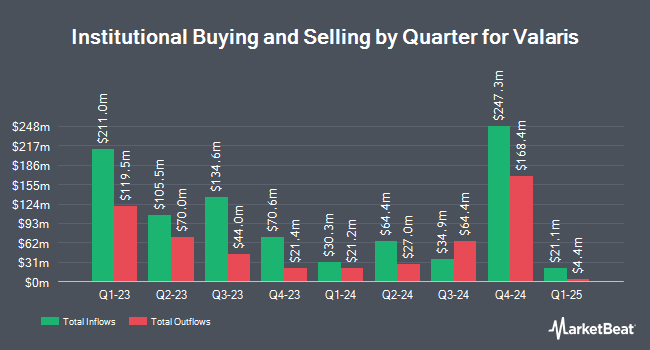

Privium Fund Management B.V. reduced its position in shares of Valaris Limited (NYSE:VAL - Free Report) by 31.7% in the second quarter, according to its most recent filing with the SEC. The fund owned 13,803 shares of the company's stock after selling 6,419 shares during the quarter. Privium Fund Management B.V.'s holdings in Valaris were worth $606,000 at the end of the most recent reporting period.

Other large investors also recently bought and sold shares of the company. Bayforest Capital Ltd lifted its holdings in shares of Valaris by 17.2% in the 1st quarter. Bayforest Capital Ltd now owns 1,920 shares of the company's stock valued at $75,000 after acquiring an additional 282 shares during the last quarter. Signaturefd LLC boosted its holdings in shares of Valaris by 45.4% in the 2nd quarter. Signaturefd LLC now owns 916 shares of the company's stock worth $39,000 after purchasing an additional 286 shares during the period. Fifth Third Bancorp increased its position in shares of Valaris by 77.9% during the 2nd quarter. Fifth Third Bancorp now owns 822 shares of the company's stock valued at $35,000 after purchasing an additional 360 shares during the last quarter. Moody National Bank Trust Division raised its holdings in Valaris by 4.8% during the 2nd quarter. Moody National Bank Trust Division now owns 9,645 shares of the company's stock valued at $406,000 after buying an additional 438 shares during the period. Finally, Fermata Advisors LLC lifted its position in Valaris by 8.9% in the second quarter. Fermata Advisors LLC now owns 6,133 shares of the company's stock worth $258,000 after buying an additional 501 shares during the last quarter. Institutional investors own 96.74% of the company's stock.

Wall Street Analysts Forecast Growth

VAL has been the subject of a number of recent analyst reports. Clarkson Capital cut Valaris from a "buy" rating to a "neutral" rating and set a $54.00 price objective for the company. in a report on Tuesday, September 2nd. Citigroup boosted their target price on shares of Valaris from $50.00 to $55.00 and gave the company a "neutral" rating in a research note on Wednesday, October 8th. Wall Street Zen raised shares of Valaris from a "sell" rating to a "hold" rating in a research note on Saturday, August 30th. Capital One Financial set a $55.00 price objective on shares of Valaris in a research report on Monday, September 15th. Finally, Fearnley Fonds downgraded shares of Valaris from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 30th. One investment analyst has rated the stock with a Buy rating, eight have issued a Hold rating and two have assigned a Sell rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Reduce" and an average price target of $48.69.

Get Our Latest Report on VAL

Valaris Stock Up 1.2%

Shares of Valaris stock opened at $48.93 on Tuesday. The company has a quick ratio of 1.81, a current ratio of 1.81 and a debt-to-equity ratio of 0.46. The company has a market cap of $3.48 billion, a P/E ratio of 12.74 and a beta of 1.15. The firm's 50 day moving average price is $49.62 and its 200-day moving average price is $43.92. Valaris Limited has a 52-week low of $27.15 and a 52-week high of $53.98.

Valaris (NYSE:VAL - Get Free Report) last announced its earnings results on Wednesday, July 30th. The company reported $1.61 earnings per share for the quarter, topping the consensus estimate of $1.16 by $0.45. Valaris had a return on equity of 12.36% and a net margin of 11.18%.The firm had revenue of $615.20 million for the quarter, compared to the consensus estimate of $582.70 million. During the same period in the previous year, the business earned $2.03 EPS. The firm's revenue for the quarter was up .8% on a year-over-year basis. On average, sell-side analysts predict that Valaris Limited will post 3.96 EPS for the current fiscal year.

About Valaris

(

Free Report)

Valaris Limited, together with its subsidiaries, provides offshore contract drilling services Gulf of Mexico, South America, North Sea, the Middle East, Africa, and the Asia Pacific. The company operates through four segments: Floaters, Jackups, ARO, and Other. It owns an offshore drilling rig fleet, which include drillships, dynamically positioned semisubmersible rigs, moored semisubmersible rig, and jackup rigs.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Valaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valaris wasn't on the list.

While Valaris currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.