Private Advisor Group LLC cut its position in American Airlines Group Inc. (NASDAQ:AAL - Free Report) by 37.6% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 36,269 shares of the airline's stock after selling 21,820 shares during the quarter. Private Advisor Group LLC's holdings in American Airlines Group were worth $383,000 as of its most recent filing with the Securities and Exchange Commission.

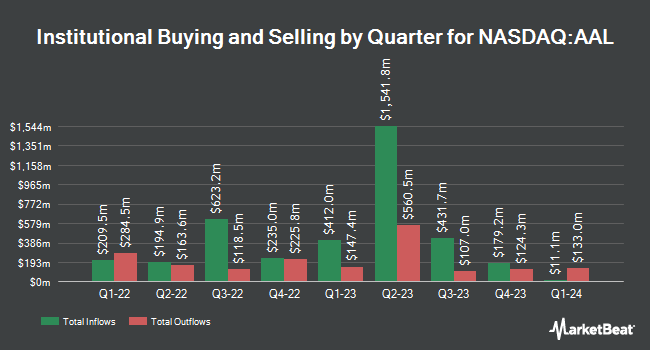

A number of other institutional investors have also modified their holdings of AAL. Elequin Capital LP boosted its position in shares of American Airlines Group by 208.5% during the 4th quarter. Elequin Capital LP now owns 1,749 shares of the airline's stock worth $30,000 after acquiring an additional 1,182 shares in the last quarter. Bogart Wealth LLC boosted its position in shares of American Airlines Group by 1,300.0% during the 1st quarter. Bogart Wealth LLC now owns 2,800 shares of the airline's stock worth $30,000 after acquiring an additional 2,600 shares in the last quarter. Golden State Wealth Management LLC boosted its position in shares of American Airlines Group by 121.4% during the 1st quarter. Golden State Wealth Management LLC now owns 3,117 shares of the airline's stock worth $33,000 after acquiring an additional 1,709 shares in the last quarter. Bernard Wealth Management Corp. acquired a new position in shares of American Airlines Group during the 4th quarter worth about $42,000. Finally, Cullen Frost Bankers Inc. boosted its position in shares of American Airlines Group by 10,110.4% during the 1st quarter. Cullen Frost Bankers Inc. now owns 4,901 shares of the airline's stock worth $52,000 after acquiring an additional 4,853 shares in the last quarter. 52.44% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts recently issued reports on AAL shares. Raymond James Financial dropped their price target on American Airlines Group from $15.00 to $14.00 and set an "outperform" rating on the stock in a research note on Friday, April 25th. Susquehanna reduced their price objective on American Airlines Group from $18.00 to $10.00 and set a "neutral" rating for the company in a research note on Monday, April 7th. Bank of America upped their price objective on American Airlines Group from $10.00 to $12.00 and gave the company a "neutral" rating in a research note on Tuesday, July 1st. TD Cowen upped their price objective on American Airlines Group to $13.00 and gave the company an "unchanged" rating in a research note on Friday, April 25th. Finally, The Goldman Sachs Group downgraded American Airlines Group from a "neutral" rating to a "sell" rating and cut their target price for the stock from $16.00 to $8.00 in a research note on Tuesday, April 8th. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $16.76.

Check Out Our Latest Stock Analysis on American Airlines Group

American Airlines Group Stock Up 2.6%

NASDAQ AAL traded up $0.30 during mid-day trading on Tuesday, hitting $11.57. The stock had a trading volume of 51,049,626 shares, compared to its average volume of 56,656,035. The company has a 50 day simple moving average of $11.52 and a 200 day simple moving average of $12.27. The company has a market cap of $7.63 billion, a price-to-earnings ratio of 14.46, a P/E/G ratio of 2.50 and a beta of 1.43. American Airlines Group Inc. has a 52-week low of $8.50 and a 52-week high of $19.10.

American Airlines Group (NASDAQ:AAL - Get Free Report) last announced its earnings results on Thursday, July 24th. The airline reported $0.95 EPS for the quarter, beating analysts' consensus estimates of $0.79 by $0.16. The firm had revenue of $14.39 billion for the quarter, compared to analysts' expectations of $14.27 billion. American Airlines Group had a negative return on equity of 24.55% and a net margin of 1.05%. American Airlines Group's quarterly revenue was up .4% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.09 EPS. As a group, equities analysts anticipate that American Airlines Group Inc. will post 2.42 earnings per share for the current fiscal year.

American Airlines Group Profile

(

Free Report)

American Airlines Group Inc, through its subsidiaries, operates as a network air carrier. The company provides scheduled air transportation services for passengers and cargo through its hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, DC, as well as through partner gateways in London, Doha, Madrid, Seattle/Tacoma, Sydney, and Tokyo.

See Also

Before you consider American Airlines Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Airlines Group wasn't on the list.

While American Airlines Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.