Mutual of America Capital Management LLC grew its position in Rambus, Inc. (NASDAQ:RMBS - Free Report) by 4.8% in the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 151,854 shares of the semiconductor company's stock after purchasing an additional 6,932 shares during the period. Mutual of America Capital Management LLC owned approximately 0.14% of Rambus worth $9,722,000 as of its most recent SEC filing.

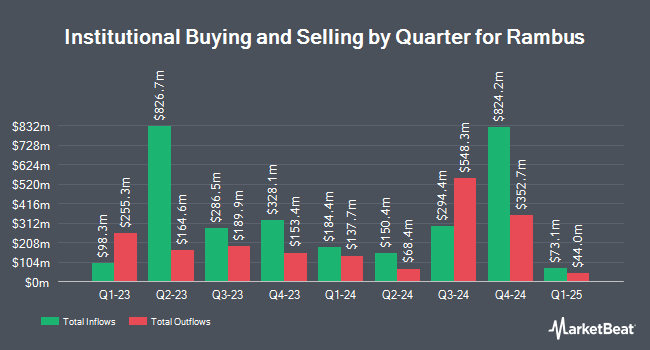

Several other institutional investors and hedge funds have also recently bought and sold shares of RMBS. Price T Rowe Associates Inc. MD grew its position in Rambus by 60.5% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 8,746,856 shares of the semiconductor company's stock worth $452,870,000 after purchasing an additional 3,297,728 shares during the last quarter. EdgePoint Investment Group Inc. bought a new position in Rambus in the 1st quarter worth about $60,535,000. Nuveen LLC bought a new position in Rambus in the 1st quarter worth about $57,084,000. Assenagon Asset Management S.A. grew its position in Rambus by 392.9% in the 2nd quarter. Assenagon Asset Management S.A. now owns 881,562 shares of the semiconductor company's stock worth $56,438,000 after purchasing an additional 702,704 shares during the last quarter. Finally, Park West Asset Management LLC bought a new position in Rambus in the 1st quarter worth about $30,503,000. Institutional investors own 88.54% of the company's stock.

Insider Activity

In other news, Director Meera Rao sold 653 shares of the business's stock in a transaction that occurred on Wednesday, October 1st. The shares were sold at an average price of $101.99, for a total transaction of $66,599.47. Following the sale, the director owned 29,261 shares in the company, valued at $2,984,329.39. The trade was a 2.18% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Necip Sayiner sold 7,500 shares of the company's stock in a transaction that occurred on Thursday, September 11th. The shares were sold at an average price of $85.63, for a total transaction of $642,225.00. Following the completion of the transaction, the director owned 30,824 shares in the company, valued at approximately $2,639,459.12. This represents a 19.57% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 29,913 shares of company stock worth $2,474,452 over the last three months. 1.00% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

RMBS has been the subject of several recent analyst reports. Susquehanna set a $100.00 target price on shares of Rambus and gave the stock a "neutral" rating in a research report on Monday, October 6th. Wall Street Zen lowered shares of Rambus from a "buy" rating to a "hold" rating in a research note on Sunday, August 10th. Evercore ISI upped their price target on shares of Rambus from $81.00 to $114.00 and gave the stock an "outperform" rating in a research note on Tuesday, September 16th. Robert W. Baird upped their price target on shares of Rambus from $90.00 to $120.00 and gave the stock an "outperform" rating in a research note on Monday, September 15th. Finally, Arete Research raised shares of Rambus to a "strong-buy" rating in a research note on Thursday, August 28th. Two equities research analysts have rated the stock with a Strong Buy rating, seven have issued a Buy rating and two have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $96.63.

View Our Latest Analysis on RMBS

Rambus Price Performance

RMBS stock opened at $96.26 on Monday. Rambus, Inc. has a 52-week low of $40.12 and a 52-week high of $109.15. The company's 50 day simple moving average is $87.63 and its 200-day simple moving average is $68.36. The firm has a market capitalization of $10.36 billion, a P/E ratio of 45.41 and a beta of 1.46.

About Rambus

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.