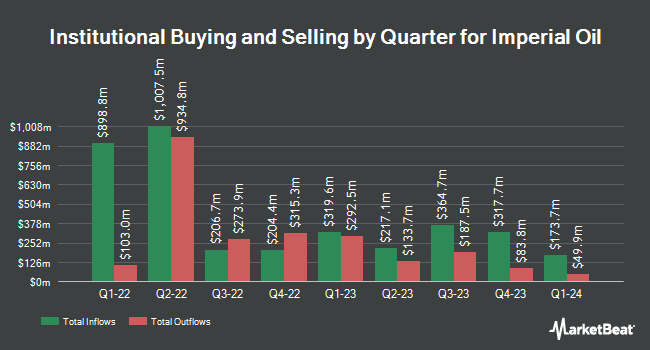

Quantbot Technologies LP boosted its holdings in shares of Imperial Oil Limited (NYSEAMERICAN:IMO - Free Report) TSE: IMO by 485.9% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 18,403 shares of the energy company's stock after buying an additional 15,262 shares during the period. Quantbot Technologies LP's holdings in Imperial Oil were worth $1,331,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds also recently added to or reduced their stakes in the business. TD Asset Management Inc increased its position in Imperial Oil by 1.0% during the 1st quarter. TD Asset Management Inc now owns 4,873,843 shares of the energy company's stock valued at $352,014,000 after buying an additional 47,898 shares in the last quarter. Bank of America Corp DE grew its stake in Imperial Oil by 1.1% during the 4th quarter. Bank of America Corp DE now owns 2,398,899 shares of the energy company's stock valued at $147,772,000 after purchasing an additional 26,891 shares during the last quarter. Mackenzie Financial Corp grew its stake in Imperial Oil by 54.7% during the 1st quarter. Mackenzie Financial Corp now owns 690,024 shares of the energy company's stock valued at $49,842,000 after purchasing an additional 243,894 shares during the last quarter. Bank of Nova Scotia grew its stake in Imperial Oil by 0.7% during the 1st quarter. Bank of Nova Scotia now owns 574,221 shares of the energy company's stock valued at $41,485,000 after purchasing an additional 3,773 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its stake in Imperial Oil by 2.2% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 534,265 shares of the energy company's stock valued at $38,588,000 after purchasing an additional 11,543 shares during the last quarter. 20.74% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

IMO has been the topic of several research analyst reports. Wolfe Research downgraded Imperial Oil from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, July 23rd. Desjardins downgraded Imperial Oil from a "hold" rating to a "strong sell" rating in a research note on Tuesday, June 3rd. BMO Capital Markets reiterated an "outperform" rating on shares of Imperial Oil in a research note on Monday, August 4th. Raymond James Financial downgraded Imperial Oil from a "moderate buy" rating to a "hold" rating in a research note on Thursday, July 3rd. Finally, Tudor Pickering downgraded Imperial Oil from a "strong-buy" rating to a "hold" rating in a research note on Friday, July 25th. One research analyst has rated the stock with a Buy rating, five have issued a Hold rating and three have assigned a Sell rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Reduce" and a consensus target price of $105.50.

Read Our Latest Stock Analysis on IMO

Imperial Oil Stock Performance

Shares of IMO traded up $0.40 during mid-day trading on Thursday, reaching $90.22. The company had a trading volume of 75,746 shares, compared to its average volume of 447,111. The stock has a market capitalization of $45.70 billion, a P/E ratio of 13.89 and a beta of 0.92. The stock has a 50 day moving average of $82.96 and a two-hundred day moving average of $74.10. The company has a quick ratio of 1.34, a current ratio of 1.58 and a debt-to-equity ratio of 0.16. Imperial Oil Limited has a 52-week low of $58.76 and a 52-week high of $89.97.

Imperial Oil Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Thursday, September 4th will be given a dividend of $0.72 per share. This is an increase from Imperial Oil's previous quarterly dividend of $0.52. This represents a $2.88 dividend on an annualized basis and a yield of 3.2%. The ex-dividend date is Thursday, September 4th. Imperial Oil's dividend payout ratio (DPR) is currently 31.87%.

Imperial Oil Company Profile

(

Free Report)

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

See Also

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.