Raymond James Financial Inc. boosted its position in shares of Monster Beverage Corporation (NASDAQ:MNST - Free Report) by 5.8% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,152,403 shares of the company's stock after acquiring an additional 118,878 shares during the quarter. Raymond James Financial Inc. owned 0.22% of Monster Beverage worth $125,959,000 at the end of the most recent quarter.

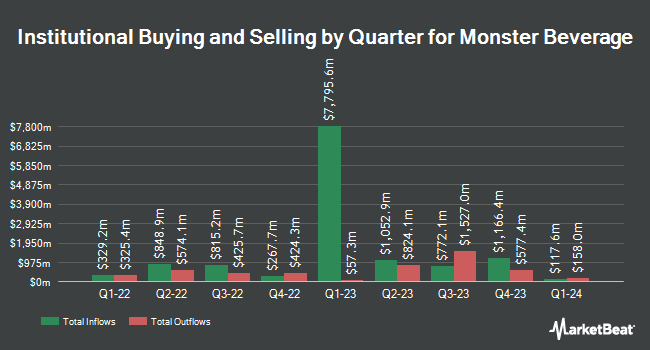

Other hedge funds and other institutional investors have also made changes to their positions in the company. Wayfinding Financial LLC purchased a new position in shares of Monster Beverage in the first quarter valued at approximately $29,000. Coppell Advisory Solutions LLC boosted its stake in shares of Monster Beverage by 259.2% in the fourth quarter. Coppell Advisory Solutions LLC now owns 686 shares of the company's stock valued at $36,000 after purchasing an additional 495 shares during the period. Park Square Financial Group LLC purchased a new position in shares of Monster Beverage in the fourth quarter valued at approximately $36,000. Migdal Insurance & Financial Holdings Ltd. boosted its stake in shares of Monster Beverage by 37.1% in the first quarter. Migdal Insurance & Financial Holdings Ltd. now owns 724 shares of the company's stock valued at $42,000 after purchasing an additional 196 shares during the period. Finally, Banque Cantonale Vaudoise purchased a new position in shares of Monster Beverage in the first quarter valued at approximately $43,000. Hedge funds and other institutional investors own 72.36% of the company's stock.

Monster Beverage Stock Performance

MNST stock traded down $1.52 during midday trading on Friday, reaching $62.84. 4,681,285 shares of the company were exchanged, compared to its average volume of 6,158,675. Monster Beverage Corporation has a 1-year low of $45.70 and a 1-year high of $66.75. The stock's 50-day simple moving average is $61.70 and its 200 day simple moving average is $58.95. The company has a market cap of $61.36 billion, a price-to-earnings ratio of 39.03, a price-to-earnings-growth ratio of 2.11 and a beta of 0.55.

Monster Beverage (NASDAQ:MNST - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported $0.52 EPS for the quarter, beating analysts' consensus estimates of $0.48 by $0.04. The business had revenue of $2.11 billion for the quarter, compared to analysts' expectations of $2.08 billion. Monster Beverage had a net margin of 20.54% and a return on equity of 27.46%. The company's quarterly revenue was up 11.1% on a year-over-year basis. During the same period in the previous year, the company posted $0.41 EPS. On average, research analysts anticipate that Monster Beverage Corporation will post 1.62 earnings per share for the current year.

Wall Street Analysts Forecast Growth

MNST has been the subject of a number of recent research reports. Wall Street Zen upgraded shares of Monster Beverage from a "hold" rating to a "buy" rating in a research note on Saturday, August 16th. Citigroup lifted their price target on shares of Monster Beverage from $70.00 to $74.00 and gave the stock a "buy" rating in a research note on Friday, August 8th. Wells Fargo & Company set a $73.00 price target on shares of Monster Beverage and gave the stock an "overweight" rating in a research note on Friday, August 8th. Bank of America lifted their price target on shares of Monster Beverage from $66.00 to $72.00 and gave the stock a "buy" rating in a research note on Friday, August 8th. Finally, Royal Bank Of Canada set a $68.00 price target on shares of Monster Beverage and gave the stock an "outperform" rating in a research note on Friday, August 8th. Twelve investment analysts have rated the stock with a Buy rating, eight have given a Hold rating and two have assigned a Sell rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and a consensus price target of $65.10.

Read Our Latest Research Report on Monster Beverage

Insiders Place Their Bets

In other news, CFO Thomas J. Kelly sold 27,000 shares of Monster Beverage stock in a transaction on Thursday, May 29th. The shares were sold at an average price of $63.40, for a total value of $1,711,800.00. Following the transaction, the chief financial officer directly owned 69,273 shares of the company's stock, valued at $4,391,908.20. The trade was a 28.05% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Mark Vidergauz sold 10,000 shares of Monster Beverage stock in a transaction on Wednesday, August 13th. The shares were sold at an average price of $63.73, for a total transaction of $637,300.00. Following the completion of the transaction, the director directly owned 51,191 shares in the company, valued at $3,262,402.43. The trade was a 16.34% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 8.30% of the company's stock.

Monster Beverage Company Profile

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Recommended Stories

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.