LPL Financial LLC raised its position in shares of RadNet, Inc. (NASDAQ:RDNT - Free Report) by 616.4% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 45,260 shares of the medical research company's stock after purchasing an additional 38,942 shares during the period. LPL Financial LLC owned 0.06% of RadNet worth $2,235,000 at the end of the most recent quarter.

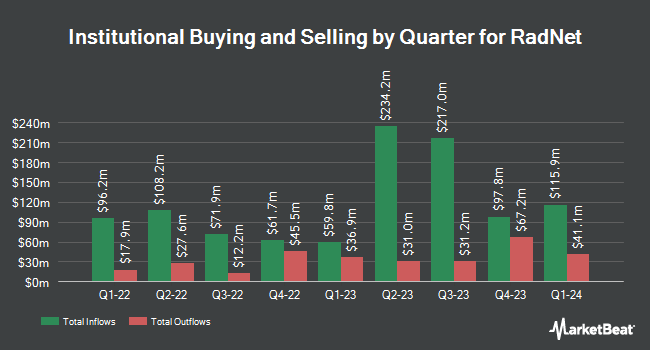

Several other large investors also recently made changes to their positions in RDNT. T. Rowe Price Investment Management Inc. grew its holdings in RadNet by 79.3% in the 4th quarter. T. Rowe Price Investment Management Inc. now owns 913,691 shares of the medical research company's stock worth $63,813,000 after buying an additional 404,241 shares in the last quarter. Tidal Investments LLC boosted its position in RadNet by 7,219.2% during the 4th quarter. Tidal Investments LLC now owns 389,308 shares of the medical research company's stock worth $27,189,000 after acquiring an additional 383,989 shares during the period. Alyeska Investment Group L.P. grew its stake in shares of RadNet by 108.6% in the fourth quarter. Alyeska Investment Group L.P. now owns 502,612 shares of the medical research company's stock worth $35,102,000 after purchasing an additional 261,711 shares in the last quarter. Allspring Global Investments Holdings LLC raised its stake in shares of RadNet by 14.4% during the first quarter. Allspring Global Investments Holdings LLC now owns 1,689,275 shares of the medical research company's stock valued at $85,511,000 after purchasing an additional 213,280 shares in the last quarter. Finally, RTW Investments LP grew its position in RadNet by 9.4% in the 4th quarter. RTW Investments LP now owns 1,978,582 shares of the medical research company's stock valued at $138,184,000 after buying an additional 169,978 shares in the last quarter. Institutional investors and hedge funds own 77.90% of the company's stock.

Analyst Ratings Changes

A number of research firms recently commented on RDNT. Truist Financial set a $74.00 price objective on shares of RadNet in a research note on Thursday, July 10th. Morgan Stanley raised RadNet to an "overweight" rating in a research note on Monday, August 11th. Zacks Research raised RadNet from a "strong sell" rating to a "hold" rating in a research note on Monday, August 18th. B. Riley initiated coverage on RadNet in a report on Friday, June 13th. They issued a "buy" rating and a $69.00 price objective for the company. Finally, Wall Street Zen raised shares of RadNet from a "sell" rating to a "hold" rating in a report on Saturday, August 16th. Three analysts have rated the stock with a Strong Buy rating, four have issued a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat.com, RadNet currently has an average rating of "Buy" and a consensus price target of $71.60.

Check Out Our Latest Research Report on RadNet

Insiders Place Their Bets

In other news, insider Ranjan Jayanathan sold 65,598 shares of the company's stock in a transaction dated Tuesday, August 19th. The stock was sold at an average price of $67.50, for a total value of $4,427,865.00. Following the transaction, the insider owned 138,198 shares in the company, valued at $9,328,365. This represents a 32.19% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Cornelis Wesdorp sold 1,500 shares of the stock in a transaction that occurred on Tuesday, August 19th. The stock was sold at an average price of $66.98, for a total transaction of $100,470.00. Following the completion of the sale, the chief executive officer directly owned 54,495 shares of the company's stock, valued at $3,650,075.10. This trade represents a 2.68% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 84,098 shares of company stock worth $5,689,605. 5.60% of the stock is currently owned by company insiders.

RadNet Trading Up 2.2%

RadNet stock traded up $1.49 during midday trading on Friday, reaching $70.10. The stock had a trading volume of 700,892 shares, compared to its average volume of 1,035,385. RadNet, Inc. has a twelve month low of $45.00 and a twelve month high of $93.65. The company has a debt-to-equity ratio of 0.91, a current ratio of 2.00 and a quick ratio of 2.00. The firm has a market cap of $5.39 billion, a price-to-earnings ratio of -350.48 and a beta of 1.43. The firm's fifty day simple moving average is $58.44 and its two-hundred day simple moving average is $55.87.

RadNet (NASDAQ:RDNT - Get Free Report) last announced its earnings results on Sunday, August 10th. The medical research company reported $0.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.17 by $0.14. The company had revenue of $498.23 million for the quarter, compared to the consensus estimate of $488.06 million. RadNet had a negative net margin of 0.78% and a positive return on equity of 2.41%. The company's revenue was up 8.4% on a year-over-year basis. During the same period in the previous year, the business earned $0.16 EPS. Equities analysts anticipate that RadNet, Inc. will post 0.56 EPS for the current fiscal year.

RadNet Company Profile

(

Free Report)

RadNet, Inc, together with its subsidiaries, provides outpatient diagnostic imaging services in the United States. The company operates in two segments: Imaging Centers and Artificial Intelligence. Its services include magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, diagnostic radiology, fluoroscopy, and other related procedures, as well as multi-modality imaging services.

Recommended Stories

Before you consider RadNet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RadNet wasn't on the list.

While RadNet currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report