's stock, valued at approximately $1,129,700. This represents a 20.87% decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, EVP Steven M. Blum sold 22,420 shares of the stock in a transaction that occurred on Friday, September 5th. The shares were sold at an average price of $323.75, for a total value of $7,258,475.00. Following the completion of the sale, the executive vice president directly owned 13,099 shares of the company's stock, valued at approximately $4,240,801.25. The trade was a 63.12% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 35,386 shares of company stock worth $11,433,201. 0.15% of the stock is owned by corporate insiders.

Autodesk Profile

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.