R Squared Ltd acquired a new position in shares of UFP Technologies, Inc. (NASDAQ:UFPT - Free Report) in the second quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 1,348 shares of the industrial products company's stock, valued at approximately $329,000.

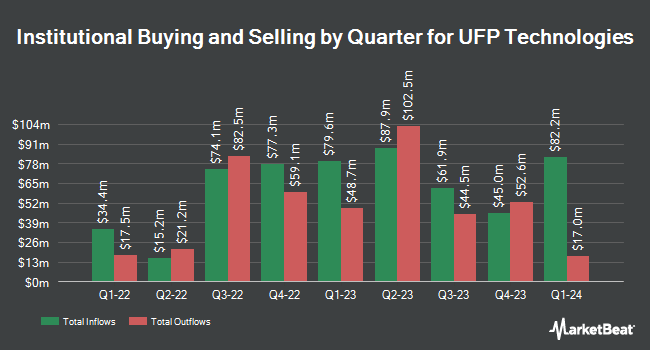

Other large investors also recently added to or reduced their stakes in the company. Allspring Global Investments Holdings LLC acquired a new position in UFP Technologies during the first quarter worth $2,971,000. Fiera Capital Corp raised its position in UFP Technologies by 12.5% during the first quarter. Fiera Capital Corp now owns 46,105 shares of the industrial products company's stock worth $9,300,000 after acquiring an additional 5,105 shares during the period. Principal Financial Group Inc. raised its position in UFP Technologies by 3.0% during the first quarter. Principal Financial Group Inc. now owns 40,274 shares of the industrial products company's stock worth $8,124,000 after acquiring an additional 1,166 shares during the period. Envestnet Portfolio Solutions Inc. raised its position in UFP Technologies by 25.8% during the first quarter. Envestnet Portfolio Solutions Inc. now owns 1,033 shares of the industrial products company's stock worth $208,000 after acquiring an additional 212 shares during the period. Finally, LPL Financial LLC raised its position in UFP Technologies by 54.6% during the first quarter. LPL Financial LLC now owns 14,150 shares of the industrial products company's stock worth $2,824,000 after acquiring an additional 4,999 shares during the period. 87.28% of the stock is currently owned by institutional investors and hedge funds.

UFP Technologies Price Performance

UFP Technologies stock opened at $200.99 on Friday. UFP Technologies, Inc. has a 52-week low of $178.26 and a 52-week high of $354.22. The firm has a market capitalization of $1.55 billion, a price-to-earnings ratio of 23.29 and a beta of 1.19. The company has a fifty day simple moving average of $203.15 and a 200-day simple moving average of $220.44. The company has a quick ratio of 1.53, a current ratio of 2.77 and a debt-to-equity ratio of 0.39.

UFP Technologies (NASDAQ:UFPT - Get Free Report) last released its earnings results on Thursday, November 9th. The industrial products company reported $1.37 earnings per share (EPS) for the quarter. UFP Technologies had a net margin of 11.40% and a return on equity of 21.54%. The business had revenue of $96.97 million during the quarter.

Wall Street Analysts Forecast Growth

A number of research firms have weighed in on UFPT. Weiss Ratings restated a "hold (c)" rating on shares of UFP Technologies in a research report on Friday. Lake Street Capital upped their target price on shares of UFP Technologies from $252.00 to $289.00 and gave the stock a "buy" rating in a report on Wednesday, August 6th. One analyst has rated the stock with a Buy rating and two have assigned a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $289.00.

View Our Latest Analysis on UFPT

UFP Technologies Profile

(

Free Report)

UFP Technologies, Inc designs and manufactures solutions for medical devices, sterile packaging, and other highly engineered custom products. The company offers protective drapes for robotic surgery, single patient use surfaces, advanced wound care, infection prevention, disposables for surgical and endoscopic procedures, packaging for medical devices, orthopedic implants, biopharma drug manufacturing, and coils for catheters; and molded components for applications in acoustic insulation, interior trim, load floors, sunshades, SUV cargo cover handles, driveshaft damping, engine and manifold covers, quarter panels, and wheel liners.

Further Reading

Want to see what other hedge funds are holding UFPT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for UFP Technologies, Inc. (NASDAQ:UFPT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider UFP Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UFP Technologies wasn't on the list.

While UFP Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.