Clough Capital Partners L P raised its stake in Range Resources Corporation (NYSE:RRC - Free Report) by 102.9% in the 1st quarter, according to its most recent filing with the SEC. The fund owned 351,210 shares of the oil and gas exploration company's stock after purchasing an additional 178,110 shares during the period. Range Resources accounts for approximately 1.8% of Clough Capital Partners L P's holdings, making the stock its 22nd biggest holding. Clough Capital Partners L P owned 0.15% of Range Resources worth $14,024,000 at the end of the most recent reporting period.

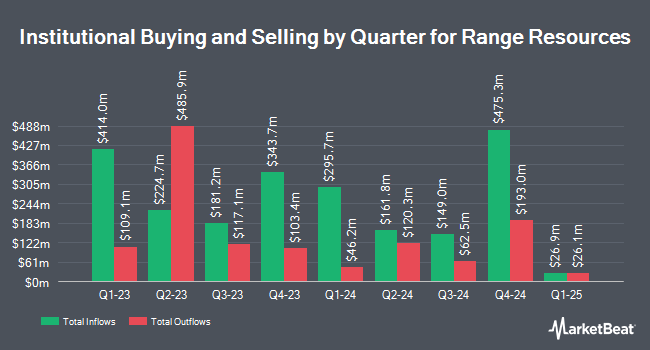

Several other hedge funds and other institutional investors also recently modified their holdings of RRC. Hollencrest Capital Management acquired a new position in shares of Range Resources in the 1st quarter valued at about $33,000. Bessemer Group Inc. raised its holdings in shares of Range Resources by 48.0% in the 1st quarter. Bessemer Group Inc. now owns 971 shares of the oil and gas exploration company's stock worth $39,000 after purchasing an additional 315 shares in the last quarter. Cullen Frost Bankers Inc. bought a new stake in shares of Range Resources in the 1st quarter worth approximately $39,000. State of Wyoming bought a new stake in shares of Range Resources in the 1st quarter worth approximately $71,000. Finally, Fifth Third Bancorp raised its holdings in shares of Range Resources by 20.6% during the first quarter. Fifth Third Bancorp now owns 2,078 shares of the oil and gas exploration company's stock valued at $83,000 after acquiring an additional 355 shares during the period. Institutional investors own 98.93% of the company's stock.

Range Resources Stock Performance

Range Resources stock traded down $0.40 during trading hours on Wednesday, reaching $34.24. 1,154,226 shares of the stock were exchanged, compared to its average volume of 2,839,776. The firm's 50 day moving average is $36.21 and its 200 day moving average is $37.20. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.55 and a current ratio of 0.55. The stock has a market cap of $8.16 billion, a P/E ratio of 17.20, a P/E/G ratio of 0.29 and a beta of 0.55. Range Resources Corporation has a 52-week low of $27.55 and a 52-week high of $43.50.

Range Resources (NYSE:RRC - Get Free Report) last announced its quarterly earnings results on Tuesday, July 22nd. The oil and gas exploration company reported $0.66 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.65 by $0.01. The business had revenue of $856.28 million during the quarter, compared to the consensus estimate of $708.38 million. Range Resources had a net margin of 17.22% and a return on equity of 15.95%. During the same quarter last year, the firm posted $0.46 EPS. Analysts predict that Range Resources Corporation will post 2.02 EPS for the current fiscal year.

Range Resources Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Friday, September 12th will be given a $0.09 dividend. The ex-dividend date of this dividend is Friday, September 12th. This represents a $0.36 annualized dividend and a dividend yield of 1.1%. Range Resources's dividend payout ratio (DPR) is currently 18.09%.

Analyst Ratings Changes

Several research analysts have weighed in on RRC shares. UBS Group dropped their price objective on shares of Range Resources from $42.00 to $40.00 and set a "neutral" rating on the stock in a research note on Wednesday, August 20th. Bank of America upped their price objective on shares of Range Resources from $45.00 to $47.00 and gave the stock a "buy" rating in a report on Friday, May 23rd. Mizuho upped their price objective on shares of Range Resources from $46.00 to $48.00 and gave the stock an "outperform" rating in a report on Wednesday, July 23rd. Barclays increased their price target on shares of Range Resources from $39.00 to $44.00 and gave the company an "equal weight" rating in a report on Monday, July 7th. Finally, Roth Capital downgraded shares of Range Resources from a "buy" rating to a "neutral" rating and reduced their price objective for the stock from $44.00 to $35.00 in a report on Monday, August 18th. Seven analysts have rated the stock with a Buy rating, twelve have issued a Hold rating and one has issued a Sell rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $42.75.

Check Out Our Latest Analysis on Range Resources

Range Resources Company Profile

(

Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Featured Articles

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.