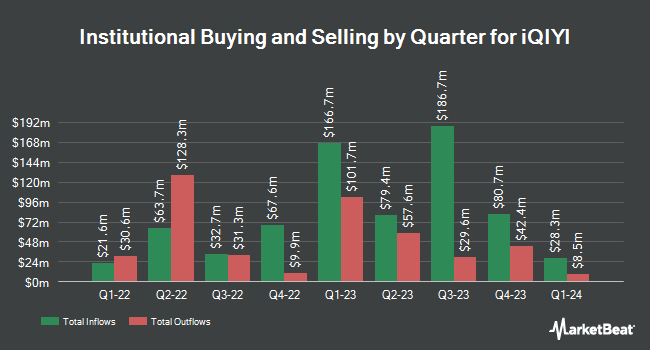

Public Employees Retirement System of Ohio increased its holdings in iQIYI, Inc. Sponsored ADR (NASDAQ:IQ - Free Report) by 48.2% during the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 425,400 shares of the company's stock after buying an additional 138,300 shares during the quarter. Public Employees Retirement System of Ohio's holdings in iQIYI were worth $753,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the business. SG Americas Securities LLC increased its stake in shares of iQIYI by 56.6% in the 1st quarter. SG Americas Securities LLC now owns 1,181,344 shares of the company's stock worth $2,670,000 after purchasing an additional 427,076 shares in the last quarter. Krane Funds Advisors LLC grew its holdings in iQIYI by 23.6% during the first quarter. Krane Funds Advisors LLC now owns 26,905,091 shares of the company's stock valued at $60,806,000 after purchasing an additional 5,141,322 shares during the period. Ping Capital Management Inc. purchased a new stake in iQIYI in the first quarter worth about $90,000. Private Advisor Group LLC bought a new position in shares of iQIYI in the first quarter worth about $30,000. Finally, Federated Hermes Inc. lifted its position in shares of iQIYI by 44.5% during the 1st quarter. Federated Hermes Inc. now owns 9,370,852 shares of the company's stock valued at $21,178,000 after buying an additional 2,886,631 shares in the last quarter. 52.69% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

IQ has been the subject of several analyst reports. Weiss Ratings reissued a "sell (d)" rating on shares of iQIYI in a report on Saturday, September 27th. Jefferies Financial Group increased their price objective on shares of iQIYI from $2.10 to $2.50 and gave the stock a "buy" rating in a research note on Wednesday, August 20th. Wall Street Zen cut shares of iQIYI from a "hold" rating to a "sell" rating in a research note on Saturday, July 26th. UBS Group raised shares of iQIYI from a "neutral" rating to a "buy" rating and set a $3.32 target price for the company in a report on Thursday, August 21st. Finally, Cfra Research cut iQIYI from a "hold" rating to a "moderate sell" rating in a report on Thursday, August 28th. Three research analysts have rated the stock with a Buy rating, four have issued a Hold rating and two have issued a Sell rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $2.51.

View Our Latest Stock Analysis on iQIYI

iQIYI Price Performance

iQIYI stock opened at $2.47 on Monday. iQIYI, Inc. Sponsored ADR has a 52-week low of $1.50 and a 52-week high of $3.21. The company has a quick ratio of 0.42, a current ratio of 0.42 and a debt-to-equity ratio of 0.67. The firm's fifty day moving average is $2.36 and its 200 day moving average is $2.02. The company has a market cap of $2.38 billion, a price-to-earnings ratio of 247.25 and a beta of -0.12.

iQIYI Company Profile

(

Free Report)

iQIYI, Inc, together with its subsidiaries, provides online entertainment video services in the People's Republic of China. It offers various products and services, including online video, online games, online literature, animations, and other products. The company operates a platform that provides a collection of internet video content, such as professionally produced content licensed from professional content providers and self-produced content.

Featured Stories

Want to see what other hedge funds are holding IQ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for iQIYI, Inc. Sponsored ADR (NASDAQ:IQ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider iQIYI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iQIYI wasn't on the list.

While iQIYI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.