Raiffeisen Bank International AG grew its holdings in Zscaler, Inc. (NASDAQ:ZS - Free Report) by 7.2% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 33,149 shares of the company's stock after acquiring an additional 2,236 shares during the quarter. Raiffeisen Bank International AG's holdings in Zscaler were worth $6,866,000 at the end of the most recent reporting period.

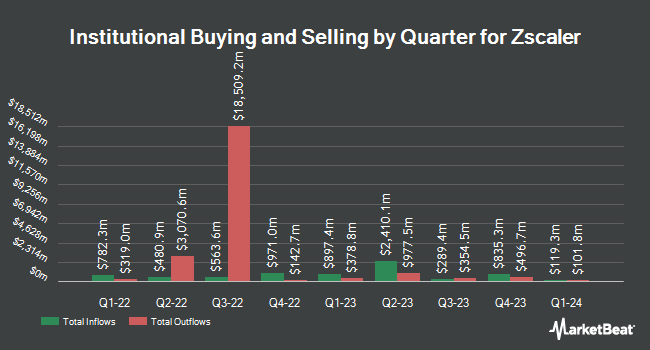

Several other large investors also recently modified their holdings of the business. Manchester Capital Management LLC increased its holdings in shares of Zscaler by 23.0% in the first quarter. Manchester Capital Management LLC now owns 935 shares of the company's stock worth $186,000 after acquiring an additional 175 shares in the last quarter. Scotia Capital Inc. boosted its position in shares of Zscaler by 96.1% during the first quarter. Scotia Capital Inc. now owns 29,031 shares of the company's stock worth $5,760,000 after buying an additional 14,224 shares during the period. Malaga Cove Capital LLC boosted its position in shares of Zscaler by 24.0% during the first quarter. Malaga Cove Capital LLC now owns 8,312 shares of the company's stock worth $1,649,000 after buying an additional 1,609 shares during the period. OVERSEA CHINESE BANKING Corp Ltd boosted its position in shares of Zscaler by 1,136.1% during the first quarter. OVERSEA CHINESE BANKING Corp Ltd now owns 27,083 shares of the company's stock worth $5,374,000 after buying an additional 24,892 shares during the period. Finally, PNC Financial Services Group Inc. boosted its position in shares of Zscaler by 13.0% during the first quarter. PNC Financial Services Group Inc. now owns 7,420 shares of the company's stock worth $1,472,000 after buying an additional 855 shares during the period. 46.45% of the stock is currently owned by institutional investors.

Insider Activity

In other news, insider Robert Schlossman sold 4,618 shares of Zscaler stock in a transaction on Wednesday, June 4th. The stock was sold at an average price of $300.00, for a total value of $1,385,400.00. Following the transaction, the insider owned 95,612 shares in the company, valued at approximately $28,683,600. This trade represents a 4.61% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Andrew William Fraser Brown sold 20,333 shares of Zscaler stock in a transaction on Wednesday, June 4th. The shares were sold at an average price of $296.72, for a total value of $6,033,207.76. Following the completion of the transaction, the director owned 27,216 shares in the company, valued at approximately $8,075,531.52. The trade was a 42.76% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 200,793 shares of company stock worth $58,752,794. 18.10% of the stock is currently owned by insiders.

Zscaler Trading Down 1.9%

Shares of NASDAQ ZS opened at $280.27 on Monday. The business's 50 day moving average is $295.21 and its 200-day moving average is $238.92. Zscaler, Inc. has a 1-year low of $153.45 and a 1-year high of $318.46. The firm has a market cap of $43.64 billion, a P/E ratio of -1,077.96, a price-to-earnings-growth ratio of 240.75 and a beta of 1.06.

Zscaler (NASDAQ:ZS - Get Free Report) last posted its quarterly earnings data on Thursday, May 29th. The company reported $0.84 EPS for the quarter, topping analysts' consensus estimates of $0.76 by $0.08. Zscaler had a negative return on equity of 0.59% and a negative net margin of 1.52%. The firm had revenue of $678.03 million for the quarter, compared to analyst estimates of $667.13 million. During the same quarter last year, the company earned $0.88 EPS. The company's revenue was up 22.6% on a year-over-year basis. Analysts forecast that Zscaler, Inc. will post -0.1 EPS for the current year.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on ZS shares. BMO Capital Markets upped their price objective on Zscaler from $233.00 to $295.00 and gave the stock an "outperform" rating in a research report on Friday, May 30th. Stephens reaffirmed an "overweight" rating and set a $255.00 price objective on shares of Zscaler in a research report on Tuesday, May 27th. Canaccord Genuity Group set a $305.00 price objective on Zscaler and gave the stock a "buy" rating in a research report on Monday, June 2nd. Rosenblatt Securities upped their price objective on Zscaler from $235.00 to $315.00 and gave the stock a "buy" rating in a research report on Friday, May 30th. Finally, Guggenheim reissued a "neutral" rating on shares of Zscaler in a research report on Friday, May 30th. Seven research analysts have rated the stock with a hold rating, twenty-nine have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, Zscaler currently has a consensus rating of "Moderate Buy" and an average target price of $296.82.

Check Out Our Latest Analysis on ZS

About Zscaler

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.