Public Employees Retirement System of Ohio trimmed its position in shares of Lyft, Inc. (NASDAQ:LYFT - Free Report) by 26.1% in the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 166,628 shares of the ride-sharing company's stock after selling 58,881 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Lyft were worth $2,626,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

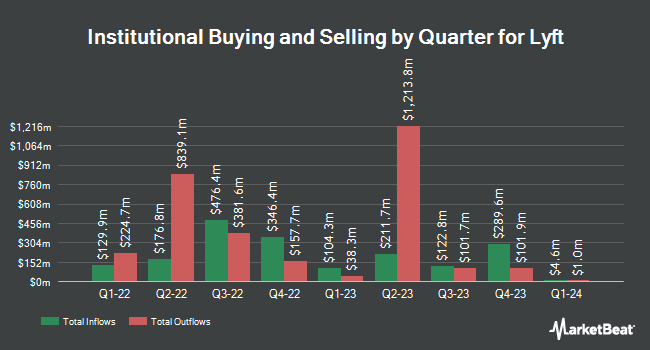

Other institutional investors have also made changes to their positions in the company. MassMutual Private Wealth & Trust FSB lifted its holdings in shares of Lyft by 162.6% during the 2nd quarter. MassMutual Private Wealth & Trust FSB now owns 1,943 shares of the ride-sharing company's stock valued at $31,000 after buying an additional 1,203 shares during the last quarter. Atwood & Palmer Inc. acquired a new stake in shares of Lyft during the 2nd quarter valued at about $32,000. GAMMA Investing LLC lifted its holdings in shares of Lyft by 81.4% during the 1st quarter. GAMMA Investing LLC now owns 2,756 shares of the ride-sharing company's stock valued at $33,000 after buying an additional 1,237 shares during the last quarter. FNY Investment Advisers LLC acquired a new stake in shares of Lyft during the 1st quarter valued at about $35,000. Finally, Bank Julius Baer & Co. Ltd Zurich acquired a new stake in shares of Lyft during the 1st quarter valued at about $35,000. 83.07% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities research analysts have recently issued reports on the company. Deutsche Bank Aktiengesellschaft lifted their price target on Lyft from $16.00 to $21.00 and gave the company a "hold" rating in a report on Thursday, September 18th. Canaccord Genuity Group boosted their target price on Lyft from $11.00 to $18.00 and gave the stock a "hold" rating in a report on Thursday, September 18th. Wall Street Zen lowered Lyft from a "strong-buy" rating to a "buy" rating in a report on Saturday, September 13th. Morgan Stanley boosted their target price on Lyft from $19.00 to $20.50 and gave the stock an "equal weight" rating in a report on Thursday, September 11th. Finally, Wells Fargo & Company boosted their target price on Lyft from $15.00 to $16.00 and gave the stock an "equal weight" rating in a report on Friday, September 5th. Ten equities research analysts have rated the stock with a Buy rating, twenty-one have issued a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $19.02.

Get Our Latest Stock Report on Lyft

Lyft Stock Performance

Shares of NASDAQ LYFT opened at $21.82 on Thursday. The company has a quick ratio of 0.70, a current ratio of 0.70 and a debt-to-equity ratio of 0.72. The business's 50 day moving average is $17.28 and its two-hundred day moving average is $15.09. The company has a market cap of $8.87 billion, a P/E ratio of 90.92, a P/E/G ratio of 3.44 and a beta of 2.40. Lyft, Inc. has a 12 month low of $9.66 and a 12 month high of $23.50.

Lyft (NASDAQ:LYFT - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The ride-sharing company reported $0.10 EPS for the quarter, missing the consensus estimate of $0.27 by ($0.17). The business had revenue of $1.59 billion during the quarter, compared to the consensus estimate of $1.61 billion. Lyft had a return on equity of 14.32% and a net margin of 1.51%.The business's quarterly revenue was up 10.6% on a year-over-year basis. During the same period in the prior year, the firm earned $0.24 earnings per share. On average, equities analysts expect that Lyft, Inc. will post 0.22 EPS for the current year.

Insiders Place Their Bets

In other Lyft news, CFO Erin Brewer sold 15,000 shares of Lyft stock in a transaction that occurred on Wednesday, August 20th. The stock was sold at an average price of $15.24, for a total value of $228,600.00. Following the transaction, the chief financial officer directly owned 540,759 shares of the company's stock, valued at $8,241,167.16. The trade was a 2.70% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO John David Risher acquired 5,926 shares of the stock in a transaction dated Wednesday, September 3rd. The shares were purchased at an average price of $16.88 per share, for a total transaction of $100,030.88. Following the completion of the transaction, the chief executive officer owned 11,797,266 shares of the company's stock, valued at $199,137,850.08. This trade represents a 0.05% increase in their position. The disclosure for this purchase can be found here. Insiders have sold a total of 74,427 shares of company stock valued at $1,252,686 in the last three months. Company insiders own 3.07% of the company's stock.

Lyft Company Profile

(

Free Report)

Lyft, Inc operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. It operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications. The company's platform provides a ridesharing marketplace, which connects drivers with riders; Express Drive, a car rental program for drivers; and a network of shared bikes and scooters in various cities to address the needs of riders for short trips.

Recommended Stories

Want to see what other hedge funds are holding LYFT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Lyft, Inc. (NASDAQ:LYFT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.