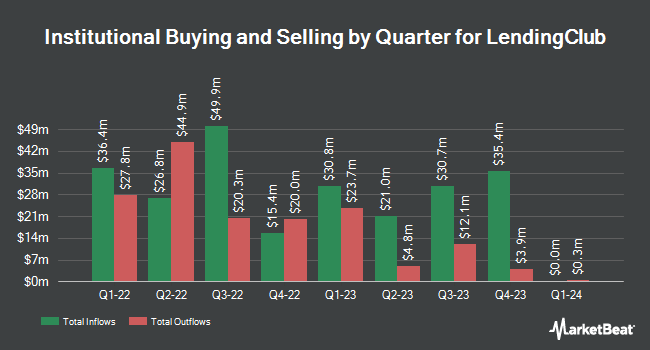

Quantbot Technologies LP raised its stake in LendingClub Corporation (NYSE:LC - Free Report) by 115.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 308,599 shares of the credit services provider's stock after buying an additional 165,069 shares during the quarter. Quantbot Technologies LP owned about 0.27% of LendingClub worth $3,185,000 at the end of the most recent quarter.

A number of other large investors also recently bought and sold shares of the stock. LPL Financial LLC acquired a new stake in shares of LendingClub during the fourth quarter worth about $594,000. Wells Fargo & Company MN lifted its position in shares of LendingClub by 277.9% during the fourth quarter. Wells Fargo & Company MN now owns 191,206 shares of the credit services provider's stock worth $3,096,000 after purchasing an additional 140,611 shares in the last quarter. Invesco Ltd. lifted its position in shares of LendingClub by 87.1% during the fourth quarter. Invesco Ltd. now owns 637,458 shares of the credit services provider's stock worth $10,320,000 after purchasing an additional 296,813 shares in the last quarter. Legal & General Group Plc lifted its position in shares of LendingClub by 4.1% during the fourth quarter. Legal & General Group Plc now owns 122,498 shares of the credit services provider's stock worth $1,983,000 after purchasing an additional 4,779 shares in the last quarter. Finally, Raymond James Financial Inc. acquired a new stake in shares of LendingClub during the fourth quarter worth about $1,696,000. Institutional investors and hedge funds own 74.08% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently issued reports on LC shares. Stephens started coverage on shares of LendingClub in a research report on Thursday, June 12th. They set an "overweight" rating and a $15.00 price target on the stock. Wall Street Zen upgraded LendingClub from a "sell" rating to a "hold" rating in a report on Saturday, August 2nd. Keefe, Bruyette & Woods upped their price target on LendingClub from $14.00 to $16.50 and gave the stock an "outperform" rating in a report on Wednesday, July 30th. Citizens Jmp initiated coverage on LendingClub in a report on Monday, July 7th. They set a "market perform" rating on the stock. Finally, Citigroup initiated coverage on LendingClub in a report on Monday, July 7th. They set a "market perform" rating on the stock. Six equities research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $16.57.

Read Our Latest Stock Analysis on LendingClub

LendingClub Trading Up 0.7%

NYSE:LC traded up $0.11 during mid-day trading on Monday, hitting $16.42. The stock had a trading volume of 276,164 shares, compared to its average volume of 1,703,483. The stock has a 50-day simple moving average of $13.47 and a two-hundred day simple moving average of $11.78. The company has a market capitalization of $1.88 billion, a PE ratio of 25.69 and a beta of 2.46. LendingClub Corporation has a twelve month low of $7.90 and a twelve month high of $18.75.

LendingClub (NYSE:LC - Get Free Report) last issued its earnings results on Tuesday, July 29th. The credit services provider reported $0.33 earnings per share for the quarter, beating the consensus estimate of $0.15 by $0.18. The firm had revenue of $248.44 million for the quarter, compared to analysts' expectations of $227.04 million. LendingClub had a net margin of 8.36% and a return on equity of 5.66%. The firm's revenue was up 14.1% compared to the same quarter last year. During the same quarter last year, the company earned $0.13 earnings per share. Sell-side analysts predict that LendingClub Corporation will post 0.72 EPS for the current fiscal year.

Insider Activity at LendingClub

In other LendingClub news, CEO Scott Sanborn sold 5,250 shares of the stock in a transaction that occurred on Thursday, July 17th. The shares were sold at an average price of $12.98, for a total value of $68,145.00. Following the transaction, the chief executive officer directly owned 1,283,175 shares in the company, valued at $16,655,611.50. This represents a 0.41% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO Andrew Labenne sold 17,955 shares of the stock in a transaction that occurred on Wednesday, July 30th. The shares were sold at an average price of $16.65, for a total transaction of $298,950.75. Following the completion of the transaction, the chief financial officer owned 178,111 shares in the company, valued at $2,965,548.15. This represents a 9.16% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 38,955 shares of company stock worth $545,648 over the last quarter. 3.19% of the stock is currently owned by insiders.

LendingClub Company Profile

(

Free Report)

LendingClub Corporation, operates as a bank holding company, that provides range of financial products and services in the United States. It offers deposit products, including savings accounts, checking accounts, and certificates of deposit. The company also provides loan products, such as consumer loans comprising unsecured personal loans, secured auto refinance loans, and patient and education finance loans; and commercial loans, including small business loans.

Featured Articles

Before you consider LendingClub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingClub wasn't on the list.

While LendingClub currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.