Range Financial Group LLC purchased a new stake in shares of Pitney Bowes Inc. (NYSE:PBI - Free Report) during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor purchased 106,385 shares of the technology company's stock, valued at approximately $963,000. Range Financial Group LLC owned 0.06% of Pitney Bowes as of its most recent SEC filing.

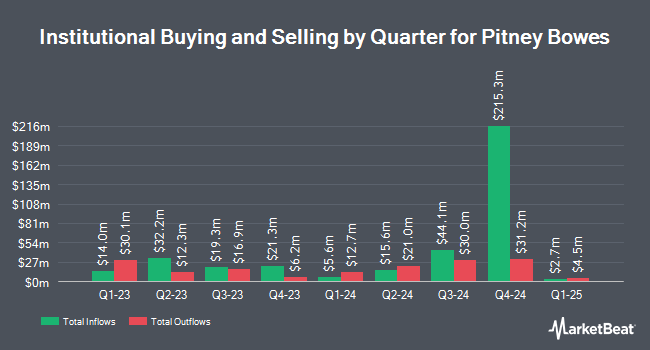

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Meeder Asset Management Inc. bought a new stake in shares of Pitney Bowes during the fourth quarter valued at about $31,000. Smartleaf Asset Management LLC increased its position in shares of Pitney Bowes by 130.3% during the fourth quarter. Smartleaf Asset Management LLC now owns 5,078 shares of the technology company's stock valued at $37,000 after buying an additional 2,873 shares during the period. Xponance Inc. increased its position in shares of Pitney Bowes by 36.7% during the fourth quarter. Xponance Inc. now owns 14,283 shares of the technology company's stock valued at $103,000 after buying an additional 3,837 shares during the period. PharVision Advisers LLC bought a new position in shares of Pitney Bowes in the fourth quarter worth approximately $107,000. Finally, Cibc World Markets Corp bought a new position in shares of Pitney Bowes in the fourth quarter worth approximately $110,000. 67.88% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on PBI shares. Wall Street Zen cut shares of Pitney Bowes from a "strong-buy" rating to a "buy" rating in a research report on Thursday, May 15th. Sidoti upgraded shares of Pitney Bowes to a "hold" rating in a research report on Monday, May 5th.

Get Our Latest Report on Pitney Bowes

Pitney Bowes Price Performance

NYSE PBI traded up $0.03 on Thursday, reaching $10.48. 1,408,868 shares of the company's stock traded hands, compared to its average volume of 2,140,326. Pitney Bowes Inc. has a 12 month low of $4.62 and a 12 month high of $11.01. The stock has a 50-day simple moving average of $9.14 and a 200 day simple moving average of $8.79. The stock has a market cap of $1.92 billion, a PE ratio of -9.36, a P/E/G ratio of 0.59 and a beta of 1.61.

Pitney Bowes (NYSE:PBI - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The technology company reported $0.33 earnings per share for the quarter, beating analysts' consensus estimates of $0.28 by $0.05. The firm had revenue of $493.42 million during the quarter, compared to analyst estimates of $498.99 million. Pitney Bowes had a negative return on equity of 20.95% and a negative net margin of 7.71%. The business's quarterly revenue was down 5.3% compared to the same quarter last year. During the same quarter in the prior year, the firm posted ($0.01) earnings per share. As a group, analysts anticipate that Pitney Bowes Inc. will post 1.21 EPS for the current year.

Pitney Bowes Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, June 6th. Investors of record on Monday, May 19th were paid a $0.07 dividend. This is a positive change from Pitney Bowes's previous quarterly dividend of $0.06. The ex-dividend date of this dividend was Monday, May 19th. This represents a $0.28 dividend on an annualized basis and a yield of 2.67%. Pitney Bowes's dividend payout ratio (DPR) is presently -30.77%.

Pitney Bowes Profile

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Featured Articles

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.