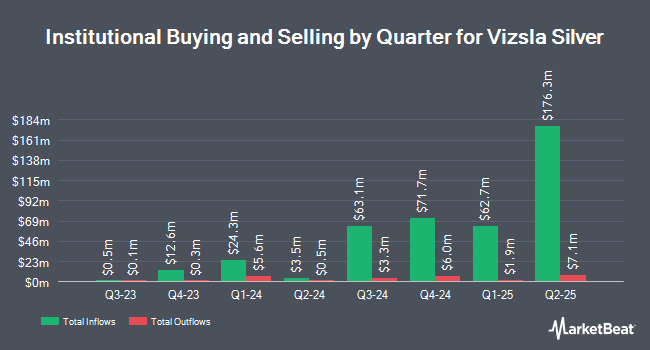

Privium Fund Management B.V. increased its holdings in Vizsla Silver Corp. (NYSEAMERICAN:VZLA - Free Report) by 30.3% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 250,790 shares of the company's stock after buying an additional 58,303 shares during the quarter. Privium Fund Management B.V. owned 0.07% of Vizsla Silver worth $732,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Mackenzie Financial Corp raised its position in Vizsla Silver by 83.7% in the first quarter. Mackenzie Financial Corp now owns 7,647,130 shares of the company's stock worth $17,482,000 after acquiring an additional 3,484,743 shares during the period. Millennium Management LLC raised its holdings in Vizsla Silver by 1,165.0% in the 1st quarter. Millennium Management LLC now owns 2,932,731 shares of the company's stock worth $6,666,000 after purchasing an additional 2,700,887 shares during the period. Jupiter Asset Management Ltd. lifted its position in Vizsla Silver by 37.7% during the first quarter. Jupiter Asset Management Ltd. now owns 7,468,218 shares of the company's stock valued at $17,072,000 after purchasing an additional 2,043,880 shares in the last quarter. Amundi grew its holdings in Vizsla Silver by 125.0% during the first quarter. Amundi now owns 2,250,000 shares of the company's stock valued at $4,838,000 after purchasing an additional 1,250,000 shares during the period. Finally, Ninepoint Partners LP bought a new stake in Vizsla Silver during the first quarter valued at about $2,653,000. 22.46% of the stock is owned by hedge funds and other institutional investors.

Vizsla Silver Stock Performance

Shares of NYSEAMERICAN VZLA opened at $4.69 on Tuesday. Vizsla Silver Corp. has a 52-week low of $1.67 and a 52-week high of $5.07. The firm has a market capitalization of $1.60 billion, a price-to-earnings ratio of -117.25 and a beta of 0.98. The stock has a 50 day moving average price of $3.98 and a 200 day moving average price of $3.20.

Analyst Upgrades and Downgrades

A number of research analysts have recently weighed in on VZLA shares. National Bank Financial raised Vizsla Silver to a "strong-buy" rating in a research report on Thursday, June 26th. Zacks Research downgraded shares of Vizsla Silver from a "strong-buy" rating to a "hold" rating in a report on Friday, August 22nd. Finally, Roth Capital reiterated a "buy" rating on shares of Vizsla Silver in a research report on Monday, September 8th. One investment analyst has rated the stock with a Strong Buy rating, four have assigned a Buy rating and one has given a Hold rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Buy" and an average target price of $3.25.

Read Our Latest Analysis on VZLA

About Vizsla Silver

(

Free Report)

Vizsla Silver Corp. engages in the exploration, and development of precious and base metal assets. The company explores for gold, silver, and copper deposits. It owns 100% interest in the Panuco Project covering an area of 7,189.5 hectares located in located in southern Sinaloa, Mexico. The company was formerly known as Vizsla Resources Corp.

Featured Articles

Want to see what other hedge funds are holding VZLA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Vizsla Silver Corp. (NYSEAMERICAN:VZLA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vizsla Silver, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vizsla Silver wasn't on the list.

While Vizsla Silver currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.