Price T Rowe Associates Inc. MD raised its holdings in shares of Las Vegas Sands Corp. (NYSE:LVS - Free Report) by 3.9% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 15,722,816 shares of the casino operator's stock after buying an additional 592,321 shares during the period. Price T Rowe Associates Inc. MD owned about 2.23% of Las Vegas Sands worth $607,373,000 at the end of the most recent reporting period.

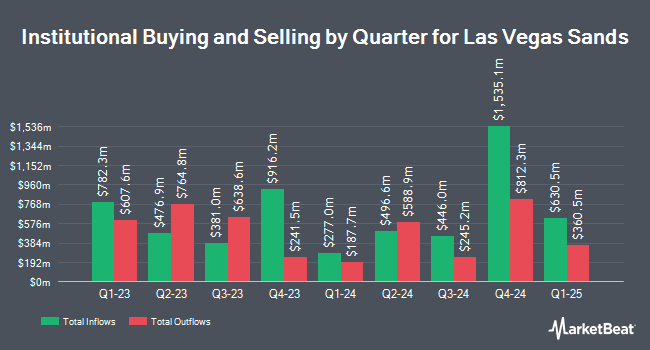

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. NewEdge Advisors LLC lifted its holdings in Las Vegas Sands by 430.7% during the 4th quarter. NewEdge Advisors LLC now owns 4,596 shares of the casino operator's stock worth $236,000 after buying an additional 3,730 shares during the last quarter. GeoWealth Management LLC boosted its holdings in shares of Las Vegas Sands by 104.7% in the 4th quarter. GeoWealth Management LLC now owns 1,775 shares of the casino operator's stock valued at $91,000 after buying an additional 908 shares during the period. First Trust Advisors LP boosted its holdings in shares of Las Vegas Sands by 674.0% in the 4th quarter. First Trust Advisors LP now owns 349,667 shares of the casino operator's stock valued at $17,959,000 after buying an additional 304,488 shares during the period. Dimensional Fund Advisors LP boosted its holdings in shares of Las Vegas Sands by 42.7% in the 4th quarter. Dimensional Fund Advisors LP now owns 2,652,458 shares of the casino operator's stock valued at $136,218,000 after buying an additional 793,789 shares during the period. Finally, IHT Wealth Management LLC boosted its holdings in shares of Las Vegas Sands by 134.9% in the 4th quarter. IHT Wealth Management LLC now owns 14,428 shares of the casino operator's stock valued at $741,000 after buying an additional 8,286 shares during the period. Hedge funds and other institutional investors own 39.16% of the company's stock.

Las Vegas Sands Price Performance

Las Vegas Sands stock traded up $0.53 during midday trading on Wednesday, hitting $56.72. The company's stock had a trading volume of 3,174,864 shares, compared to its average volume of 5,606,707. The company has a quick ratio of 1.21, a current ratio of 1.22 and a debt-to-equity ratio of 6.53. The stock's 50-day moving average price is $49.87 and its 200-day moving average price is $43.42. Las Vegas Sands Corp. has a 12 month low of $30.18 and a 12 month high of $56.92. The company has a market capitalization of $38.94 billion, a PE ratio of 28.65, a price-to-earnings-growth ratio of 2.13 and a beta of 1.08.

Las Vegas Sands (NYSE:LVS - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The casino operator reported $0.79 EPS for the quarter, topping the consensus estimate of $0.53 by $0.26. Las Vegas Sands had a net margin of 12.16% and a return on equity of 55.37%. The firm had revenue of $3.18 billion for the quarter, compared to analysts' expectations of $2.83 billion. During the same period in the previous year, the business earned $0.55 earnings per share. Las Vegas Sands's revenue for the quarter was up 15.0% compared to the same quarter last year. Analysts anticipate that Las Vegas Sands Corp. will post 2.6 earnings per share for the current fiscal year.

Las Vegas Sands Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, August 13th. Investors of record on Tuesday, August 5th were given a $0.25 dividend. The ex-dividend date was Tuesday, August 5th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 1.8%. Las Vegas Sands's dividend payout ratio (DPR) is 50.51%.

Wall Street Analyst Weigh In

LVS has been the topic of several recent research reports. Susquehanna cut their price target on Las Vegas Sands from $59.00 to $58.00 and set a "positive" rating on the stock in a report on Monday, July 21st. Bank of America raised their price target on Las Vegas Sands from $52.50 to $58.00 and gave the stock a "neutral" rating in a report on Thursday, July 24th. UBS Group lifted their price objective on shares of Las Vegas Sands from $48.00 to $55.00 and gave the company a "neutral" rating in a research report on Wednesday, July 30th. Wall Street Zen upgraded shares of Las Vegas Sands from a "hold" rating to a "buy" rating in a research report on Saturday, July 26th. Finally, Barclays boosted their price target on shares of Las Vegas Sands from $57.00 to $58.00 and gave the stock an "overweight" rating in a research report on Thursday, July 24th. One analyst has rated the stock with a Strong Buy rating, ten have assigned a Buy rating and five have issued a Hold rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $58.33.

View Our Latest Research Report on Las Vegas Sands

About Las Vegas Sands

(

Free Report)

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Macao and Singapore. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore.

Featured Stories

Before you consider Las Vegas Sands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Las Vegas Sands wasn't on the list.

While Las Vegas Sands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.