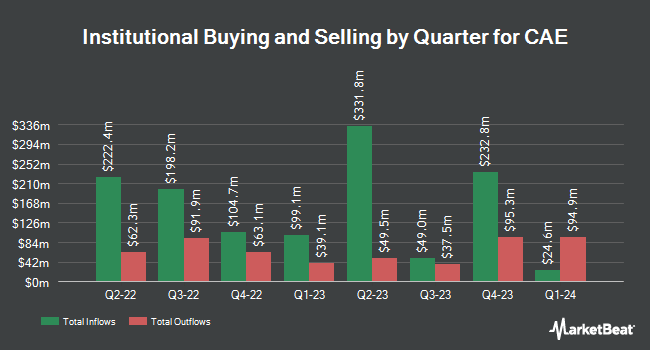

Public Employees Retirement System of Ohio reduced its position in shares of CAE Inc (NYSE:CAE - Free Report) TSE: CAE by 56.7% during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 41,258 shares of the aerospace company's stock after selling 54,034 shares during the period. Public Employees Retirement System of Ohio's holdings in CAE were worth $1,207,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also made changes to their positions in the company. Ballentine Partners LLC acquired a new stake in shares of CAE during the 2nd quarter valued at approximately $277,000. Intech Investment Management LLC raised its position in shares of CAE by 108.8% during the 1st quarter. Intech Investment Management LLC now owns 180,771 shares of the aerospace company's stock valued at $4,444,000 after acquiring an additional 94,200 shares in the last quarter. Plato Investment Management Ltd raised its position in shares of CAE by 13.5% during the 1st quarter. Plato Investment Management Ltd now owns 37,746 shares of the aerospace company's stock valued at $938,000 after acquiring an additional 4,502 shares in the last quarter. United Services Automobile Association raised its position in shares of CAE by 4.5% during the 1st quarter. United Services Automobile Association now owns 10,822 shares of the aerospace company's stock valued at $265,000 after acquiring an additional 462 shares in the last quarter. Finally, Goldman Sachs Group Inc. raised its position in shares of CAE by 142.6% during the 1st quarter. Goldman Sachs Group Inc. now owns 1,709,480 shares of the aerospace company's stock valued at $42,036,000 after acquiring an additional 1,004,820 shares in the last quarter. 67.36% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on CAE shares. TD Securities raised CAE from a "hold" rating to a "buy" rating in a research report on Wednesday, August 13th. The Goldman Sachs Group initiated coverage on CAE in a research report on Monday, June 30th. They issued a "buy" rating and a $33.00 target price on the stock. Weiss Ratings reaffirmed a "hold (c)" rating on shares of CAE in a research report on Saturday, September 27th. Cibc World Mkts raised CAE from a "hold" rating to a "strong-buy" rating in a research report on Friday, June 27th. Finally, Wall Street Zen lowered CAE from a "buy" rating to a "hold" rating in a research report on Saturday, August 16th. Two equities research analysts have rated the stock with a Strong Buy rating, five have issued a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat.com, CAE presently has an average rating of "Moderate Buy" and a consensus target price of $33.67.

Get Our Latest Stock Analysis on CAE

CAE Price Performance

NYSE:CAE opened at $28.77 on Friday. The business's 50-day moving average price is $27.76 and its 200 day moving average price is $26.57. The firm has a market cap of $9.23 billion, a P/E ratio of 31.27, a PEG ratio of 2.55 and a beta of 1.36. CAE Inc has a 52-week low of $17.58 and a 52-week high of $30.13. The company has a quick ratio of 0.60, a current ratio of 0.87 and a debt-to-equity ratio of 0.63.

CAE (NYSE:CAE - Get Free Report) TSE: CAE last released its earnings results on Tuesday, August 12th. The aerospace company reported $0.15 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.15. The firm had revenue of $806.92 million for the quarter, compared to analyst estimates of $1.12 billion. CAE had a return on equity of 7.92% and a net margin of 8.70%.During the same period in the previous year, the company earned $0.21 earnings per share. As a group, sell-side analysts predict that CAE Inc will post 0.83 earnings per share for the current fiscal year.

About CAE

(

Free Report)

CAE Inc, together with its subsidiaries, provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, the Oceania, Africa, and Rest of the Americas. It operates through two segments, Civil Aviation; and Defense and Security. The Civil Aviation segment offers training solutions for flight, cabin, maintenance, and ground personnel in commercial, business, and helicopter aviation; a range of flight simulation training devices; and ab initio pilot training and crew sourcing services, as well as aircraft flight operations solutions.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CAE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAE wasn't on the list.

While CAE currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.