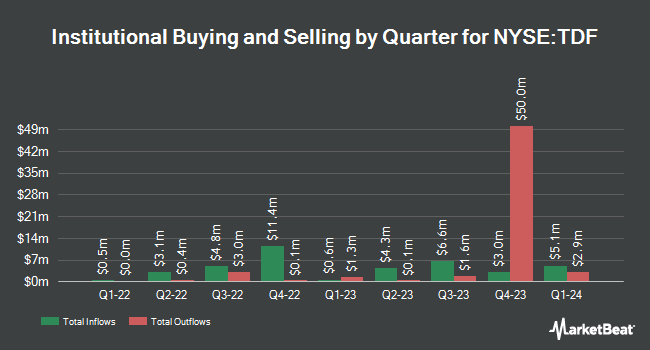

Public Employees Retirement System of Ohio decreased its holdings in shares of Templeton Dragon Fund, Inc. (NYSE:TDF - Free Report) by 5.5% during the second quarter, according to its most recent filing with the SEC. The firm owned 1,523,013 shares of the financial services provider's stock after selling 88,920 shares during the period. Public Employees Retirement System of Ohio owned 6.01% of Templeton Dragon Fund worth $15,215,000 at the end of the most recent reporting period.

Several other hedge funds have also recently modified their holdings of TDF. 180 Wealth Advisors LLC boosted its stake in shares of Templeton Dragon Fund by 26.6% during the first quarter. 180 Wealth Advisors LLC now owns 221,033 shares of the financial services provider's stock valued at $2,144,000 after purchasing an additional 46,509 shares in the last quarter. Uncommon Cents Investing LLC boosted its position in Templeton Dragon Fund by 3.9% during the 1st quarter. Uncommon Cents Investing LLC now owns 507,410 shares of the financial services provider's stock valued at $4,922,000 after acquiring an additional 19,170 shares in the last quarter. Matisse Capital boosted its position in Templeton Dragon Fund by 4.0% during the 1st quarter. Matisse Capital now owns 342,000 shares of the financial services provider's stock valued at $3,317,000 after acquiring an additional 13,000 shares in the last quarter. Calamos Advisors LLC increased its holdings in shares of Templeton Dragon Fund by 55.1% in the 1st quarter. Calamos Advisors LLC now owns 25,356 shares of the financial services provider's stock valued at $246,000 after acquiring an additional 9,007 shares during the period. Finally, Dakota Wealth Management raised its position in shares of Templeton Dragon Fund by 7.0% in the 1st quarter. Dakota Wealth Management now owns 17,946 shares of the financial services provider's stock worth $174,000 after acquiring an additional 1,173 shares in the last quarter. Hedge funds and other institutional investors own 47.20% of the company's stock.

Templeton Dragon Fund Stock Performance

Shares of NYSE TDF opened at $11.43 on Friday. Templeton Dragon Fund, Inc. has a 1-year low of $8.07 and a 1-year high of $11.95. The business has a fifty day moving average price of $10.90 and a 200 day moving average price of $10.06.

Templeton Dragon Fund Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Thursday, September 18th will be issued a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a dividend yield of 3.5%. The ex-dividend date is Thursday, September 18th.

Templeton Dragon Fund Company Profile

(

Free Report)

Templeton Dragon Fund, Inc is a closed ended equity mutual fund launched by Franklin Resources, Inc The fund is managed by Templeton Asset Management Ltd. It invests in the public equity markets of China. The fund seeks to invest in stocks of companies operating across diversified sectors. It primarily invests in value stocks of companies.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Templeton Dragon Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Templeton Dragon Fund wasn't on the list.

While Templeton Dragon Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.