Putney Financial Group LLC bought a new position in shares of Bank of America Co. (NYSE:BAC - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm bought 6,905 shares of the financial services provider's stock, valued at approximately $303,000.

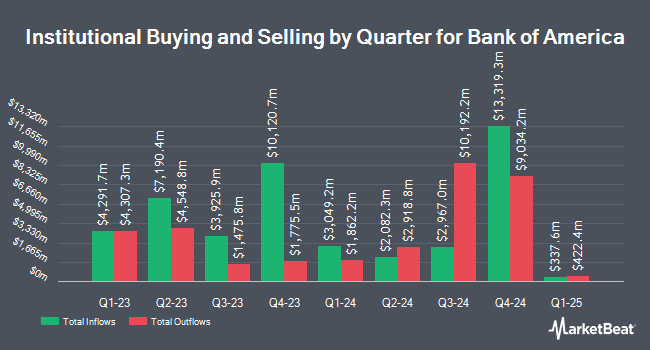

A number of other large investors also recently bought and sold shares of BAC. Collier Financial bought a new position in Bank of America during the 4th quarter worth approximately $25,000. Life Planning Partners Inc lifted its holdings in Bank of America by 3,883.2% during the 4th quarter. Life Planning Partners Inc now owns 559,995 shares of the financial services provider's stock worth $25,000 after buying an additional 545,936 shares during the last quarter. Graney & King LLC bought a new position in Bank of America during the 4th quarter worth approximately $25,000. Fairway Wealth LLC bought a new position in Bank of America during the 4th quarter worth approximately $29,000. Finally, Vega Investment Solutions bought a new position in Bank of America during the 4th quarter worth approximately $30,000. Institutional investors own 70.71% of the company's stock.

Bank of America Stock Up 0.1%

Shares of Bank of America stock traded up $0.05 during midday trading on Thursday, hitting $44.11. The company's stock had a trading volume of 13,312,587 shares, compared to its average volume of 39,696,680. The firm has a market capitalization of $332.19 billion, a P/E ratio of 13.70, a PEG ratio of 1.21 and a beta of 1.27. The stock has a 50-day simple moving average of $40.42 and a 200-day simple moving average of $43.59. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 1.04. Bank of America Co. has a 1-year low of $33.07 and a 1-year high of $48.08.

Bank of America (NYSE:BAC - Get Free Report) last released its quarterly earnings data on Tuesday, April 15th. The financial services provider reported $0.90 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.80 by $0.10. The firm had revenue of $27.37 billion during the quarter, compared to analysts' expectations of $26.83 billion. Bank of America had a return on equity of 10.29% and a net margin of 14.10%. As a group, sell-side analysts expect that Bank of America Co. will post 3.7 earnings per share for the current year.

Bank of America Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, June 27th. Shareholders of record on Friday, June 6th will be issued a dividend of $0.26 per share. The ex-dividend date of this dividend is Friday, June 6th. This represents a $1.04 annualized dividend and a yield of 2.36%. Bank of America's dividend payout ratio (DPR) is currently 30.95%.

Wall Street Analysts Forecast Growth

BAC has been the topic of a number of research reports. UBS Group increased their price target on Bank of America from $46.00 to $50.00 and gave the stock a "buy" rating in a research report on Wednesday, April 16th. Barclays lowered their target price on Bank of America from $58.00 to $54.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 16th. Argus lowered their target price on Bank of America from $53.00 to $47.00 and set a "buy" rating on the stock in a research report on Wednesday, April 16th. Cowen assumed coverage on Bank of America in a research report on Wednesday, May 14th. They issued a "buy" rating on the stock. Finally, Truist Financial lowered their target price on Bank of America from $50.00 to $47.00 and set a "buy" rating on the stock in a research report on Wednesday, April 16th. Two investment analysts have rated the stock with a sell rating, five have issued a hold rating, seventeen have given a buy rating and four have issued a strong buy rating to the stock. According to data from MarketBeat.com, Bank of America has an average rating of "Moderate Buy" and a consensus price target of $47.50.

Read Our Latest Research Report on BAC

Bank of America Profile

(

Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Featured Articles

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.