Raymond James Financial Inc. increased its position in shares of Seabridge Gold, Inc. (NYSE:SA - Free Report) TSE: SEA by 7.9% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,199,101 shares of the basic materials company's stock after purchasing an additional 88,115 shares during the quarter. Raymond James Financial Inc. owned 1.19% of Seabridge Gold worth $13,994,000 at the end of the most recent reporting period.

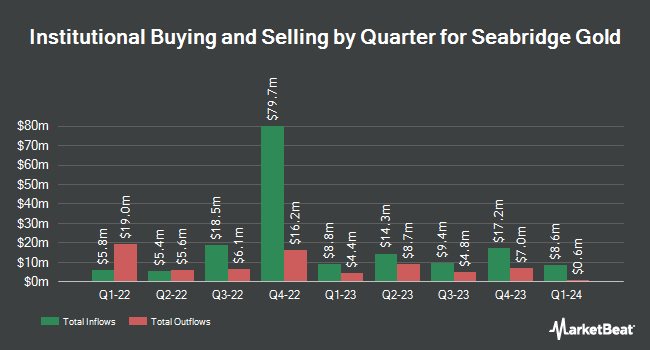

Several other institutional investors and hedge funds have also bought and sold shares of the company. Nebula Research & Development LLC lifted its position in Seabridge Gold by 6.9% during the fourth quarter. Nebula Research & Development LLC now owns 13,681 shares of the basic materials company's stock worth $156,000 after purchasing an additional 881 shares during the period. Geode Capital Management LLC lifted its position in Seabridge Gold by 3.2% during the fourth quarter. Geode Capital Management LLC now owns 37,649 shares of the basic materials company's stock worth $434,000 after purchasing an additional 1,171 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in Seabridge Gold by 2.0% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 75,450 shares of the basic materials company's stock worth $861,000 after purchasing an additional 1,490 shares during the period. Wealth Enhancement Advisory Services LLC lifted its position in Seabridge Gold by 5.7% during the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 27,850 shares of the basic materials company's stock worth $318,000 after purchasing an additional 1,500 shares during the period. Finally, Confluence Investment Management LLC lifted its position in Seabridge Gold by 3.8% during the first quarter. Confluence Investment Management LLC now owns 44,811 shares of the basic materials company's stock worth $523,000 after purchasing an additional 1,621 shares during the period. Institutional investors own 34.85% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen downgraded shares of Seabridge Gold from a "hold" rating to a "sell" rating in a research note on Saturday, August 16th.

Get Our Latest Analysis on Seabridge Gold

Seabridge Gold Trading Up 0.2%

NYSE SA traded up $0.04 during trading hours on Wednesday, reaching $17.65. The company's stock had a trading volume of 927,697 shares, compared to its average volume of 805,751. The firm has a fifty day simple moving average of $16.06 and a 200-day simple moving average of $13.54. The stock has a market cap of $1.80 billion, a P/E ratio of -46.44 and a beta of 0.68. Seabridge Gold, Inc. has a 52 week low of $9.40 and a 52 week high of $20.55. The company has a debt-to-equity ratio of 0.57, a current ratio of 4.24 and a quick ratio of 4.24.

Seabridge Gold (NYSE:SA - Get Free Report) TSE: SEA last issued its quarterly earnings data on Wednesday, August 13th. The basic materials company reported $0.09 earnings per share (EPS) for the quarter.

Seabridge Gold Profile

(

Free Report)

Seabridge Gold Inc, together with its subsidiaries, engages in the acquisition and exploration of gold properties in North America. The company also explores for gold, copper, silver, and molybdenum deposits. The company was formerly known as Seabridge Resources Inc and changed its name to Seabridge Gold Inc in June 2002.

See Also

Before you consider Seabridge Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seabridge Gold wasn't on the list.

While Seabridge Gold currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.