Quantbot Technologies LP grew its holdings in Easterly Government Properties, Inc. (NYSE:DEA - Free Report) by 888.5% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 84,836 shares of the real estate investment trust's stock after buying an additional 76,254 shares during the period. Quantbot Technologies LP owned 0.19% of Easterly Government Properties worth $899,000 at the end of the most recent quarter.

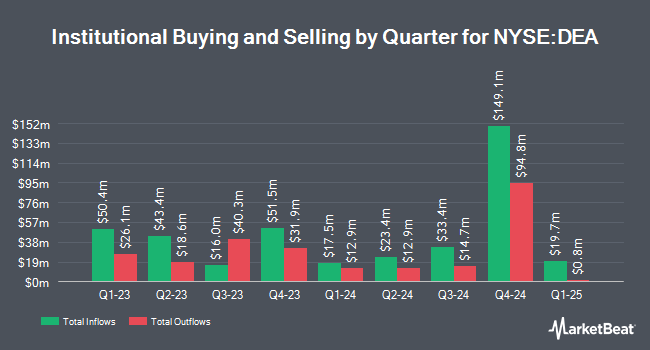

A number of other hedge funds also recently made changes to their positions in the business. Arrow Investment Advisors LLC lifted its position in shares of Easterly Government Properties by 14.2% in the first quarter. Arrow Investment Advisors LLC now owns 13,548 shares of the real estate investment trust's stock valued at $144,000 after buying an additional 1,686 shares during the last quarter. Accel Wealth Management lifted its holdings in Easterly Government Properties by 20.0% during the 1st quarter. Accel Wealth Management now owns 12,000 shares of the real estate investment trust's stock worth $127,000 after purchasing an additional 2,000 shares during the last quarter. Avantax Advisory Services Inc. lifted its holdings in Easterly Government Properties by 10.1% during the 1st quarter. Avantax Advisory Services Inc. now owns 27,217 shares of the real estate investment trust's stock worth $288,000 after purchasing an additional 2,501 shares during the last quarter. Cetera Investment Advisers lifted its holdings in Easterly Government Properties by 22.0% during the 4th quarter. Cetera Investment Advisers now owns 14,601 shares of the real estate investment trust's stock worth $166,000 after purchasing an additional 2,637 shares during the last quarter. Finally, Swiss National Bank lifted its holdings in Easterly Government Properties by 1.6% during the 1st quarter. Swiss National Bank now owns 194,410 shares of the real estate investment trust's stock worth $2,061,000 after purchasing an additional 3,100 shares during the last quarter. 86.51% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

DEA has been the subject of several research reports. BMO Capital Markets raised Easterly Government Properties from a "strong sell" rating to a "hold" rating and set a $25.00 price target for the company in a report on Wednesday, July 16th. Wall Street Zen cut Easterly Government Properties from a "hold" rating to a "sell" rating in a report on Friday, June 6th. Finally, Royal Bank Of Canada dropped their price target on Easterly Government Properties from $27.50 to $22.00 and set an "underperform" rating for the company in a report on Monday, June 2nd. One equities research analyst has rated the stock with a Buy rating, three have issued a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, Easterly Government Properties currently has a consensus rating of "Hold" and a consensus target price of $27.15.

Read Our Latest Stock Report on DEA

Easterly Government Properties Price Performance

Shares of NYSE:DEA traded down $0.04 during trading on Friday, reaching $22.83. 657,992 shares of the company traded hands, compared to its average volume of 522,428. The company's 50 day moving average is $22.53 and its two-hundred day moving average is $23.23. The firm has a market capitalization of $1.04 billion, a PE ratio of 55.67 and a beta of 0.94. The company has a quick ratio of 3.75, a current ratio of 3.75 and a debt-to-equity ratio of 1.24. Easterly Government Properties, Inc. has a 52 week low of $19.33 and a 52 week high of $36.31.

Easterly Government Properties (NYSE:DEA - Get Free Report) last released its earnings results on Tuesday, August 5th. The real estate investment trust reported $0.74 earnings per share for the quarter, meeting analysts' consensus estimates of $0.74. The firm had revenue of $80.37 million during the quarter, compared to the consensus estimate of $81.73 million. Easterly Government Properties had a return on equity of 1.26% and a net margin of 5.54%.The company's revenue was up 10.5% compared to the same quarter last year. During the same period in the prior year, the company posted $0.29 EPS. Easterly Government Properties has set its FY 2025 guidance at 2.980-3.030 EPS. As a group, sell-side analysts predict that Easterly Government Properties, Inc. will post 1.17 earnings per share for the current year.

Easterly Government Properties Cuts Dividend

The business also recently announced a quarterly dividend, which was paid on Monday, August 25th. Stockholders of record on Wednesday, August 13th were given a dividend of $0.45 per share. This represents a $1.80 dividend on an annualized basis and a dividend yield of 7.9%. The ex-dividend date was Wednesday, August 13th. Easterly Government Properties's dividend payout ratio is presently 439.02%.

About Easterly Government Properties

(

Free Report)

Easterly Government Properties, Inc NYSE: DEA is based in Washington, DC, and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S. Government. Easterly's experienced management team brings specialized insight into the strategy and needs of mission-critical U.S.

See Also

Before you consider Easterly Government Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Easterly Government Properties wasn't on the list.

While Easterly Government Properties currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.