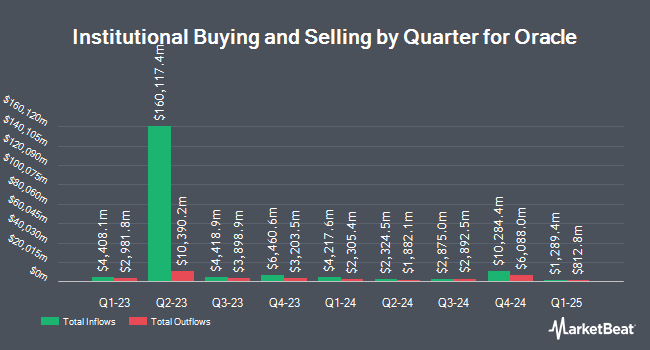

Prime Capital Investment Advisors LLC decreased its holdings in Oracle Corporation (NYSE:ORCL - Free Report) by 5.3% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 54,658 shares of the enterprise software provider's stock after selling 3,080 shares during the quarter. Prime Capital Investment Advisors LLC's holdings in Oracle were worth $11,950,000 as of its most recent filing with the Securities & Exchange Commission.

Other large investors have also bought and sold shares of the company. Harel Insurance Investments & Financial Services Ltd. grew its position in shares of Oracle by 71.6% in the 1st quarter. Harel Insurance Investments & Financial Services Ltd. now owns 257,378 shares of the enterprise software provider's stock worth $35,984,000 after buying an additional 107,404 shares during the period. Lockheed Martin Investment Management Co. grew its holdings in Oracle by 4.3% in the first quarter. Lockheed Martin Investment Management Co. now owns 51,350 shares of the enterprise software provider's stock worth $7,179,000 after purchasing an additional 2,110 shares during the period. Lockerman Financial Group Inc. bought a new position in shares of Oracle during the second quarter valued at approximately $328,000. Elser Financial Planning Inc bought a new stake in shares of Oracle in the 2nd quarter worth approximately $1,066,000. Finally, Canoe Financial LP increased its position in Oracle by 314.8% during the 2nd quarter. Canoe Financial LP now owns 484,098 shares of the enterprise software provider's stock valued at $105,838,000 after buying an additional 367,400 shares in the last quarter. 42.44% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several equities analysts have recently issued reports on ORCL shares. The Goldman Sachs Group lifted their price target on Oracle from $195.00 to $310.00 and gave the stock a "neutral" rating in a research report on Monday, September 15th. Cowen reiterated a "buy" rating and issued a $375.00 target price on shares of Oracle in a research note on Wednesday, September 10th. Morgan Stanley raised their price target on shares of Oracle from $246.00 to $320.00 and gave the company an "equal weight" rating in a research report on Tuesday, September 23rd. UBS Group set a $364.00 price objective on Oracle in a research report on Friday, September 26th. Finally, Sanford C. Bernstein lifted their price objective on Oracle from $363.00 to $364.00 and gave the stock an "outperform" rating in a report on Friday, September 26th. Two equities research analysts have rated the stock with a Strong Buy rating, twenty-five have assigned a Buy rating, ten have issued a Hold rating and two have assigned a Sell rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $304.71.

Get Our Latest Stock Report on Oracle

Oracle Stock Down 0.9%

ORCL opened at $286.23 on Monday. The firm's 50 day simple moving average is $262.53 and its two-hundred day simple moving average is $205.85. The company has a market capitalization of $815.99 billion, a PE ratio of 66.26, a PEG ratio of 3.08 and a beta of 1.53. Oracle Corporation has a 1-year low of $118.86 and a 1-year high of $345.72. The company has a current ratio of 0.62, a quick ratio of 0.62 and a debt-to-equity ratio of 3.33.

Oracle (NYSE:ORCL - Get Free Report) last issued its quarterly earnings data on Tuesday, September 9th. The enterprise software provider reported $1.47 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.48 by ($0.01). Oracle had a net margin of 21.08% and a return on equity of 72.93%. The business had revenue of $14.93 billion for the quarter, compared to the consensus estimate of $15.04 billion. During the same period in the previous year, the firm earned $1.39 EPS. The company's revenue was up 12.2% on a year-over-year basis. Oracle has set its Q2 2026 guidance at 1.270-1.310 EPS. As a group, equities analysts forecast that Oracle Corporation will post 5 EPS for the current year.

Oracle Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 23rd. Shareholders of record on Thursday, October 9th will be given a $0.50 dividend. The ex-dividend date is Thursday, October 9th. This represents a $2.00 dividend on an annualized basis and a yield of 0.7%. Oracle's dividend payout ratio is presently 46.30%.

Insider Buying and Selling

In other Oracle news, Director William G. Parrett sold 11,500 shares of Oracle stock in a transaction that occurred on Friday, September 12th. The shares were sold at an average price of $306.00, for a total transaction of $3,519,000.00. Following the transaction, the director owned 17,764 shares of the company's stock, valued at $5,435,784. The trade was a 39.30% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Naomi O. Seligman sold 3,303 shares of the stock in a transaction on Wednesday, July 16th. The stock was sold at an average price of $233.32, for a total transaction of $770,655.96. Following the completion of the sale, the director directly owned 31,447 shares of the company's stock, valued at approximately $7,337,214.04. This trade represents a 9.51% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 104,314 shares of company stock worth $31,272,223 over the last ninety days. 40.90% of the stock is owned by corporate insiders.

Oracle Company Profile

(

Free Report)

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oracle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oracle wasn't on the list.

While Oracle currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report