Primecap Management Co. CA lessened its position in Tapestry, Inc. (NYSE:TPR - Free Report) by 12.2% during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 357,495 shares of the luxury accessories retailer's stock after selling 49,600 shares during the period. Primecap Management Co. CA owned 0.17% of Tapestry worth $25,171,000 at the end of the most recent reporting period.

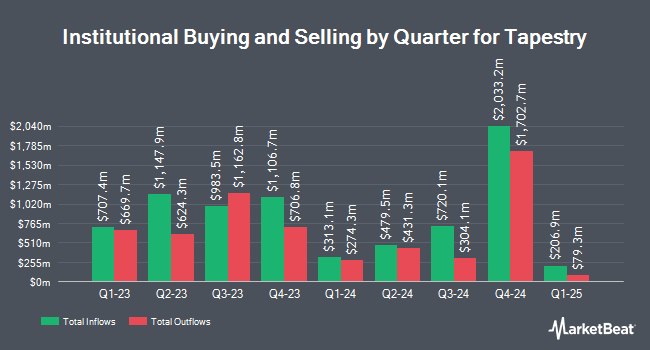

A number of other hedge funds and other institutional investors have also bought and sold shares of TPR. China Universal Asset Management Co. Ltd. purchased a new position in shares of Tapestry in the 1st quarter valued at approximately $1,708,000. Curat Global LLC bought a new position in Tapestry in the first quarter worth $382,000. Nisa Investment Advisors LLC lifted its position in Tapestry by 16.7% during the first quarter. Nisa Investment Advisors LLC now owns 63,342 shares of the luxury accessories retailer's stock valued at $4,460,000 after buying an additional 9,049 shares during the period. Allworth Financial LP boosted its holdings in shares of Tapestry by 689.0% during the 1st quarter. Allworth Financial LP now owns 13,374 shares of the luxury accessories retailer's stock valued at $913,000 after buying an additional 11,679 shares in the last quarter. Finally, Neo Ivy Capital Management purchased a new stake in shares of Tapestry in the 1st quarter worth about $1,476,000. Institutional investors own 90.77% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on the stock. The Goldman Sachs Group upped their price objective on shares of Tapestry from $84.00 to $93.00 and gave the stock a "buy" rating in a report on Friday, May 9th. Cowen reissued a "buy" rating on shares of Tapestry in a research report on Thursday. UBS Group reaffirmed a "neutral" rating and set a $112.00 price objective (up previously from $73.00) on shares of Tapestry in a research report on Monday, August 4th. Wells Fargo & Company reissued an "overweight" rating and issued a $100.00 target price (up from $90.00) on shares of Tapestry in a research note on Wednesday, May 14th. Finally, Barclays reaffirmed an "overweight" rating and issued a $105.00 price target (up previously from $98.00) on shares of Tapestry in a research report on Friday, July 11th. Four equities research analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $99.72.

Check Out Our Latest Research Report on TPR

Insider Activity

In other news, CEO Todd Kahn sold 40,000 shares of Tapestry stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $81.40, for a total value of $3,256,000.00. Following the completion of the transaction, the chief executive officer owned 116,062 shares in the company, valued at approximately $9,447,446.80. The trade was a 25.63% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, VP Manesh Dadlani sold 1,399 shares of the stock in a transaction on Monday, May 12th. The shares were sold at an average price of $81.88, for a total value of $114,550.12. Following the sale, the vice president owned 40,922 shares in the company, valued at $3,350,693.36. The trade was a 3.31% decrease in their position. The disclosure for this sale can be found here. 1.18% of the stock is currently owned by corporate insiders.

Tapestry Price Performance

Shares of NYSE:TPR traded up $0.51 during midday trading on Friday, reaching $108.99. 3,243,764 shares of the company were exchanged, compared to its average volume of 4,031,584. The company has a current ratio of 1.76, a quick ratio of 1.22 and a debt-to-equity ratio of 1.59. The stock has a market cap of $22.64 billion, a PE ratio of 28.68, a price-to-earnings-growth ratio of 2.20 and a beta of 1.51. The business's fifty day moving average is $94.16 and its two-hundred day moving average is $81.62. Tapestry, Inc. has a one year low of $37.13 and a one year high of $113.08.

Tapestry (NYSE:TPR - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The luxury accessories retailer reported $1.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.89 by $0.14. Tapestry had a return on equity of 51.84% and a net margin of 12.50%. The business had revenue of $1.58 billion for the quarter, compared to analysts' expectations of $1.53 billion. During the same period in the prior year, the firm earned $0.81 EPS. The company's revenue for the quarter was up 6.9% on a year-over-year basis. As a group, analysts predict that Tapestry, Inc. will post 4.91 earnings per share for the current year.

Tapestry Profile

(

Free Report)

Tapestry, Inc provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman. It offers women's handbags; and women's accessories, such as small leather goods which includes mini and micro handbags, money pieces, wristlets, pouches, and cosmetic cases, as well as novelty accessories including address books, time management and travel accessories, sketchbooks, and portfolios; and belts, key rings, and charms.

Recommended Stories

Before you consider Tapestry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tapestry wasn't on the list.

While Tapestry currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.