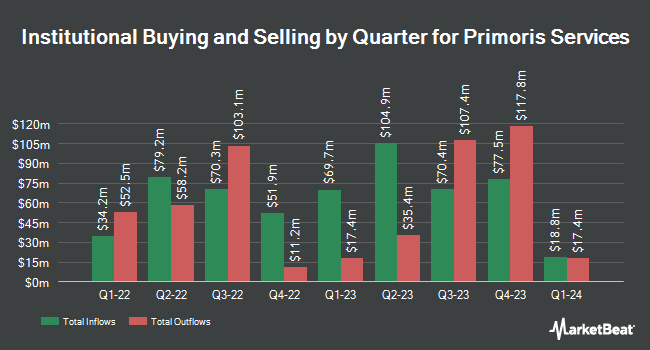

Millennium Management LLC lifted its position in Primoris Services Co. (NASDAQ:PRIM - Free Report) by 262.1% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 728,405 shares of the construction company's stock after purchasing an additional 527,240 shares during the quarter. Millennium Management LLC owned 1.35% of Primoris Services worth $41,818,000 at the end of the most recent reporting period.

A number of other large investors have also modified their holdings of PRIM. Centiva Capital LP acquired a new position in shares of Primoris Services in the fourth quarter valued at $306,000. Fiduciary Trust Co acquired a new position in shares of Primoris Services in the fourth quarter valued at $218,000. Ethic Inc. acquired a new position in shares of Primoris Services in the fourth quarter valued at $209,000. Gotham Asset Management LLC raised its stake in shares of Primoris Services by 125.4% in the fourth quarter. Gotham Asset Management LLC now owns 38,910 shares of the construction company's stock valued at $2,973,000 after purchasing an additional 21,647 shares in the last quarter. Finally, Janus Henderson Group PLC raised its stake in shares of Primoris Services by 16.7% in the fourth quarter. Janus Henderson Group PLC now owns 107,288 shares of the construction company's stock valued at $8,196,000 after purchasing an additional 15,356 shares in the last quarter. 91.82% of the stock is currently owned by institutional investors and hedge funds.

Primoris Services Trading Up 2.5%

PRIM stock traded up $3.06 during midday trading on Monday, reaching $125.16. The stock had a trading volume of 94,477 shares, compared to its average volume of 914,754. The business has a fifty day simple moving average of $103.86 and a two-hundred day simple moving average of $80.08. The company has a quick ratio of 1.38, a current ratio of 1.38 and a debt-to-equity ratio of 0.61. The firm has a market cap of $6.76 billion, a price-to-earnings ratio of 41.37 and a beta of 1.42. Primoris Services Co. has a twelve month low of $49.10 and a twelve month high of $125.17.

Primoris Services (NASDAQ:PRIM - Get Free Report) last announced its quarterly earnings data on Monday, August 4th. The construction company reported $1.68 EPS for the quarter, topping analysts' consensus estimates of $1.10 by $0.58. The firm had revenue of $1.89 billion during the quarter, compared to analyst estimates of $1.69 billion. Primoris Services had a return on equity of 15.23% and a net margin of 2.68%.The company's revenue was up 20.9% on a year-over-year basis. During the same period last year, the company earned $1.04 earnings per share. Primoris Services has set its FY 2025 guidance at 4.900-5.100 EPS. As a group, research analysts expect that Primoris Services Co. will post 3.26 EPS for the current fiscal year.

Primoris Services Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Tuesday, September 30th will be given a $0.08 dividend. This represents a $0.32 dividend on an annualized basis and a yield of 0.3%. The ex-dividend date is Tuesday, September 30th. Primoris Services's dividend payout ratio (DPR) is presently 7.26%.

Insider Buying and Selling

In other Primoris Services news, Director John P. Schauerman sold 20,000 shares of the firm's stock in a transaction dated Tuesday, August 12th. The stock was sold at an average price of $114.01, for a total transaction of $2,280,200.00. Following the transaction, the director owned 82,281 shares in the company, valued at approximately $9,380,856.81. This trade represents a 19.55% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 1.40% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Several research analysts have issued reports on PRIM shares. KeyCorp increased their price objective on Primoris Services from $119.00 to $129.00 and gave the stock an "overweight" rating in a research note on Tuesday, September 2nd. Janney Montgomery Scott started coverage on Primoris Services in a research note on Thursday, July 3rd. They set a "buy" rating and a $102.00 price objective for the company. Mizuho started coverage on Primoris Services in a research note on Thursday, September 4th. They set a "neutral" rating and a $112.00 price objective for the company. DA Davidson increased their price objective on Primoris Services from $85.00 to $125.00 and gave the stock a "buy" rating in a research note on Wednesday, August 6th. Finally, UBS Group increased their price objective on Primoris Services from $100.00 to $110.00 and gave the stock a "buy" rating in a research note on Tuesday, August 5th. Eight investment analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $103.70.

Read Our Latest Research Report on PRIM

Primoris Services Profile

(

Free Report)

Primoris Services Corporation, a specialty contractor company, provides a range of specialty construction, fabrication, maintenance, replacement, and engineering services in the United States and Canada. The company operates through Utilities and Energy/Renewables segments. The Utilities segment offers installation and maintenance services for new and existing natural gas distribution systems, electric utility distribution and transmission systems, and communications systems.

See Also

Before you consider Primoris Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Primoris Services wasn't on the list.

While Primoris Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.