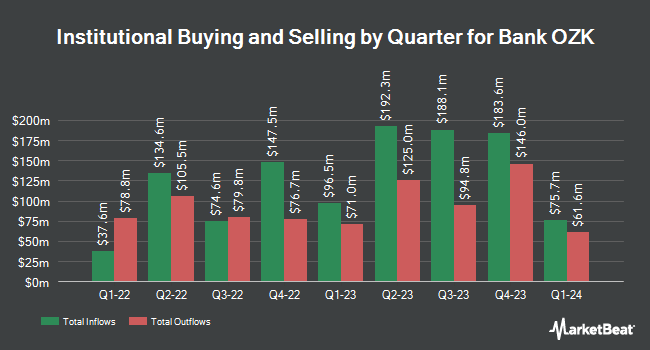

Raymond James Financial Inc. boosted its stake in shares of Bank OZK (NASDAQ:OZK - Free Report) by 8.5% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 343,066 shares of the company's stock after buying an additional 26,946 shares during the period. Raymond James Financial Inc. owned approximately 0.30% of Bank OZK worth $14,906,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Tidal Investments LLC raised its holdings in Bank OZK by 1.0% during the fourth quarter. Tidal Investments LLC now owns 21,575 shares of the company's stock valued at $961,000 after acquiring an additional 205 shares during the period. National Bank of Canada FI raised its holdings in Bank OZK by 12.8% during the first quarter. National Bank of Canada FI now owns 1,960 shares of the company's stock valued at $85,000 after acquiring an additional 223 shares during the period. Louisiana State Employees Retirement System raised its holdings in Bank OZK by 1.0% during the first quarter. Louisiana State Employees Retirement System now owns 29,600 shares of the company's stock valued at $1,286,000 after acquiring an additional 300 shares during the period. State of Alaska Department of Revenue raised its holdings in Bank OZK by 2.7% during the first quarter. State of Alaska Department of Revenue now owns 12,359 shares of the company's stock valued at $536,000 after acquiring an additional 330 shares during the period. Finally, Focus Partners Advisor Solutions LLC raised its holdings in Bank OZK by 0.9% during the fourth quarter. Focus Partners Advisor Solutions LLC now owns 38,327 shares of the company's stock valued at $1,707,000 after acquiring an additional 347 shares during the period. Institutional investors own 86.18% of the company's stock.

Bank OZK Trading Down 0.4%

NASDAQ OZK traded down $0.22 during trading hours on Tuesday, hitting $52.25. 336,071 shares of the company were exchanged, compared to its average volume of 1,163,891. Bank OZK has a 52 week low of $35.71 and a 52 week high of $53.66. The stock has a 50-day moving average price of $50.29 and a 200 day moving average price of $46.35. The stock has a market cap of $5.94 billion, a PE ratio of 8.48 and a beta of 0.92. The company has a quick ratio of 1.04, a current ratio of 1.04 and a debt-to-equity ratio of 0.23.

Bank OZK (NASDAQ:OZK - Get Free Report) last announced its earnings results on Thursday, July 17th. The company reported $1.58 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.51 by $0.07. Bank OZK had a return on equity of 13.24% and a net margin of 25.83%.The business had revenue of $428.04 million during the quarter, compared to analyst estimates of $423.41 million. During the same quarter in the previous year, the business earned $1.52 earnings per share. Analysts forecast that Bank OZK will post 6.02 earnings per share for the current fiscal year.

Bank OZK Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, July 18th. Shareholders of record on Friday, July 11th were given a dividend of $0.44 per share. This represents a $1.76 annualized dividend and a dividend yield of 3.4%. This is a boost from Bank OZK's previous quarterly dividend of $0.43. The ex-dividend date was Friday, July 11th. Bank OZK's dividend payout ratio (DPR) is presently 28.57%.

Analyst Upgrades and Downgrades

OZK has been the subject of a number of research reports. Stephens raised Bank OZK from an "equal weight" rating to an "overweight" rating and increased their price target for the company from $58.00 to $65.00 in a research note on Wednesday, August 20th. Raymond James Financial upgraded Bank OZK from a "market perform" rating to an "outperform" rating and set a $58.00 price target for the company in a report on Tuesday, July 8th. Finally, Wells Fargo & Company raised their price target on Bank OZK from $48.00 to $49.00 and gave the company an "equal weight" rating in a report on Monday, July 21st. Three research analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $54.25.

View Our Latest Analysis on Bank OZK

About Bank OZK

(

Free Report)

Bank OZK provides various retail and commercial banking services for individuals and businesses in the United States. The company offers deposit services, including non-interest bearing checking, interest bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time and reciprocal deposits.

Read More

Before you consider Bank OZK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank OZK wasn't on the list.

While Bank OZK currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.