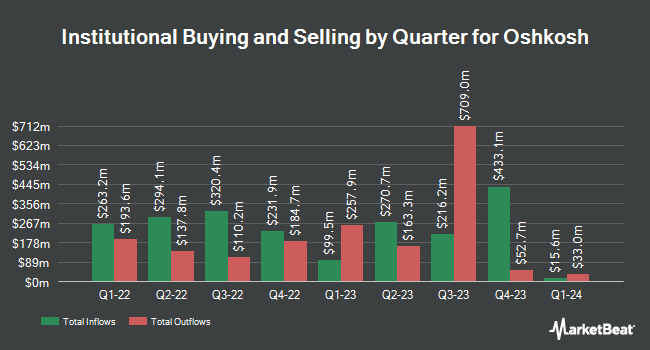

Pzena Investment Management LLC acquired a new position in Oshkosh Corporation (NYSE:OSK - Free Report) during the 2nd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund acquired 525,887 shares of the company's stock, valued at approximately $59,709,000. Pzena Investment Management LLC owned 0.82% of Oshkosh at the end of the most recent quarter.

Other large investors have also recently modified their holdings of the company. Kodai Capital Management LP purchased a new position in shares of Oshkosh in the first quarter worth about $7,077,000. Ieq Capital LLC purchased a new position in Oshkosh during the 1st quarter valued at about $7,682,000. Principal Financial Group Inc. increased its holdings in Oshkosh by 0.4% during the 1st quarter. Principal Financial Group Inc. now owns 149,716 shares of the company's stock valued at $14,085,000 after purchasing an additional 553 shares during the period. OMNI 360 Wealth Inc. purchased a new position in Oshkosh during the 2nd quarter valued at about $237,000. Finally, Sumitomo Mitsui Trust Group Inc. purchased a new position in Oshkosh during the 1st quarter valued at about $263,000. Hedge funds and other institutional investors own 92.36% of the company's stock.

Oshkosh Stock Down 6.3%

OSK stock opened at $124.21 on Monday. Oshkosh Corporation has a fifty-two week low of $76.82 and a fifty-two week high of $144.30. The business's 50 day moving average price is $135.80 and its two-hundred day moving average price is $115.16. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.92 and a current ratio of 1.84. The company has a market capitalization of $7.95 billion, a price-to-earnings ratio of 12.47, a price-to-earnings-growth ratio of 1.54 and a beta of 1.47.

Oshkosh (NYSE:OSK - Get Free Report) last posted its earnings results on Friday, August 1st. The company reported $3.41 earnings per share for the quarter, topping analysts' consensus estimates of $2.98 by $0.43. The firm had revenue of $2.73 billion for the quarter, compared to the consensus estimate of $2.67 billion. Oshkosh had a return on equity of 16.70% and a net margin of 6.25%.The business's revenue for the quarter was down 4.0% on a year-over-year basis. During the same quarter in the prior year, the business earned $3.34 EPS. Oshkosh has set its FY 2025 guidance at 11.000-11.000 EPS. As a group, analysts forecast that Oshkosh Corporation will post 10.96 earnings per share for the current fiscal year.

Oshkosh Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, September 2nd. Investors of record on Tuesday, August 19th were paid a $0.51 dividend. The ex-dividend date was Tuesday, August 19th. This represents a $2.04 annualized dividend and a dividend yield of 1.6%. Oshkosh's dividend payout ratio is presently 20.48%.

Analysts Set New Price Targets

A number of research analysts recently issued reports on the company. Wall Street Zen downgraded Oshkosh from a "buy" rating to a "hold" rating in a report on Sunday, September 21st. Truist Financial boosted their price target on Oshkosh from $155.00 to $171.00 and gave the company a "buy" rating in a report on Wednesday. KeyCorp boosted their price target on Oshkosh from $140.00 to $180.00 and gave the company an "overweight" rating in a report on Tuesday, August 26th. UBS Group set a $164.00 price target on Oshkosh and gave the company a "buy" rating in a report on Tuesday, August 5th. Finally, Zacks Research downgraded Oshkosh from a "strong-buy" rating to a "hold" rating in a report on Monday, October 6th. Ten investment analysts have rated the stock with a Buy rating, four have given a Hold rating and one has issued a Sell rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $144.25.

Get Our Latest Research Report on OSK

Insider Activity at Oshkosh

In related news, SVP Anupam Khare sold 4,000 shares of the company's stock in a transaction that occurred on Friday, August 22nd. The stock was sold at an average price of $139.03, for a total value of $556,120.00. Following the sale, the senior vice president owned 13,716 shares in the company, valued at $1,906,935.48. This represents a 22.58% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CMO Bryan K. Brandt sold 1,732 shares of the company's stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $140.37, for a total value of $243,120.84. Following the completion of the sale, the chief marketing officer owned 10,459 shares in the company, valued at $1,468,129.83. The trade was a 14.21% decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.55% of the company's stock.

Oshkosh Profile

(

Free Report)

Oshkosh Corporation provides purpose-built vehicles and equipment worldwide. The company operates through three segments: Access, Defense, and Vocational segment. Its Access Equipment segment design and manufacture aerial work platform and telehandlers for use in construction, industrial, and maintenance applications; offers financing and leasing solutions including rental fleet loans, leases, and floor plan and retail financing; and towing and recovery equipment, which includes carriers, wreckers, and rotators, as well as provides equipment installation and sale of chassis and service parts.

Further Reading

Want to see what other hedge funds are holding OSK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Oshkosh Corporation (NYSE:OSK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Oshkosh, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oshkosh wasn't on the list.

While Oshkosh currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.