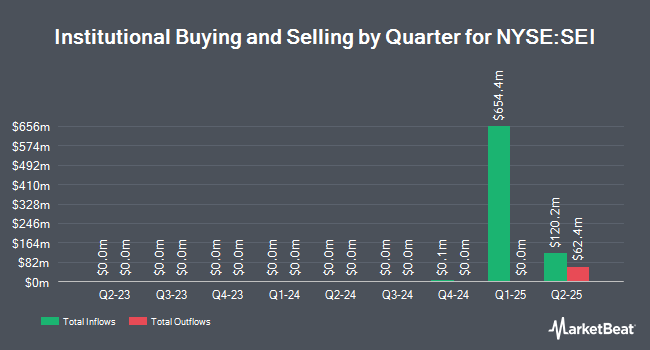

Quantbot Technologies LP purchased a new stake in Solaris Energy Infrastructure, Inc. (NYSE:SEI - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 142,793 shares of the company's stock, valued at approximately $3,107,000. Quantbot Technologies LP owned about 0.21% of Solaris Energy Infrastructure as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors have also bought and sold shares of SEI. California State Teachers Retirement System bought a new stake in shares of Solaris Energy Infrastructure during the 4th quarter valued at about $52,000. GAMMA Investing LLC acquired a new position in shares of Solaris Energy Infrastructure during the 1st quarter valued at $435,000. Rhumbline Advisers bought a new position in Solaris Energy Infrastructure during the first quarter worth $962,000. Retirement Planning Group LLC acquired a new position in shares of Solaris Energy Infrastructure during the first quarter valued at about $802,000. Finally, Riverview Trust Co acquired a new stake in Solaris Energy Infrastructure in the first quarter valued at approximately $47,000. Institutional investors own 67.44% of the company's stock.

Insider Transactions at Solaris Energy Infrastructure

In related news, Director Edgar R. Jr. Giesinger sold 10,000 shares of the company's stock in a transaction on Monday, August 25th. The shares were sold at an average price of $28.86, for a total transaction of $288,600.00. Following the completion of the sale, the director directly owned 90,956 shares of the company's stock, valued at approximately $2,624,990.16. This represents a 9.91% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 21.20% of the company's stock.

Solaris Energy Infrastructure Stock Down 1.3%

NYSE SEI traded down $0.39 during trading on Wednesday, reaching $29.47. 557,969 shares of the company's stock were exchanged, compared to its average volume of 1,518,911. The company has a 50 day moving average price of $29.99 and a two-hundred day moving average price of $26.23. Solaris Energy Infrastructure, Inc. has a 1 year low of $10.96 and a 1 year high of $39.03. The company has a debt-to-equity ratio of 0.77, a quick ratio of 3.40 and a current ratio of 3.61. The stock has a market cap of $1.99 billion, a P/E ratio of 66.98 and a beta of 1.14.

Solaris Energy Infrastructure Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Tuesday, September 16th will be paid a dividend of $0.12 per share. The ex-dividend date of this dividend is Tuesday, September 16th. This represents a $0.48 annualized dividend and a dividend yield of 1.6%. Solaris Energy Infrastructure's dividend payout ratio is presently 81.36%.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on SEI. Stifel Nicolaus reissued a "buy" rating and issued a $45.00 price target (up previously from $41.00) on shares of Solaris Energy Infrastructure in a research report on Friday, July 25th. Piper Sandler lowered their target price on Solaris Energy Infrastructure from $51.00 to $50.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 20th. Vertical Research began coverage on Solaris Energy Infrastructure in a research note on Wednesday, May 14th. They set a "buy" rating and a $36.00 target price on the stock. Barclays lifted their target price on Solaris Energy Infrastructure from $39.00 to $44.00 and gave the stock an "overweight" rating in a research note on Monday, July 28th. Finally, Citigroup began coverage on Solaris Energy Infrastructure in a research note on Thursday, May 22nd. They set a "buy" rating on the stock. Two investment analysts have rated the stock with a Strong Buy rating and ten have assigned a Buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Buy" and an average price target of $43.67.

Read Our Latest Stock Report on Solaris Energy Infrastructure

Solaris Energy Infrastructure Profile

(

Free Report)

Solaris Energy Infrastructure, Inc is a holding company, which engages in the manufacture of patented mobile proppant management systems that unload, store, and deliver proppant to oil and natural gas well sites. Its products include Mobile Proppant and Mobile Chemical Management Systems, and Inventory Management Software.

Recommended Stories

Before you consider Solaris Energy Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solaris Energy Infrastructure wasn't on the list.

While Solaris Energy Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.