Public Employees Retirement System of Ohio decreased its holdings in shares of Harmony Gold Mining Company Limited (NYSE:HMY - Free Report) by 52.8% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 135,240 shares of the mining company's stock after selling 151,354 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Harmony Gold Mining were worth $1,889,000 at the end of the most recent quarter.

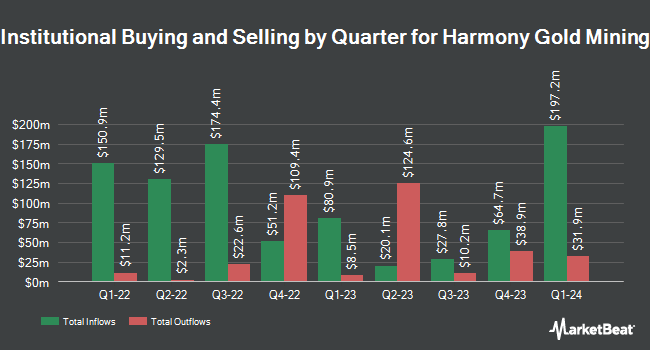

Several other institutional investors also recently modified their holdings of HMY. Squarepoint Ops LLC acquired a new stake in shares of Harmony Gold Mining during the 4th quarter worth approximately $279,000. GAMMA Investing LLC grew its holdings in Harmony Gold Mining by 1,540.5% during the first quarter. GAMMA Investing LLC now owns 128,337 shares of the mining company's stock valued at $18,960,000 after purchasing an additional 120,514 shares during the period. Parallel Advisors LLC grew its holdings in Harmony Gold Mining by 71.4% during the first quarter. Parallel Advisors LLC now owns 4,706 shares of the mining company's stock valued at $70,000 after purchasing an additional 1,961 shares during the period. Ritholtz Wealth Management grew its holdings in Harmony Gold Mining by 4.9% during the first quarter. Ritholtz Wealth Management now owns 169,833 shares of the mining company's stock valued at $2,508,000 after purchasing an additional 7,994 shares during the period. Finally, Rakuten Securities Inc. acquired a new position in Harmony Gold Mining during the first quarter valued at approximately $326,000. Institutional investors and hedge funds own 31.79% of the company's stock.

Harmony Gold Mining Stock Performance

Shares of HMY stock opened at $18.16 on Friday. The company's fifty day simple moving average is $15.53 and its 200-day simple moving average is $15.03. The company has a quick ratio of 1.41, a current ratio of 1.72 and a debt-to-equity ratio of 0.04. The firm has a market cap of $11.52 billion, a PE ratio of 10.74, a P/E/G ratio of 0.15 and a beta of 0.79. Harmony Gold Mining Company Limited has a 12 month low of $7.97 and a 12 month high of $18.94.

Harmony Gold Mining Announces Dividend

The company also recently declared a semi-annual dividend, which will be paid on Monday, October 20th. Shareholders of record on Friday, October 10th will be given a dividend of $0.0893 per share. This represents a yield of 120.0%. The ex-dividend date of this dividend is Friday, October 10th. Harmony Gold Mining's dividend payout ratio is 11.24%.

Analyst Upgrades and Downgrades

HMY has been the subject of a number of analyst reports. Weiss Ratings restated a "buy (b)" rating on shares of Harmony Gold Mining in a report on Saturday, September 27th. Zacks Research cut shares of Harmony Gold Mining from a "hold" rating to a "strong sell" rating in a report on Monday, September 22nd. Finally, BMO Capital Markets assumed coverage on shares of Harmony Gold Mining in a report on Thursday, July 17th. They set a "market perform" rating and a $16.00 price objective for the company. One equities research analyst has rated the stock with a Buy rating, four have assigned a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat, Harmony Gold Mining has a consensus rating of "Hold" and an average price target of $12.20.

Read Our Latest Stock Report on HMY

About Harmony Gold Mining

(

Free Report)

Harmony Gold Mining Company Limited engages in the exploration, extraction, and processing of gold. The company explores for uranium, silver, copper, and molybdenum deposits. It has eight underground operations in the Witwatersrand Basin; an open-pit mine on the Kraaipan Greenstone Belt; and various surface source operations in South Africa.

Further Reading

Want to see what other hedge funds are holding HMY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Harmony Gold Mining Company Limited (NYSE:HMY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Harmony Gold Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmony Gold Mining wasn't on the list.

While Harmony Gold Mining currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.