QRG Capital Management Inc. acquired a new stake in Armstrong World Industries, Inc. (NYSE:AWI - Free Report) in the second quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 1,533 shares of the construction company's stock, valued at approximately $249,000.

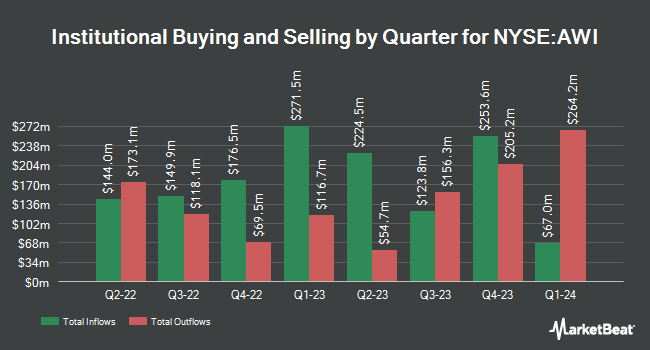

A number of other institutional investors have also recently bought and sold shares of AWI. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its stake in Armstrong World Industries by 131.4% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 440,519 shares of the construction company's stock valued at $62,060,000 after purchasing an additional 250,133 shares during the period. Invesco Ltd. grew its stake in Armstrong World Industries by 34.0% in the 1st quarter. Invesco Ltd. now owns 680,622 shares of the construction company's stock valued at $95,886,000 after purchasing an additional 172,779 shares during the period. Nuveen LLC bought a new position in shares of Armstrong World Industries during the 1st quarter worth $23,449,000. Global Alpha Capital Management Ltd. bought a new position in shares of Armstrong World Industries during the 1st quarter worth $21,301,000. Finally, AQR Capital Management LLC grew its stake in shares of Armstrong World Industries by 91.7% during the 1st quarter. AQR Capital Management LLC now owns 248,363 shares of the construction company's stock worth $34,296,000 after acquiring an additional 118,830 shares during the period. Institutional investors own 98.93% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the company. UBS Group reiterated a "neutral" rating and set a $178.00 price target (up previously from $158.00) on shares of Armstrong World Industries in a research note on Wednesday, July 30th. Evercore ISI increased their price target on Armstrong World Industries from $157.00 to $182.00 and gave the stock an "in-line" rating in a research note on Wednesday, July 30th. Truist Financial increased their price target on Armstrong World Industries from $195.00 to $230.00 and gave the stock a "buy" rating in a research note on Friday, September 12th. Loop Capital set a $190.00 price target on Armstrong World Industries and gave the stock a "hold" rating in a research note on Wednesday, July 30th. Finally, Weiss Ratings reiterated a "buy (b)" rating on shares of Armstrong World Industries in a research note on Wednesday, October 8th. Five equities research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company's stock. According to data from MarketBeat, Armstrong World Industries has a consensus rating of "Moderate Buy" and an average price target of $197.14.

Get Our Latest Analysis on Armstrong World Industries

Armstrong World Industries Stock Down 0.6%

Shares of NYSE AWI opened at $193.56 on Monday. Armstrong World Industries, Inc. has a 52 week low of $122.37 and a 52 week high of $201.72. The business has a 50-day simple moving average of $194.97 and a two-hundred day simple moving average of $168.00. The company has a quick ratio of 1.11, a current ratio of 1.61 and a debt-to-equity ratio of 0.59. The company has a market cap of $8.37 billion, a P/E ratio of 28.63, a P/E/G ratio of 1.94 and a beta of 1.45.

Armstrong World Industries (NYSE:AWI - Get Free Report) last issued its earnings results on Monday, November 6th. The construction company reported $1.36 EPS for the quarter. Armstrong World Industries had a return on equity of 39.80% and a net margin of 18.95%.The business had revenue of $325.00 million during the quarter. Research analysts anticipate that Armstrong World Industries, Inc. will post 6.18 earnings per share for the current fiscal year.

Armstrong World Industries Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, August 21st. Shareholders of record on Thursday, August 7th were issued a $0.308 dividend. The ex-dividend date of this dividend was Thursday, August 7th. This represents a $1.23 annualized dividend and a dividend yield of 0.6%. Armstrong World Industries's dividend payout ratio (DPR) is presently 18.20%.

Armstrong World Industries Profile

(

Free Report)

Armstrong World Industries, Inc, together with its subsidiaries, engages in the design, manufacture, and sale of ceiling and wall solutions in the Americas. It operates through Mineral Fiber and Architectural Specialties segments. The company offers mineral fiber, fiberglass wool, metal, wood, felt, wood fiber, and glass-reinforced-gypsum; ceiling component products, such as ceiling perimeters and trims, as well as grid products that support drywall ceiling systems; ceilings, walls, and facades for use in commercial settings; and manufactures ceiling suspension system (grid) products.

See Also

Want to see what other hedge funds are holding AWI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Armstrong World Industries, Inc. (NYSE:AWI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Armstrong World Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Armstrong World Industries wasn't on the list.

While Armstrong World Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.