Private Wealth Advisors LLC trimmed its stake in Caterpillar Inc. (NYSE:CAT - Free Report) by 55.4% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 609 shares of the industrial products company's stock after selling 756 shares during the period. Private Wealth Advisors LLC's holdings in Caterpillar were worth $201,000 as of its most recent SEC filing.

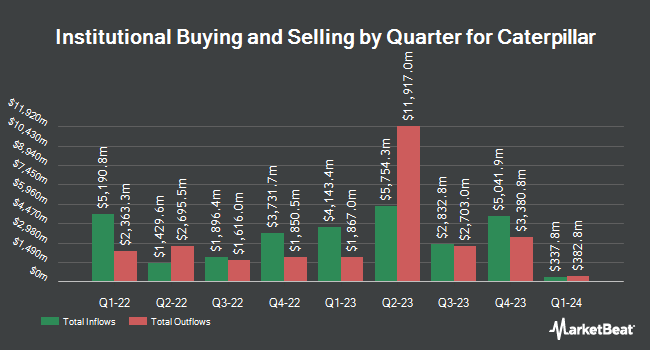

A number of other institutional investors and hedge funds have also bought and sold shares of CAT. Victrix Investment Advisors purchased a new position in shares of Caterpillar during the fourth quarter worth approximately $2,090,000. Charles Schwab Investment Management Inc. raised its stake in shares of Caterpillar by 0.5% during the first quarter. Charles Schwab Investment Management Inc. now owns 3,304,448 shares of the industrial products company's stock worth $1,089,798,000 after acquiring an additional 15,347 shares in the last quarter. Pacific Point Advisors LLC purchased a new position in shares of Caterpillar in the fourth quarter worth $579,000. Wealth Enhancement Advisory Services LLC increased its stake in shares of Caterpillar by 18.6% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 191,640 shares of the industrial products company's stock worth $63,202,000 after buying an additional 30,070 shares during the period. Finally, Crestwood Advisors Group LLC increased its stake in shares of Caterpillar by 3.4% in the first quarter. Crestwood Advisors Group LLC now owns 22,689 shares of the industrial products company's stock worth $7,483,000 after buying an additional 743 shares during the period. 70.98% of the stock is owned by hedge funds and other institutional investors.

Caterpillar Stock Down 2.0%

Shares of CAT stock traded down $8.13 during mid-day trading on Monday, reaching $408.40. 3,415,993 shares of the company's stock traded hands, compared to its average volume of 2,969,034. The company has a market cap of $191.32 billion, a P/E ratio of 20.77, a P/E/G ratio of 2.47 and a beta of 1.40. The company's 50-day moving average price is $394.65 and its 200-day moving average price is $355.11. Caterpillar Inc. has a 12 month low of $267.30 and a 12 month high of $441.15. The company has a quick ratio of 0.81, a current ratio of 1.34 and a debt-to-equity ratio of 1.50.

Caterpillar (NYSE:CAT - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The industrial products company reported $4.72 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $4.88 by ($0.16). The firm had revenue of $16.57 billion during the quarter, compared to the consensus estimate of $16.14 billion. Caterpillar had a return on equity of 48.95% and a net margin of 14.95%. The business's revenue for the quarter was down .7% on a year-over-year basis. During the same quarter in the previous year, the firm earned $5.99 EPS. On average, equities analysts expect that Caterpillar Inc. will post 19.86 earnings per share for the current fiscal year.

Caterpillar Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, August 20th. Stockholders of record on Monday, July 21st will be paid a $1.51 dividend. This is an increase from Caterpillar's previous quarterly dividend of $1.41. This represents a $6.04 annualized dividend and a dividend yield of 1.5%. The ex-dividend date is Monday, July 21st. Caterpillar's dividend payout ratio (DPR) is presently 30.72%.

Wall Street Analyst Weigh In

Several brokerages recently commented on CAT. Sanford C. Bernstein reaffirmed a "market perform" rating on shares of Caterpillar in a research note on Monday, July 14th. Citigroup lifted their target price on shares of Caterpillar from $460.00 to $500.00 and gave the stock a "buy" rating in a research note on Wednesday, August 6th. UBS Group raised shares of Caterpillar from a "sell" rating to a "neutral" rating and lifted their target price for the stock from $272.00 to $357.00 in a research note on Friday, May 16th. JPMorgan Chase & Co. lifted their target price on shares of Caterpillar from $475.00 to $520.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 6th. Finally, Barclays boosted their price objective on shares of Caterpillar from $383.00 to $425.00 and gave the company an "equal weight" rating in a research report on Wednesday, August 6th. Seven equities research analysts have rated the stock with a hold rating, ten have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $444.00.

Read Our Latest Stock Analysis on CAT

Caterpillar Company Profile

(

Free Report)

Caterpillar Inc manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in worldwide. Its Construction Industries segment offers asphalt pavers, compactors, road reclaimers, forestry machines, cold planers, material handlers, track-type tractors, excavators, telehandlers, motor graders, and pipelayers; compact track, wheel, track-type, backhoe, and skid steer loaders; and related parts and tools.

Further Reading

Before you consider Caterpillar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caterpillar wasn't on the list.

While Caterpillar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.