Price T Rowe Associates Inc. MD increased its stake in Hexcel Corporation (NYSE:HXL - Free Report) by 32.4% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 3,314,702 shares of the aerospace company's stock after buying an additional 812,026 shares during the quarter. Price T Rowe Associates Inc. MD owned about 4.12% of Hexcel worth $181,514,000 as of its most recent filing with the SEC.

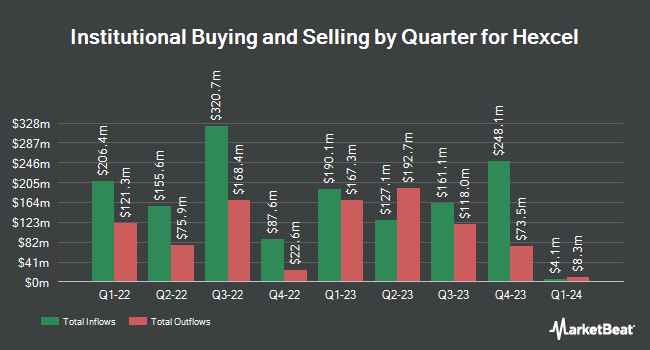

Several other hedge funds have also modified their holdings of HXL. Beverly Hills Private Wealth LLC grew its position in Hexcel by 4.0% in the first quarter. Beverly Hills Private Wealth LLC now owns 5,323 shares of the aerospace company's stock valued at $291,000 after acquiring an additional 207 shares in the last quarter. ProShare Advisors LLC boosted its stake in shares of Hexcel by 5.0% in the fourth quarter. ProShare Advisors LLC now owns 4,938 shares of the aerospace company's stock valued at $310,000 after purchasing an additional 236 shares during the period. Retirement Systems of Alabama grew its holdings in Hexcel by 0.3% during the 1st quarter. Retirement Systems of Alabama now owns 98,746 shares of the aerospace company's stock valued at $5,407,000 after purchasing an additional 255 shares in the last quarter. State of Alaska Department of Revenue grew its holdings in Hexcel by 2.8% during the 1st quarter. State of Alaska Department of Revenue now owns 9,497 shares of the aerospace company's stock valued at $520,000 after purchasing an additional 260 shares in the last quarter. Finally, Aviso Financial Inc. increased its stake in Hexcel by 1.9% during the 1st quarter. Aviso Financial Inc. now owns 13,830 shares of the aerospace company's stock worth $757,000 after buying an additional 260 shares during the period. 95.47% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

HXL has been the subject of a number of analyst reports. BMO Capital Markets upped their price objective on shares of Hexcel from $52.00 to $67.00 and gave the company a "market perform" rating in a research report on Tuesday, July 29th. Morgan Stanley increased their price target on Hexcel from $50.00 to $55.00 and gave the company an "underweight" rating in a report on Thursday, July 17th. Royal Bank Of Canada restated an "outperform" rating and set a $70.00 price objective (up from $65.00) on shares of Hexcel in a report on Monday, July 28th. Finally, UBS Group increased their target price on Hexcel from $60.00 to $65.00 and gave the company a "neutral" rating in a research note on Monday, July 28th. Two analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has given a Sell rating to the company's stock. According to MarketBeat.com, Hexcel currently has a consensus rating of "Hold" and an average target price of $63.33.

Check Out Our Latest Analysis on Hexcel

Hexcel Stock Performance

HXL traded down $0.75 during trading hours on Friday, hitting $63.21. 936,066 shares of the stock were exchanged, compared to its average volume of 836,265. The stock has a market cap of $5.03 billion, a price-to-earnings ratio of 58.53, a price-to-earnings-growth ratio of 2.09 and a beta of 1.36. The stock has a 50-day simple moving average of $60.16 and a 200-day simple moving average of $56.83. The company has a debt-to-equity ratio of 0.53, a current ratio of 2.69 and a quick ratio of 1.50. Hexcel Corporation has a 12 month low of $45.28 and a 12 month high of $71.05.

Hexcel (NYSE:HXL - Get Free Report) last released its earnings results on Thursday, July 24th. The aerospace company reported $0.50 earnings per share for the quarter, beating the consensus estimate of $0.46 by $0.04. Hexcel had a net margin of 4.69% and a return on equity of 9.76%. The firm had revenue of $489.90 million during the quarter, compared to analyst estimates of $482.20 million. During the same quarter in the previous year, the firm earned $0.60 earnings per share. The firm's revenue for the quarter was down 2.1% compared to the same quarter last year. Hexcel has set its FY 2025 guidance at 1.850-2.050 EPS. Analysts anticipate that Hexcel Corporation will post 2.14 earnings per share for the current year.

Hexcel Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, August 15th. Investors of record on Friday, August 8th were paid a dividend of $0.17 per share. The ex-dividend date was Friday, August 8th. This represents a $0.68 annualized dividend and a yield of 1.1%. Hexcel's dividend payout ratio is 62.96%.

Hexcel Company Profile

(

Free Report)

Hexcel Corporation develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications. It operates through two segments, Composite Materials and Engineered Products.

Read More

Before you consider Hexcel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hexcel wasn't on the list.

While Hexcel currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.