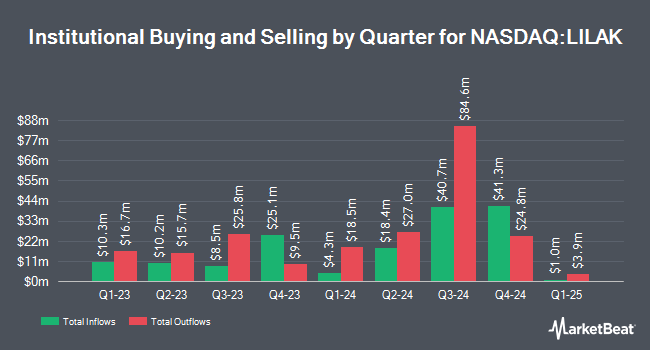

Public Employees Retirement System of Ohio boosted its holdings in Liberty Global PLC (NASDAQ:LILAK - Free Report) by 444.9% in the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 58,797 shares of the company's stock after purchasing an additional 48,007 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Liberty Global were worth $366,000 at the end of the most recent quarter.

Several other hedge funds have also bought and sold shares of LILAK. GAMMA Investing LLC boosted its holdings in Liberty Global by 577.2% during the 1st quarter. GAMMA Investing LLC now owns 11,811 shares of the company's stock worth $73,000 after acquiring an additional 10,067 shares during the last quarter. Teacher Retirement System of Texas purchased a new position in Liberty Global during the 1st quarter worth $121,000. Harbor Capital Advisors Inc. boosted its holdings in Liberty Global by 1,604.2% during the 1st quarter. Harbor Capital Advisors Inc. now owns 21,660 shares of the company's stock worth $135,000 after acquiring an additional 20,389 shares during the last quarter. Entropy Technologies LP purchased a new position in Liberty Global during the 1st quarter worth $140,000. Finally, Cullen Investment Group LTD. boosted its holdings in Liberty Global by 87.7% during the 2nd quarter. Cullen Investment Group LTD. now owns 32,100 shares of the company's stock worth $200,000 after acquiring an additional 15,000 shares during the last quarter. Institutional investors and hedge funds own 52.98% of the company's stock.

Analysts Set New Price Targets

LILAK has been the topic of a number of analyst reports. Scotiabank lifted their price objective on shares of Liberty Global from $5.10 to $8.20 and gave the stock a "sector perform" rating in a report on Thursday, August 28th. Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Liberty Global in a report on Saturday, September 27th. Two investment analysts have rated the stock with a Hold rating and one has assigned a Sell rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Reduce" and a consensus price target of $7.85.

View Our Latest Research Report on Liberty Global

Liberty Global Trading Up 0.7%

Shares of Liberty Global stock opened at $8.50 on Tuesday. Liberty Global PLC has a 52-week low of $4.23 and a 52-week high of $10.67. The stock's 50-day simple moving average is $7.95 and its 200 day simple moving average is $6.49. The stock has a market capitalization of $1.70 billion, a P/E ratio of -1.43 and a beta of 0.98. The company has a debt-to-equity ratio of 5.00, a quick ratio of 1.08 and a current ratio of 1.08.

Liberty Global (NASDAQ:LILAK - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported ($2.12) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.02 by ($2.14). Liberty Global had a negative net margin of 26.61% and a negative return on equity of 71.58%. The firm had revenue of $1.09 billion during the quarter, compared to the consensus estimate of $1.11 billion.

About Liberty Global

(

Free Report)

Liberty Latin America Ltd., together with its subsidiaries, provides fixed, mobile, and subsea telecommunications services. The company operates through C&W Caribbean, C&W Panama, Liberty Networks, Liberty Puerto Rico, and Liberty Costa Rico segments. It offers communications and entertainment services, including video, broadband internet, fixed-line, telephony, and mobiles services to residential and business customers; and business products and services that include enterprise-grade connectivity, data center, hosting, and managed solutions, as well as information technology solutions for small and medium enterprises, international companies, and governmental agencies.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Liberty Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Global wasn't on the list.

While Liberty Global currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.