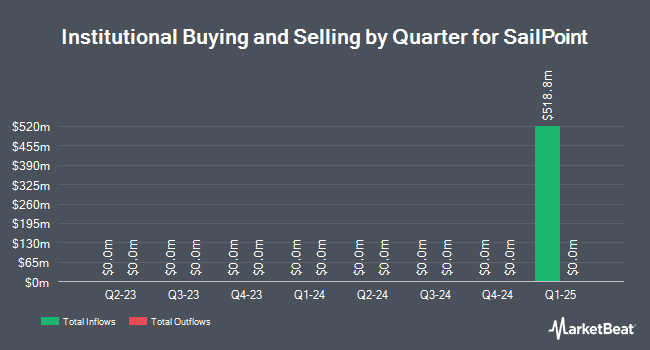

Raymond James Financial Inc. purchased a new stake in SailPoint, Inc. (NASDAQ:SAIL - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor purchased 183,514 shares of the company's stock, valued at approximately $3,441,000.

Other institutional investors have also made changes to their positions in the company. Stephens Investment Management Group LLC acquired a new position in SailPoint in the first quarter valued at about $23,213,000. Allianz Asset Management GmbH acquired a new stake in shares of SailPoint in the 1st quarter valued at approximately $3,496,000. GW&K Investment Management LLC acquired a new stake in shares of SailPoint in the 1st quarter valued at approximately $2,173,000. Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in shares of SailPoint in the 1st quarter valued at approximately $1,683,000. Finally, Assetmark Inc. acquired a new stake in shares of SailPoint in the 1st quarter valued at approximately $32,000.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on SAIL. Arete Research raised SailPoint to a "strong sell" rating and set a $16.00 price objective on the stock in a research note on Monday, July 7th. Barclays raised their price objective on SailPoint from $23.00 to $25.00 and gave the stock an "overweight" rating in a research note on Thursday, June 12th. BMO Capital Markets lowered their target price on SailPoint from $27.00 to $25.00 and set an "outperform" rating for the company in a report on Tuesday. Arete started coverage on SailPoint in a report on Monday, July 7th. They set a "sell" rating and a $16.00 target price for the company. Finally, Mizuho increased their target price on SailPoint from $24.00 to $26.00 and gave the stock a "neutral" rating in a report on Wednesday, June 11th. One equities research analyst has rated the stock with a Strong Buy rating, fourteen have given a Buy rating, three have issued a Hold rating and two have given a Sell rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $25.48.

Check Out Our Latest Stock Analysis on SAIL

SailPoint Price Performance

Shares of NASDAQ SAIL traded up $1.03 during mid-day trading on Thursday, hitting $20.84. The company had a trading volume of 2,605,347 shares, compared to its average volume of 2,594,165. The firm has a 50-day simple moving average of $20.61 and a two-hundred day simple moving average of $19.97. SailPoint, Inc. has a one year low of $15.05 and a one year high of $26.35.

SailPoint (NASDAQ:SAIL - Get Free Report) last announced its quarterly earnings data on Tuesday, September 9th. The company reported $0.07 earnings per share for the quarter, beating the consensus estimate of $0.04 by $0.03. The company had revenue of $264.36 million during the quarter, compared to the consensus estimate of $243.41 million. The business's revenue for the quarter was up 32.9% on a year-over-year basis. SailPoint has set its FY 2026 guidance at 0.200-0.220 EPS. Q3 2026 guidance at 0.050-0.06 EPS.

SailPoint Company Profile

(

Free Report)

SailPoint, Inc delivers solutions to enable comprehensive identity security for the enterprise. Its solutions enable organizations to establish, control, and automate policies that help them define and maintain a robust security posture and achieve regulatory compliance. The company was founded by Mark David McClain in 2005 and is headquartered in Austin, TX.

Further Reading

Before you consider SailPoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SailPoint wasn't on the list.

While SailPoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.