Price T Rowe Associates Inc. MD lowered its position in shares of The TJX Companies, Inc. (NYSE:TJX - Free Report) by 2.3% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 11,853,004 shares of the apparel and home fashions retailer's stock after selling 281,006 shares during the quarter. Price T Rowe Associates Inc. MD owned approximately 1.06% of TJX Companies worth $1,443,697,000 at the end of the most recent reporting period.

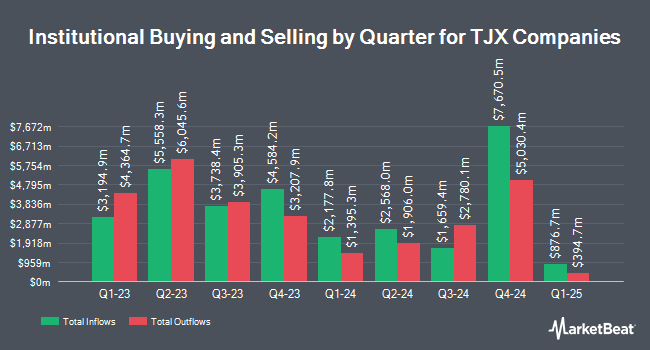

Several other large investors have also made changes to their positions in the company. Brighton Jones LLC lifted its position in TJX Companies by 113.7% during the 4th quarter. Brighton Jones LLC now owns 15,039 shares of the apparel and home fashions retailer's stock valued at $1,817,000 after purchasing an additional 8,002 shares during the period. Revolve Wealth Partners LLC raised its stake in shares of TJX Companies by 12.1% during the fourth quarter. Revolve Wealth Partners LLC now owns 2,172 shares of the apparel and home fashions retailer's stock worth $262,000 after buying an additional 235 shares during the last quarter. Pinebridge Investments L.P. lifted its holdings in TJX Companies by 29.5% in the fourth quarter. Pinebridge Investments L.P. now owns 683,952 shares of the apparel and home fashions retailer's stock valued at $82,628,000 after buying an additional 155,646 shares during the period. MGO One Seven LLC boosted its stake in TJX Companies by 35.7% in the fourth quarter. MGO One Seven LLC now owns 39,724 shares of the apparel and home fashions retailer's stock valued at $4,799,000 after acquiring an additional 10,454 shares during the last quarter. Finally, Coppell Advisory Solutions LLC grew its holdings in TJX Companies by 31.8% during the 4th quarter. Coppell Advisory Solutions LLC now owns 435 shares of the apparel and home fashions retailer's stock worth $53,000 after acquiring an additional 105 shares during the period. Institutional investors and hedge funds own 91.09% of the company's stock.

Insider Activity at TJX Companies

In related news, Director Amy B. Lane sold 950 shares of the business's stock in a transaction on Tuesday, June 3rd. The shares were sold at an average price of $128.09, for a total value of $121,685.50. Following the sale, the director directly owned 22,712 shares of the company's stock, valued at approximately $2,909,180.08. The trade was a 4.01% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 0.13% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

TJX has been the subject of several recent research reports. TD Securities upped their target price on shares of TJX Companies from $140.00 to $142.00 and gave the company a "buy" rating in a research report on Tuesday, May 20th. Wells Fargo & Company reiterated an "equal weight" rating on shares of TJX Companies in a report on Wednesday, May 21st. Barclays restated an "overweight" rating and set a $147.00 target price (up previously from $137.00) on shares of TJX Companies in a report on Thursday, May 22nd. Morgan Stanley set a $140.00 target price on TJX Companies and gave the stock an "overweight" rating in a research report on Thursday, May 22nd. Finally, Cowen reaffirmed a "buy" rating on shares of TJX Companies in a research note on Tuesday, May 20th. One equities research analyst has rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating and one has issued a Hold rating to the stock. According to data from MarketBeat.com, TJX Companies has a consensus rating of "Buy" and an average target price of $141.33.

Get Our Latest Report on TJX Companies

TJX Companies Stock Up 2.5%

NYSE:TJX opened at $138.0330 on Thursday. The TJX Companies, Inc. has a 1 year low of $111.22 and a 1 year high of $145.58. The stock has a 50-day moving average price of $126.48 and a two-hundred day moving average price of $125.31. The stock has a market cap of $154.20 billion, a price-to-earnings ratio of 32.48, a PEG ratio of 3.14 and a beta of 0.89. The company has a current ratio of 1.16, a quick ratio of 0.51 and a debt-to-equity ratio of 0.34.

TJX Companies (NYSE:TJX - Get Free Report) last released its quarterly earnings results on Wednesday, August 20th. The apparel and home fashions retailer reported $1.10 EPS for the quarter, topping analysts' consensus estimates of $1.01 by $0.09. TJX Companies had a return on equity of 58.81% and a net margin of 8.47%.The company had revenue of $14.40 billion for the quarter, compared to analyst estimates of $14.12 billion. During the same quarter last year, the firm posted $0.96 earnings per share. TJX Companies's revenue was up 6.9% compared to the same quarter last year. TJX Companies has set its FY 2026 guidance at 4.520-4.570 EPS. Q3 2026 guidance at 1.170-1.190 EPS. As a group, equities analysts expect that The TJX Companies, Inc. will post 4.18 earnings per share for the current year.

TJX Companies Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Investors of record on Thursday, August 14th will be issued a dividend of $0.425 per share. This represents a $1.70 dividend on an annualized basis and a dividend yield of 1.2%. The ex-dividend date is Thursday, August 14th. TJX Companies's dividend payout ratio (DPR) is presently 40.00%.

TJX Companies Profile

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

Further Reading

Want to see what other hedge funds are holding TJX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for The TJX Companies, Inc. (NYSE:TJX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report