Prime Capital Investment Advisors LLC trimmed its position in shares of Workday, Inc. (NASDAQ:WDAY - Free Report) by 18.9% during the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 11,307 shares of the software maker's stock after selling 2,630 shares during the quarter. Prime Capital Investment Advisors LLC's holdings in Workday were worth $2,714,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

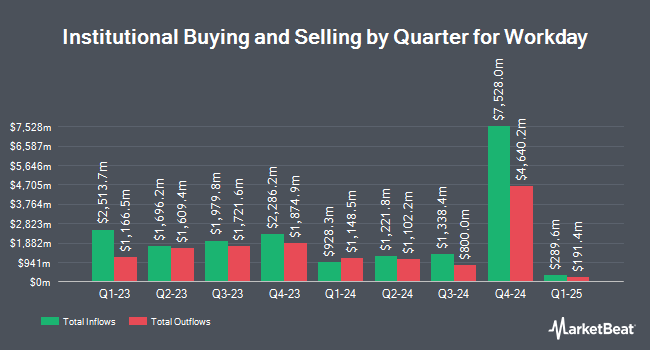

A number of other hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. boosted its holdings in Workday by 2.3% during the 1st quarter. Vanguard Group Inc. now owns 20,598,655 shares of the software maker's stock worth $4,810,404,000 after acquiring an additional 455,855 shares during the last quarter. T. Rowe Price Investment Management Inc. boosted its holdings in Workday by 47.5% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 3,764,598 shares of the software maker's stock worth $879,147,000 after acquiring an additional 1,211,659 shares during the last quarter. The Manufacturers Life Insurance Company boosted its holdings in Workday by 0.4% during the 1st quarter. The Manufacturers Life Insurance Company now owns 3,736,609 shares of the software maker's stock worth $872,610,000 after acquiring an additional 14,354 shares during the last quarter. Hotchkis & Wiley Capital Management LLC boosted its holdings in Workday by 35.6% during the 1st quarter. Hotchkis & Wiley Capital Management LLC now owns 3,479,105 shares of the software maker's stock worth $812,475,000 after acquiring an additional 913,613 shares during the last quarter. Finally, Parnassus Investments LLC boosted its holdings in shares of Workday by 22.4% in the 1st quarter. Parnassus Investments LLC now owns 2,996,429 shares of the software maker's stock worth $699,756,000 after buying an additional 548,694 shares during the last quarter. 89.81% of the stock is owned by hedge funds and other institutional investors.

Workday Trading Down 2.2%

Shares of Workday stock opened at $233.17 on Wednesday. Workday, Inc. has a 52-week low of $205.33 and a 52-week high of $294.00. The stock's 50-day simple moving average is $229.94 and its 200 day simple moving average is $237.18. The stock has a market capitalization of $62.26 billion, a P/E ratio of 107.95, a P/E/G ratio of 2.97 and a beta of 1.10. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.10 and a current ratio of 2.10.

Workday (NASDAQ:WDAY - Get Free Report) last announced its quarterly earnings data on Thursday, August 21st. The software maker reported $2.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.09 by $0.12. Workday had a return on equity of 9.74% and a net margin of 6.51%.The business had revenue of $2.35 billion for the quarter, compared to analysts' expectations of $2.34 billion. During the same period in the previous year, the business posted $1.75 EPS. The firm's quarterly revenue was up 12.6% compared to the same quarter last year. Workday has set its FY 2026 guidance at EPS. Q3 2026 guidance at EPS. As a group, research analysts anticipate that Workday, Inc. will post 2.63 EPS for the current year.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on WDAY. Barclays boosted their price target on shares of Workday from $285.00 to $288.00 and gave the stock an "overweight" rating in a report on Thursday, September 18th. Evercore ISI boosted their price target on shares of Workday from $275.00 to $300.00 and gave the stock an "outperform" rating in a report on Wednesday, September 17th. Sanford C. Bernstein reissued an "outperform" rating and issued a $304.00 price target on shares of Workday in a report on Friday, August 22nd. Royal Bank Of Canada reissued an "outperform" rating and issued a $340.00 price target on shares of Workday in a report on Wednesday, September 17th. Finally, Cowen reissued a "buy" rating on shares of Workday in a report on Wednesday, September 17th. Three equities research analysts have rated the stock with a Strong Buy rating, twenty-three have given a Buy rating and nine have given a Hold rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $287.83.

View Our Latest Research Report on Workday

Insider Activity

In other news, CAO Mark S. Garfield sold 451 shares of the company's stock in a transaction dated Thursday, July 10th. The stock was sold at an average price of $234.86, for a total transaction of $105,921.86. Following the sale, the chief accounting officer directly owned 42,977 shares in the company, valued at $10,093,578.22. This represents a 1.04% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, major shareholder David A. Duffield sold 72,118 shares of the company's stock in a transaction dated Tuesday, September 23rd. The shares were sold at an average price of $241.57, for a total value of $17,421,545.26. Following the sale, the insider owned 102,997 shares in the company, valued at approximately $24,880,985.29. This represents a 41.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 183,023 shares of company stock valued at $42,117,830. 20.00% of the stock is currently owned by insiders.

Workday Company Profile

(

Free Report)

Workday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

See Also

Want to see what other hedge funds are holding WDAY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Workday, Inc. (NASDAQ:WDAY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report