Public Sector Pension Investment Board boosted its stake in shares of Vital Energy, Inc. (NYSE:VTLE - Free Report) by 27.0% during the first quarter, according to its most recent Form 13F filing with the SEC. The fund owned 85,483 shares of the company's stock after buying an additional 18,171 shares during the period. Public Sector Pension Investment Board owned 0.22% of Vital Energy worth $1,814,000 at the end of the most recent quarter.

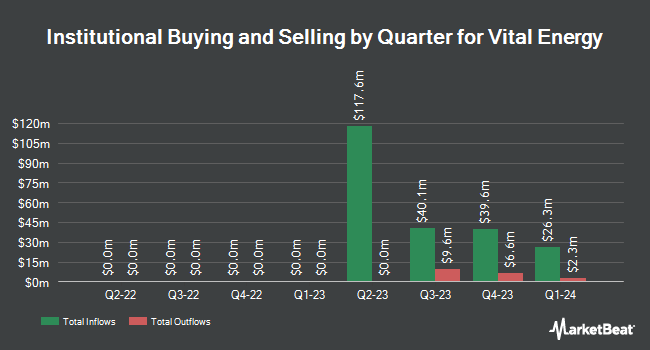

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Legal & General Group Plc lifted its stake in shares of Vital Energy by 2.9% in the 4th quarter. Legal & General Group Plc now owns 68,001 shares of the company's stock valued at $2,103,000 after purchasing an additional 1,921 shares during the last quarter. Raymond James Financial Inc. acquired a new position in shares of Vital Energy in the 4th quarter valued at $4,022,000. Sterling Capital Management LLC lifted its stake in shares of Vital Energy by 805.9% in the 4th quarter. Sterling Capital Management LLC now owns 915 shares of the company's stock valued at $28,000 after purchasing an additional 814 shares during the last quarter. Mariner LLC acquired a new position in shares of Vital Energy in the 4th quarter valued at $267,000. Finally, Guggenheim Capital LLC acquired a new position in shares of Vital Energy in the 4th quarter valued at $261,000. Institutional investors and hedge funds own 86.54% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have recently commented on the company. Piper Sandler decreased their price target on Vital Energy from $17.00 to $16.00 and set a "neutral" rating on the stock in a research note on Thursday, August 14th. Raymond James Financial downgraded Vital Energy from an "outperform" rating to an "underperform" rating in a report on Tuesday, June 24th. Wall Street Zen downgraded Vital Energy from a "hold" rating to a "sell" rating in a report on Saturday, August 9th. Wells Fargo & Company restated a "mixed" rating on shares of Vital Energy in a report on Tuesday, July 15th. Finally, Mizuho cut their price target on Vital Energy from $29.00 to $23.00 and set a "neutral" rating on the stock in a report on Tuesday, May 13th. One investment analyst has rated the stock with a Buy rating, six have issued a Hold rating and four have issued a Sell rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Reduce" and a consensus price target of $28.20.

Get Our Latest Stock Analysis on VTLE

Insiders Place Their Bets

In other Vital Energy news, major shareholder Richard D. Campbell sold 50,000 shares of the stock in a transaction that occurred on Thursday, July 10th. The stock was sold at an average price of $18.12, for a total transaction of $906,000.00. Following the completion of the sale, the insider directly owned 7,568,933 shares of the company's stock, valued at approximately $137,149,065.96. This trade represents a 0.66% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 1.20% of the company's stock.

Vital Energy Stock Down 7.1%

Shares of VTLE traded down $1.28 during mid-day trading on Tuesday, reaching $16.81. The company's stock had a trading volume of 3,310,172 shares, compared to its average volume of 1,863,597. Vital Energy, Inc. has a 12-month low of $12.30 and a 12-month high of $37.33. The stock has a market cap of $650.34 million, a PE ratio of -0.85 and a beta of 1.60. The company has a debt-to-equity ratio of 1.10, a current ratio of 0.79 and a quick ratio of 0.79. The company's 50 day moving average is $17.14 and its 200 day moving average is $18.85.

Vital Energy (NYSE:VTLE - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The company reported $2.02 EPS for the quarter, beating analysts' consensus estimates of $1.98 by $0.04. The business had revenue of $429.63 million for the quarter, compared to the consensus estimate of $481.25 million. Vital Energy had a positive return on equity of 11.86% and a negative net margin of 38.52%.The business's revenue for the quarter was down 9.8% on a year-over-year basis. During the same quarter in the prior year, the business posted $1.46 EPS. Equities analysts anticipate that Vital Energy, Inc. will post 8.49 EPS for the current fiscal year.

Vital Energy Company Profile

(

Free Report)

Vital Energy, Inc, an independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States. The company was formerly known as Laredo Petroleum, Inc and changed its name to Vital Energy, Inc in January 2023.

Featured Articles

Before you consider Vital Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Energy wasn't on the list.

While Vital Energy currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.