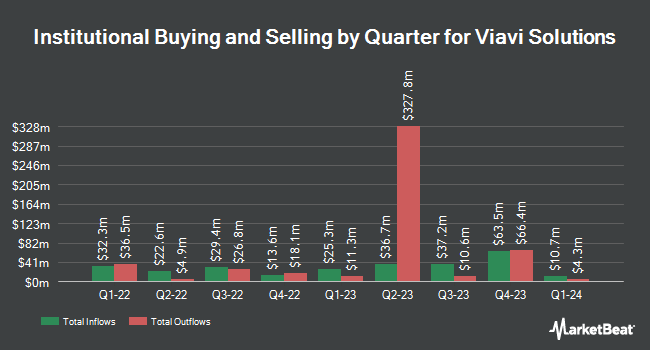

Public Employees Retirement System of Ohio lessened its holdings in Viavi Solutions Inc. (NASDAQ:VIAV - Free Report) by 96.3% during the second quarter, according to its most recent disclosure with the SEC. The institutional investor owned 4,358 shares of the communications equipment provider's stock after selling 112,554 shares during the period. Public Employees Retirement System of Ohio's holdings in Viavi Solutions were worth $44,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. Vanguard Group Inc. raised its position in shares of Viavi Solutions by 1.8% in the first quarter. Vanguard Group Inc. now owns 30,440,070 shares of the communications equipment provider's stock worth $340,624,000 after buying an additional 540,045 shares in the last quarter. T. Rowe Price Investment Management Inc. raised its position in shares of Viavi Solutions by 0.3% in the first quarter. T. Rowe Price Investment Management Inc. now owns 10,560,567 shares of the communications equipment provider's stock worth $118,173,000 after buying an additional 36,172 shares in the last quarter. Woodline Partners LP raised its position in shares of Viavi Solutions by 27.6% in the first quarter. Woodline Partners LP now owns 4,384,150 shares of the communications equipment provider's stock worth $49,059,000 after buying an additional 948,472 shares in the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of Viavi Solutions by 0.7% in the first quarter. Charles Schwab Investment Management Inc. now owns 3,358,676 shares of the communications equipment provider's stock worth $37,584,000 after buying an additional 23,783 shares in the last quarter. Finally, Victory Capital Management Inc. raised its position in shares of Viavi Solutions by 7,293.1% in the first quarter. Victory Capital Management Inc. now owns 3,083,135 shares of the communications equipment provider's stock worth $34,500,000 after buying an additional 3,041,432 shares in the last quarter. Hedge funds and other institutional investors own 95.54% of the company's stock.

Viavi Solutions Stock Down 1.0%

Shares of NASDAQ:VIAV opened at $12.65 on Wednesday. The stock's 50-day moving average price is $11.48 and its 200-day moving average price is $10.46. Viavi Solutions Inc. has a 12-month low of $8.10 and a 12-month high of $12.99. The stock has a market capitalization of $2.82 billion, a P/E ratio of 79.07 and a beta of 0.90. The company has a current ratio of 1.50, a quick ratio of 1.30 and a debt-to-equity ratio of 0.51.

Viavi Solutions (NASDAQ:VIAV - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The communications equipment provider reported $0.13 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.12 by $0.01. Viavi Solutions had a return on equity of 8.02% and a net margin of 3.21%.The firm had revenue of $290.50 million for the quarter, compared to analysts' expectations of $285.19 million. During the same period last year, the firm earned $0.08 earnings per share. The company's revenue for the quarter was up 15.3% compared to the same quarter last year. Viavi Solutions has set its Q1 2026 guidance at 0.130-0.14 EPS. On average, equities analysts anticipate that Viavi Solutions Inc. will post 0.26 earnings per share for the current year.

Insider Buying and Selling

In related news, SVP Kevin Christopher Siebert sold 9,927 shares of the firm's stock in a transaction dated Thursday, September 25th. The stock was sold at an average price of $12.17, for a total value of $120,811.59. Following the sale, the senior vice president directly owned 84,598 shares of the company's stock, valued at $1,029,557.66. This trade represents a 10.50% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Richard Belluzzo sold 8,387 shares of the firm's stock in a transaction dated Wednesday, October 1st. The stock was sold at an average price of $12.63, for a total value of $105,927.81. Following the completion of the sale, the director directly owned 217,154 shares in the company, valued at $2,742,655.02. The trade was a 3.72% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 73,789 shares of company stock valued at $857,189 over the last ninety days. 1.52% of the stock is owned by insiders.

Analysts Set New Price Targets

VIAV has been the topic of a number of recent analyst reports. Rosenblatt Securities reiterated a "buy" rating and issued a $13.50 price objective on shares of Viavi Solutions in a research report on Friday, June 20th. Weiss Ratings reiterated a "hold (c-)" rating on shares of Viavi Solutions in a research report on Saturday, September 27th. Morgan Stanley raised Viavi Solutions from an "underweight" rating to an "equal weight" rating and set a $11.00 target price on the stock in a research note on Tuesday, September 2nd. UBS Group increased their target price on Viavi Solutions from $11.00 to $12.00 and gave the company a "neutral" rating in a research note on Friday, August 8th. Finally, B. Riley increased their target price on Viavi Solutions from $11.00 to $12.00 and gave the company a "neutral" rating in a research note on Friday, August 8th. Six equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, Viavi Solutions presently has a consensus rating of "Moderate Buy" and an average target price of $13.50.

Get Our Latest Report on VIAV

About Viavi Solutions

(

Free Report)

Viavi Solutions, Inc engages in the provision of network test, monitoring, and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. It operates through the following segments: Network Enablement, Service Enablement, and Optical Security and Performance.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Viavi Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viavi Solutions wasn't on the list.

While Viavi Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.