Price T Rowe Associates Inc. MD trimmed its holdings in Equitable Holdings, Inc. (NYSE:EQH - Free Report) by 7.4% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 19,708,542 shares of the company's stock after selling 1,569,894 shares during the quarter. Price T Rowe Associates Inc. MD owned approximately 6.49% of Equitable worth $1,026,619,000 at the end of the most recent quarter.

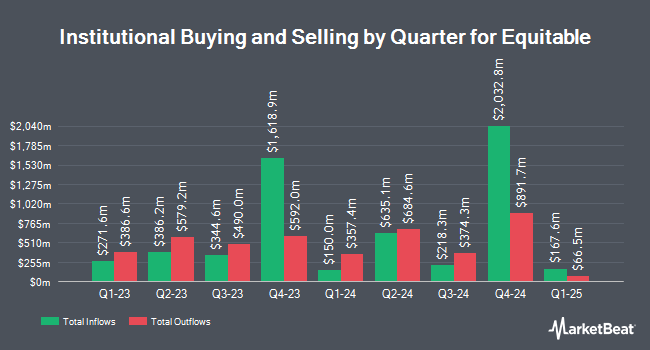

Several other hedge funds and other institutional investors have also recently modified their holdings of the business. Wellington Management Group LLP raised its holdings in shares of Equitable by 23.4% in the first quarter. Wellington Management Group LLP now owns 10,878,516 shares of the company's stock worth $566,662,000 after buying an additional 2,061,496 shares during the period. Northern Trust Corp boosted its holdings in shares of Equitable by 26.4% in the fourth quarter. Northern Trust Corp now owns 4,242,692 shares of the company's stock valued at $200,128,000 after purchasing an additional 887,123 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in shares of Equitable by 15.2% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,558,239 shares of the company's stock valued at $120,672,000 after purchasing an additional 337,883 shares during the period. Allspring Global Investments Holdings LLC boosted its holdings in shares of Equitable by 5,536.0% in the first quarter. Allspring Global Investments Holdings LLC now owns 2,109,113 shares of the company's stock valued at $110,286,000 after purchasing an additional 2,071,691 shares during the period. Finally, Boston Partners purchased a new stake in shares of Equitable in the first quarter valued at approximately $108,264,000. 92.70% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of analysts recently issued reports on the company. Keefe, Bruyette & Woods boosted their price target on Equitable from $63.00 to $64.00 and gave the company an "outperform" rating in a report on Wednesday, July 9th. Evercore ISI lowered their price target on Equitable from $69.00 to $64.00 and set an "outperform" rating for the company in a report on Thursday, May 1st. Morgan Stanley lowered their price target on Equitable from $68.00 to $67.00 and set an "overweight" rating for the company in a report on Monday, August 18th. Wells Fargo & Company lowered their price target on Equitable from $66.00 to $63.00 and set an "overweight" rating for the company in a report on Friday, August 8th. Finally, UBS Group lowered their price target on Equitable from $77.00 to $75.00 and set a "buy" rating for the company in a report on Tuesday, May 27th. Nine research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $64.90.

View Our Latest Stock Analysis on EQH

Equitable Price Performance

Shares of EQH stock traded down $0.7150 during mid-day trading on Monday, hitting $52.8750. 2,228,536 shares of the stock were exchanged, compared to its average volume of 2,803,761. The firm has a fifty day moving average of $53.13 and a 200 day moving average of $52.11. The company has a quick ratio of 0.14, a current ratio of 0.14 and a debt-to-equity ratio of 4.94. Equitable Holdings, Inc. has a 52-week low of $37.99 and a 52-week high of $56.61. The company has a market cap of $15.84 billion, a PE ratio of 42.64 and a beta of 1.14.

Equitable Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, August 12th. Stockholders of record on Tuesday, August 5th were paid a dividend of $0.27 per share. This represents a $1.08 annualized dividend and a dividend yield of 2.0%. The ex-dividend date of this dividend was Tuesday, August 5th. Equitable's dividend payout ratio is presently 87.10%.

Insider Activity at Equitable

In related news, CEO Mark Pearson sold 39,700 shares of the firm's stock in a transaction dated Monday, August 18th. The shares were sold at an average price of $53.05, for a total value of $2,106,085.00. Following the transaction, the chief executive officer directly owned 703,029 shares of the company's stock, valued at approximately $37,295,688.45. This trade represents a 5.35% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Bertram L. Scott sold 2,600 shares of the firm's stock in a transaction dated Thursday, August 21st. The shares were sold at an average price of $51.86, for a total transaction of $134,836.00. Following the completion of the transaction, the director directly owned 26,001 shares in the company, valued at $1,348,411.86. This represents a 9.09% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 143,090 shares of company stock valued at $7,549,152. 1.10% of the stock is owned by corporate insiders.

Equitable Company Profile

(

Free Report)

Equitable Holdings, Inc, together with its consolidated subsidiaries, operates as a diversified financial services company worldwide. The company operates through six segments: Individual Retirement, Group Retirement, Investment Management and Research, Protection Solutions, Wealth Management, and Legacy.

Featured Stories

Before you consider Equitable, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equitable wasn't on the list.

While Equitable currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report