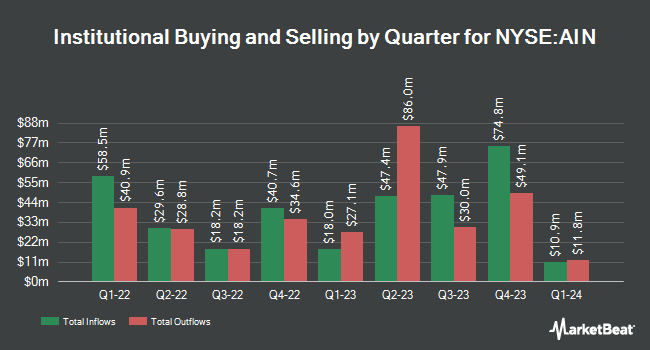

Public Sector Pension Investment Board raised its holdings in shares of Albany International Corporation (NYSE:AIN - Free Report) by 27.1% during the first quarter, according to its most recent filing with the SEC. The firm owned 99,307 shares of the textile maker's stock after purchasing an additional 21,178 shares during the period. Public Sector Pension Investment Board owned 0.33% of Albany International worth $6,856,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Nuveen LLC purchased a new position in shares of Albany International in the 1st quarter worth approximately $18,985,000. Teacher Retirement System of Texas grew its position in shares of Albany International by 5.5% in the 1st quarter. Teacher Retirement System of Texas now owns 69,301 shares of the textile maker's stock worth $4,785,000 after buying an additional 3,608 shares during the last quarter. Entropy Technologies LP purchased a new position in shares of Albany International in the 1st quarter worth approximately $407,000. QRG Capital Management Inc. grew its position in shares of Albany International by 20.2% in the 1st quarter. QRG Capital Management Inc. now owns 4,089 shares of the textile maker's stock worth $282,000 after buying an additional 686 shares during the last quarter. Finally, Principal Financial Group Inc. grew its position in shares of Albany International by 1.7% in the 1st quarter. Principal Financial Group Inc. now owns 156,089 shares of the textile maker's stock worth $10,776,000 after buying an additional 2,549 shares during the last quarter. Hedge funds and other institutional investors own 97.37% of the company's stock.

Albany International Stock Performance

NYSE AIN traded up $1.0050 on Thursday, hitting $62.3750. 271,327 shares of the company's stock traded hands, compared to its average volume of 394,721. The company has a current ratio of 3.51, a quick ratio of 2.78 and a debt-to-equity ratio of 0.50. Albany International Corporation has a 1-year low of $50.60 and a 1-year high of $94.20. The firm's 50-day moving average price is $67.17 and its two-hundred day moving average price is $69.12. The firm has a market capitalization of $1.84 billion, a PE ratio of 31.19, a P/E/G ratio of 1.44 and a beta of 1.38.

Albany International (NYSE:AIN - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The textile maker reported $0.57 EPS for the quarter, missing the consensus estimate of $0.73 by ($0.16). Albany International had a net margin of 5.25% and a return on equity of 8.87%. The business had revenue of $311.40 million for the quarter, compared to analyst estimates of $306.06 million. During the same quarter in the previous year, the firm posted $0.89 earnings per share. The business's revenue was down 6.2% on a year-over-year basis. Albany International has set its FY 2025 guidance at 3.000-3.400 EPS. As a group, analysts expect that Albany International Corporation will post 3.23 EPS for the current year.

Wall Street Analyst Weigh In

AIN has been the topic of a number of analyst reports. Truist Financial reaffirmed a "hold" rating and issued a $55.00 price objective (down previously from $70.00) on shares of Albany International in a research report on Friday, August 1st. Wall Street Zen raised shares of Albany International from a "hold" rating to a "buy" rating in a research report on Friday, May 16th. Bank of America cut their price objective on shares of Albany International from $75.00 to $65.00 and set an "underperform" rating on the stock in a research report on Monday, June 2nd. Baird R W cut shares of Albany International from a "strong-buy" rating to a "hold" rating in a research note on Thursday, July 31st. Finally, Robert W. Baird cut shares of Albany International from an "outperform" rating to a "neutral" rating and set a $79.00 target price for the company. in a research note on Thursday, July 31st. One equities research analyst has rated the stock with a Strong Buy rating, four have issued a Hold rating and one has assigned a Sell rating to the stock. According to data from MarketBeat, Albany International presently has an average rating of "Hold" and an average target price of $71.40.

Read Our Latest Report on Albany International

Albany International Company Profile

(

Free Report)

Albany International Corp., together with its subsidiaries, engages in the machine clothing and engineered composites businesses. The company operates in two segments, Machine Clothing (MC) and Albany Engineered Composites (AEC). The MC segment designs, manufactures, and markets paper machine clothing for use in the manufacturing of papers, paperboards, tissues, towels, pulps, nonwovens, building products, tannery, and textiles, as well as fiber cement and several other industrial applications.

Featured Articles

Before you consider Albany International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Albany International wasn't on the list.

While Albany International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.