Quantitative Investment Management LLC bought a new stake in Geo Group Inc (The) (NYSE:GEO - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 22,588 shares of the real estate investment trust's stock, valued at approximately $659,000.

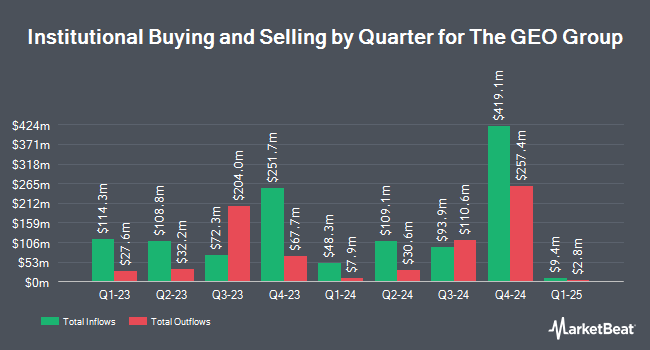

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Wellington Management Group LLP raised its holdings in shares of Geo Group by 312.7% in the first quarter. Wellington Management Group LLP now owns 2,608,619 shares of the real estate investment trust's stock valued at $76,198,000 after purchasing an additional 1,976,544 shares during the last quarter. Point72 Asset Management L.P. raised its holdings in shares of Geo Group by 202.6% in the fourth quarter. Point72 Asset Management L.P. now owns 2,124,783 shares of the real estate investment trust's stock valued at $59,451,000 after purchasing an additional 1,422,676 shares during the last quarter. Northern Trust Corp raised its holdings in shares of Geo Group by 2.1% in the first quarter. Northern Trust Corp now owns 1,554,420 shares of the real estate investment trust's stock valued at $45,405,000 after purchasing an additional 32,060 shares during the last quarter. Newbrook Capital Advisors LP purchased a new stake in shares of Geo Group in the fourth quarter valued at about $35,738,000. Finally, Invesco Ltd. raised its holdings in shares of Geo Group by 5.8% in the first quarter. Invesco Ltd. now owns 1,256,194 shares of the real estate investment trust's stock valued at $36,693,000 after purchasing an additional 68,763 shares during the last quarter. Hedge funds and other institutional investors own 76.10% of the company's stock.

Geo Group Stock Performance

NYSE GEO traded up $0.16 during trading hours on Friday, reaching $20.76. 2,518,161 shares of the company were exchanged, compared to its average volume of 3,772,985. Geo Group Inc has a 1 year low of $11.75 and a 1 year high of $36.46. The business's 50 day simple moving average is $23.61 and its 200-day simple moving average is $26.09. The company has a quick ratio of 0.90, a current ratio of 0.90 and a debt-to-equity ratio of 1.07. The stock has a market capitalization of $2.94 billion, a P/E ratio of 31.93, a P/E/G ratio of 2.25 and a beta of 0.75.

Geo Group (NYSE:GEO - Get Free Report) last issued its earnings results on Wednesday, August 6th. The real estate investment trust reported $0.22 earnings per share for the quarter, topping analysts' consensus estimates of $0.16 by $0.06. The firm had revenue of $636.17 million during the quarter, compared to analyst estimates of $621.55 million. Geo Group had a net margin of 3.69% and a return on equity of 7.26%. The company's quarterly revenue was up 4.8% on a year-over-year basis. During the same quarter last year, the business earned $0.23 earnings per share. On average, equities research analysts expect that Geo Group Inc will post 0.83 earnings per share for the current year.

Geo Group declared that its Board of Directors has authorized a share repurchase program on Wednesday, August 6th that allows the company to buyback $300.00 million in shares. This buyback authorization allows the real estate investment trust to buy up to 8.2% of its stock through open market purchases. Stock buyback programs are typically a sign that the company's leadership believes its shares are undervalued.

Wall Street Analysts Forecast Growth

Several brokerages have recently commented on GEO. Wedbush reiterated an "outperform" rating and issued a $36.00 target price on shares of Geo Group in a report on Monday, June 23rd. Wall Street Zen upgraded shares of Geo Group from a "sell" rating to a "hold" rating in a report on Friday, May 9th. Finally, Jones Trading decreased their price objective on shares of Geo Group from $50.00 to $45.00 and set a "buy" rating for the company in a report on Thursday, August 7th. Four investment analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, the company has an average rating of "Buy" and an average price target of $37.00.

Read Our Latest Analysis on Geo Group

Geo Group Company Profile

(

Free Report)

The GEO Group, Inc NYSE: GEO engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities in the United States, Australia, the United Kingdom, and South Africa. The company also provides secure facility management services, including the provision of security, administrative, rehabilitation, education, and food services; reentry services, such as temporary housing, programming, employment assistance, and other services; electronic monitoring and supervision services; and transportation services; as well as designs, constructs, and finances new facilities through projects.

Further Reading

Before you consider Geo Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geo Group wasn't on the list.

While Geo Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.