Private Management Group Inc. lifted its position in shares of MarineMax, Inc. (NYSE:HZO - Free Report) by 5.9% in the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 559,096 shares of the specialty retailer's stock after acquiring an additional 31,226 shares during the quarter. Private Management Group Inc. owned approximately 2.60% of MarineMax worth $12,021,000 at the end of the most recent quarter.

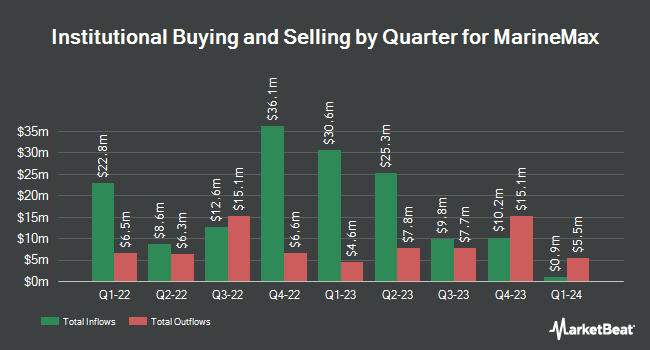

Several other large investors have also added to or reduced their stakes in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its stake in MarineMax by 4.5% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 12,375 shares of the specialty retailer's stock worth $358,000 after purchasing an additional 532 shares during the period. Bridgeway Capital Management LLC raised its holdings in shares of MarineMax by 3.6% during the 4th quarter. Bridgeway Capital Management LLC now owns 28,879 shares of the specialty retailer's stock valued at $836,000 after buying an additional 1,006 shares in the last quarter. Wells Fargo & Company MN raised its holdings in shares of MarineMax by 12.7% during the 4th quarter. Wells Fargo & Company MN now owns 12,961 shares of the specialty retailer's stock valued at $375,000 after buying an additional 1,456 shares in the last quarter. Price T Rowe Associates Inc. MD raised its holdings in shares of MarineMax by 23.4% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 8,714 shares of the specialty retailer's stock valued at $253,000 after buying an additional 1,653 shares in the last quarter. Finally, Peregrine Capital Management LLC increased its stake in MarineMax by 1.7% in the 1st quarter. Peregrine Capital Management LLC now owns 157,205 shares of the specialty retailer's stock worth $3,380,000 after purchasing an additional 2,600 shares during the period. Institutional investors own 92.85% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have recently weighed in on HZO. Truist Financial cut their price objective on MarineMax from $38.00 to $26.00 and set a "buy" rating on the stock in a research report on Monday, April 14th. Citigroup reaffirmed a "buy" rating and set a $32.00 price target (up from $29.00) on shares of MarineMax in a report on Monday, June 16th. Wall Street Zen cut MarineMax from a "hold" rating to a "sell" rating in a research report on Saturday. Finally, B. Riley reissued a "buy" rating on shares of MarineMax in a research note on Friday. One research analyst has rated the stock with a sell rating and five have assigned a buy rating to the company. According to MarketBeat, MarineMax has an average rating of "Moderate Buy" and an average target price of $33.25.

Read Our Latest Stock Report on HZO

MarineMax Stock Down 0.1%

Shares of MarineMax stock traded down $0.02 during trading on Tuesday, reaching $22.18. The company's stock had a trading volume of 172,577 shares, compared to its average volume of 341,008. The company has a quick ratio of 0.29, a current ratio of 1.21 and a debt-to-equity ratio of 0.38. The company has a market cap of $476.10 million, a price-to-earnings ratio of -16.54 and a beta of 1.60. MarineMax, Inc. has a 1-year low of $16.85 and a 1-year high of $37.86. The company has a 50-day simple moving average of $24.49 and a two-hundred day simple moving average of $24.40.

MarineMax (NYSE:HZO - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The specialty retailer reported $0.49 EPS for the quarter, missing analysts' consensus estimates of $1.16 by ($0.67). The firm had revenue of $657.16 million for the quarter, compared to analyst estimates of $737.82 million. MarineMax had a positive return on equity of 2.63% and a negative net margin of 1.15%. The business's revenue was down 13.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $1.51 EPS. As a group, equities analysts forecast that MarineMax, Inc. will post 2.41 earnings per share for the current year.

MarineMax Company Profile

(

Free Report)

MarineMax, Inc operates as a recreational boat and yacht retailer and superyacht services company in the United States. It operates in two segments, Retail Operations and Product Manufacturing. The company sells new and used recreational boats, including pleasure and fishing boats, mega-yachts, yachts, sport cruisers, motor yachts, e-power yachts, pontoon boats, ski boats, jet boats, and other recreational boats.

Further Reading

Before you consider MarineMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarineMax wasn't on the list.

While MarineMax currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.