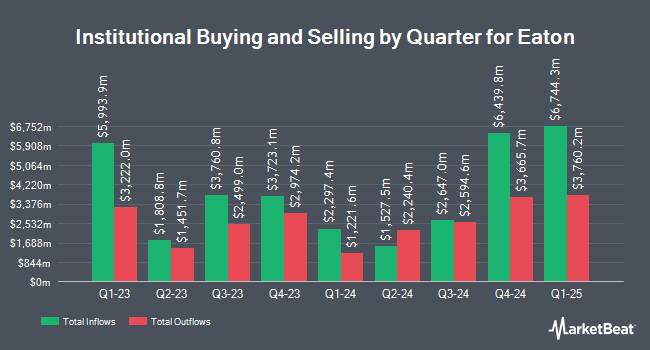

Ransom Advisory Ltd bought a new stake in Eaton Corporation, PLC (NYSE:ETN - Free Report) during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 12,465 shares of the industrial products company's stock, valued at approximately $3,388,000. Eaton comprises approximately 1.7% of Ransom Advisory Ltd's portfolio, making the stock its 14th biggest position.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Anchor Investment Management LLC boosted its stake in Eaton by 6.3% in the first quarter. Anchor Investment Management LLC now owns 1,345 shares of the industrial products company's stock valued at $366,000 after acquiring an additional 80 shares during the last quarter. Glenview Trust co lifted its stake in shares of Eaton by 31.7% during the 1st quarter. Glenview Trust co now owns 14,279 shares of the industrial products company's stock valued at $3,881,000 after buying an additional 3,436 shares in the last quarter. Aspen Investment Management Inc lifted its stake in shares of Eaton by 8.5% during the 1st quarter. Aspen Investment Management Inc now owns 3,447 shares of the industrial products company's stock valued at $937,000 after buying an additional 270 shares in the last quarter. Game Plan Financial Advisors LLC lifted its stake in shares of Eaton by 42.5% during the 1st quarter. Game Plan Financial Advisors LLC now owns 19,415 shares of the industrial products company's stock valued at $5,278,000 after buying an additional 5,790 shares in the last quarter. Finally, SCS Capital Management LLC purchased a new stake in shares of Eaton during the 1st quarter valued at approximately $815,000. 82.97% of the stock is currently owned by hedge funds and other institutional investors.

Eaton Price Performance

Shares of NYSE:ETN opened at $347.94 on Wednesday. The company's fifty day moving average price is $361.99 and its 200-day moving average price is $322.90. The firm has a market capitalization of $135.45 billion, a price-to-earnings ratio of 35.00, a PEG ratio of 2.50 and a beta of 1.16. Eaton Corporation, PLC has a one year low of $231.85 and a one year high of $399.56. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.24 and a quick ratio of 0.76.

Eaton (NYSE:ETN - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The industrial products company reported $2.95 EPS for the quarter, topping analysts' consensus estimates of $2.92 by $0.03. The firm had revenue of $7.03 billion for the quarter, compared to analyst estimates of $6.93 billion. Eaton had a net margin of 15.11% and a return on equity of 23.91%. The business's revenue for the quarter was up 10.7% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $2.73 EPS. Eaton has set its Q3 2025 guidance at 3.010-3.070 EPS. FY 2025 guidance at 11.970-12.170 EPS. On average, equities research analysts anticipate that Eaton Corporation, PLC will post 12.02 earnings per share for the current fiscal year.

Eaton Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, August 22nd. Investors of record on Thursday, August 7th were issued a dividend of $1.04 per share. The ex-dividend date of this dividend was Thursday, August 7th. This represents a $4.16 annualized dividend and a dividend yield of 1.2%. Eaton's dividend payout ratio (DPR) is currently 41.85%.

Insider Activity at Eaton

In related news, insider Olivier Leonetti sold 16,018 shares of the stock in a transaction on Thursday, August 7th. The shares were sold at an average price of $358.39, for a total transaction of $5,740,691.02. Following the transaction, the insider owned 630 shares of the company's stock, valued at approximately $225,785.70. This trade represents a 96.22% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 0.30% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages recently commented on ETN. Rothschild & Co Redburn began coverage on shares of Eaton in a research note on Wednesday, August 20th. They set a "neutral" rating and a $336.00 price target on the stock. Rothschild Redb upgraded shares of Eaton to a "hold" rating in a research note on Wednesday, August 20th. Wall Street Zen raised shares of Eaton from a "hold" rating to a "buy" rating in a report on Saturday, August 30th. The Goldman Sachs Group upped their target price on shares of Eaton from $345.00 to $382.00 and gave the stock a "buy" rating in a report on Tuesday, July 8th. Finally, Citigroup upped their target price on shares of Eaton from $420.00 to $425.00 and gave the stock a "buy" rating in a report on Wednesday, August 6th. Fourteen investment analysts have rated the stock with a Buy rating and eight have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $379.10.

Check Out Our Latest Stock Report on ETN

Eaton Profile

(

Free Report)

Eaton Corporation plc operates as a power management company worldwide. The company's Electrical Americas and Electrical Global segment provides electrical components, industrial components, power distribution and assemblies, residential products, single and three phase power quality and connectivity products, wiring devices, circuit protection products, utility power distribution products, power reliability equipment, and services, as well as hazardous duty electrical equipment, emergency lighting, fire detection, explosion-proof instrumentation, and structural support systems.

Read More

Want to see what other hedge funds are holding ETN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Eaton Corporation, PLC (NYSE:ETN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eaton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eaton wasn't on the list.

While Eaton currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.