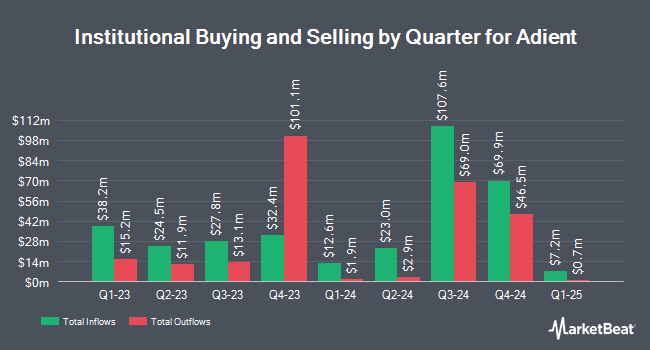

Public Sector Pension Investment Board raised its stake in shares of Adient (NYSE:ADNT - Free Report) by 22.5% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 266,136 shares of the company's stock after buying an additional 48,910 shares during the quarter. Public Sector Pension Investment Board owned about 0.32% of Adient worth $3,423,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors have also added to or reduced their stakes in the company. Point72 Hong Kong Ltd purchased a new stake in Adient during the 4th quarter valued at approximately $25,000. GAMMA Investing LLC boosted its position in shares of Adient by 157.5% during the 1st quarter. GAMMA Investing LLC now owns 2,235 shares of the company's stock valued at $29,000 after acquiring an additional 1,367 shares during the last quarter. Sterling Capital Management LLC boosted its position in shares of Adient by 803.6% during the 4th quarter. Sterling Capital Management LLC now owns 2,738 shares of the company's stock valued at $47,000 after acquiring an additional 2,435 shares during the last quarter. CWM LLC boosted its position in shares of Adient by 91.4% during the 1st quarter. CWM LLC now owns 3,426 shares of the company's stock valued at $44,000 after acquiring an additional 1,636 shares during the last quarter. Finally, PNC Financial Services Group Inc. boosted its position in shares of Adient by 75.9% during the 1st quarter. PNC Financial Services Group Inc. now owns 5,597 shares of the company's stock valued at $72,000 after acquiring an additional 2,415 shares during the last quarter. 92.44% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research analysts have recently commented on the company. Zacks Research downgraded Adient from a "strong-buy" rating to a "hold" rating in a research report on Monday, August 18th. Morgan Stanley increased their target price on Adient from $16.00 to $17.00 and gave the company an "underweight" rating in a research report on Tuesday, August 12th. Bank of America increased their target price on Adient from $15.00 to $17.50 and gave the company an "underperform" rating in a research report on Monday, June 16th. Wells Fargo & Company increased their target price on Adient from $18.00 to $24.00 and gave the company an "equal weight" rating in a research report on Thursday, August 7th. Finally, Stifel Nicolaus assumed coverage on Adient in a research report on Thursday. They set a "buy" rating and a $27.00 target price for the company. One equities research analyst has rated the stock with a Buy rating, nine have issued a Hold rating and two have issued a Sell rating to the company. According to MarketBeat, the company has a consensus rating of "Reduce" and an average price target of $21.72.

Read Our Latest Stock Report on Adient

Adient Trading Up 5.4%

ADNT traded up $1.2770 during trading on Friday, reaching $24.8470. The company had a trading volume of 1,204,281 shares, compared to its average volume of 1,236,522. The stock has a market cap of $2.02 billion, a P/E ratio of -9.38, a PEG ratio of 0.82 and a beta of 1.72. The business has a 50 day simple moving average of $21.82 and a 200-day simple moving average of $17.01. Adient has a 52 week low of $10.04 and a 52 week high of $24.96. The company has a quick ratio of 0.92, a current ratio of 1.12 and a debt-to-equity ratio of 1.15.

Adient (NYSE:ADNT - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported $0.45 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.47 by ($0.02). The company had revenue of $3.74 billion during the quarter, compared to the consensus estimate of $3.56 billion. Adient had a positive return on equity of 8.25% and a negative net margin of 1.53%.The firm's quarterly revenue was up .7% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.32 earnings per share. On average, equities analysts anticipate that Adient will post 1.76 EPS for the current fiscal year.

About Adient

(

Free Report)

Adient plc engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks. The company's automotive seating solutions include complete seating systems, frames, mechanisms, foams, head restraints, armrests, and trim covers.

Recommended Stories

Before you consider Adient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adient wasn't on the list.

While Adient currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.