Rathbones Group PLC trimmed its stake in Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) by 10.3% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 173,877 shares of the company's stock after selling 19,976 shares during the quarter. Rathbones Group PLC owned 0.10% of Take-Two Interactive Software worth $36,036,000 at the end of the most recent quarter.

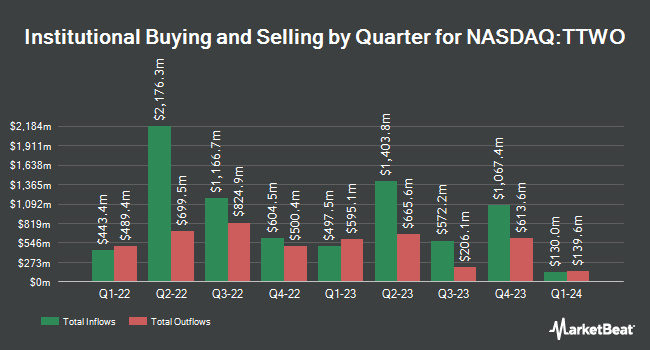

Several other hedge funds have also recently modified their holdings of the business. Nuveen LLC purchased a new stake in shares of Take-Two Interactive Software during the first quarter valued at $288,410,000. GAMMA Investing LLC boosted its position in shares of Take-Two Interactive Software by 27,563.6% during the first quarter. GAMMA Investing LLC now owns 693,251 shares of the company's stock valued at $143,676,000 after buying an additional 690,745 shares during the last quarter. Alyeska Investment Group L.P. increased its position in Take-Two Interactive Software by 74.3% during the fourth quarter. Alyeska Investment Group L.P. now owns 1,347,150 shares of the company's stock valued at $247,983,000 after acquiring an additional 574,326 shares during the last quarter. Vanguard Group Inc. increased its position in Take-Two Interactive Software by 2.6% during the first quarter. Vanguard Group Inc. now owns 19,865,489 shares of the company's stock valued at $4,117,123,000 after acquiring an additional 506,026 shares during the last quarter. Finally, Capital International Investors increased its position in Take-Two Interactive Software by 9.5% during the fourth quarter. Capital International Investors now owns 4,883,746 shares of the company's stock valued at $899,036,000 after acquiring an additional 424,893 shares during the last quarter. Hedge funds and other institutional investors own 95.46% of the company's stock.

Insider Transactions at Take-Two Interactive Software

In related news, President Karl Slatoff sold 216,661 shares of the stock in a transaction that occurred on Friday, May 30th. The stock was sold at an average price of $225.75, for a total transaction of $48,911,220.75. Following the completion of the transaction, the president directly owned 1,206,427 shares of the company's stock, valued at approximately $272,350,895.25. This represents a 15.22% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, insider Daniel P. Emerson sold 27,056 shares of the stock in a transaction that occurred on Monday, June 2nd. The shares were sold at an average price of $225.22, for a total value of $6,093,552.32. Following the transaction, the insider directly owned 152,271 shares of the company's stock, valued at approximately $34,294,474.62. The trade was a 15.09% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 460,792 shares of company stock valued at $104,014,443 in the last ninety days. Corporate insiders own 1.34% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on TTWO. DA Davidson upped their price objective on Take-Two Interactive Software from $250.00 to $270.00 and gave the company a "buy" rating in a research report on Friday, May 16th. Morgan Stanley upped their price objective on Take-Two Interactive Software from $210.00 to $265.00 and gave the company an "overweight" rating in a research report on Monday, May 19th. Bank of America upped their price objective on Take-Two Interactive Software from $260.00 to $285.00 and gave the company a "buy" rating in a research report on Friday, August 8th. Robert W. Baird upped their price objective on Take-Two Interactive Software from $210.00 to $230.00 and gave the company an "outperform" rating in a research report on Friday, May 16th. Finally, Citigroup upped their price target on Take-Two Interactive Software from $260.00 to $270.00 and gave the stock a "buy" rating in a research report on Wednesday, July 23rd. One analyst has rated the stock with a sell rating, one has issued a hold rating and nineteen have assigned a buy rating to the stock. According to MarketBeat.com, Take-Two Interactive Software presently has a consensus rating of "Moderate Buy" and a consensus target price of $245.60.

Read Our Latest Stock Report on TTWO

Take-Two Interactive Software Price Performance

Shares of NASDAQ:TTWO traded down $2.98 during trading on Thursday, hitting $233.16. 1,687,967 shares of the company's stock were exchanged, compared to its average volume of 2,050,677. The company has a debt-to-equity ratio of 0.72, a current ratio of 1.16 and a quick ratio of 1.16. Take-Two Interactive Software, Inc. has a 52-week low of $145.50 and a 52-week high of $245.07. The business's 50-day simple moving average is $233.64 and its 200 day simple moving average is $219.99. The company has a market cap of $43.01 billion, a price-to-earnings ratio of -9.74, a PEG ratio of 5.85 and a beta of 0.99.

Take-Two Interactive Software (NASDAQ:TTWO - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.61 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.28 by $0.33. Take-Two Interactive Software had a positive return on equity of 7.33% and a negative net margin of 72.92%. The firm had revenue of $1,503,800 billion during the quarter, compared to analysts' expectations of $1.31 billion. During the same quarter last year, the business posted ($1.52) earnings per share. The firm's revenue was up 16.4% on a year-over-year basis. As a group, equities analysts predict that Take-Two Interactive Software, Inc. will post 0.97 EPS for the current year.

About Take-Two Interactive Software

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Read More

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report